Trade Review and Euro Trading Recommendations

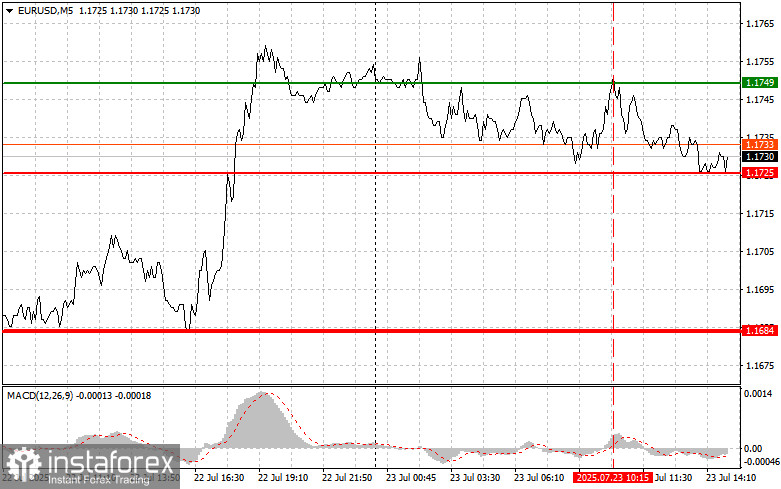

The price test at 1.1749 occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential.

The absence of key economic data from the eurozone hindered the euro's growth prospects in the first half of the day. However, the decline in the euro should not be interpreted as the start of a sustained downtrend. Rather, it appears to be a temporary correction, caused by an overbought condition ahead of the important ECB meeting, which may serve as a catalyst for further euro strength—provided that the central bank refrains from additional rate cuts. It is important to monitor the ECB's statements closely and pay attention to any signals indicating its future monetary policy intentions.

Later today, attention will shift to the U.S. existing home sales report. Analysts closely monitor this data as it serves as an indicator of economic health and consumer confidence. A drop in sales could signal a slowdown in economic growth, rising mortgage rates, or weakening consumer sentiment. Negative data may weigh on the dollar and support risk assets. Positive figures, on the other hand, would favor the dollar.

As for the intraday strategy, I will primarily rely on the implementation of Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, buying the euro is possible around the 1.1740 level (green line on the chart) with a target of 1.1794. I plan to exit at 1.1794 and open a sell position in the opposite direction, expecting a movement of 30–35 points from the entry point. A strong euro rally can be expected if the U.S. data is weak. Important: Before buying, make sure that the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro if the price tests the 1.1723 level twice, at a moment when the MACD is in oversold territory. This would limit the pair's downward potential and trigger a reversal upward. Growth to the opposite levels of 1.1740 and 1.1794 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches the 1.1723 level (red line on the chart). The target is 1.1684, where I intend to exit and open a buy trade in the opposite direction, aiming for a move of 20–25 points. Selling pressure on the pair will return if U.S. data is strong. Important: Before selling, make sure the MACD is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro if the price tests the 1.1740 level twice, at a moment when the MACD is in overbought territory. This would limit the pair's upward potential and trigger a reversal downward. A decline toward 1.1723 and 1.1684 is then expected.

Chart Legend

- Thin green line – entry price for buy trades.

- Thick green line – target level for taking profit or manually closing buy trades, as further growth above this level is unlikely.

- Thin red line – entry price for sell trades.

- Thick red line – target level for taking profit or manually closing sell trades, as further decline below this level is unlikely.

- MACD indicator – use overbought and oversold zones to guide market entries.

Important Note

Beginner Forex traders should be very cautious when making entry decisions. It is best to stay out of the market before the release of major economic reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Without stop-losses, you can quickly lose your entire deposit, especially if you're trading large volumes without applying proper money management.

Remember, successful trading requires a clear plan—like the one outlined above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.