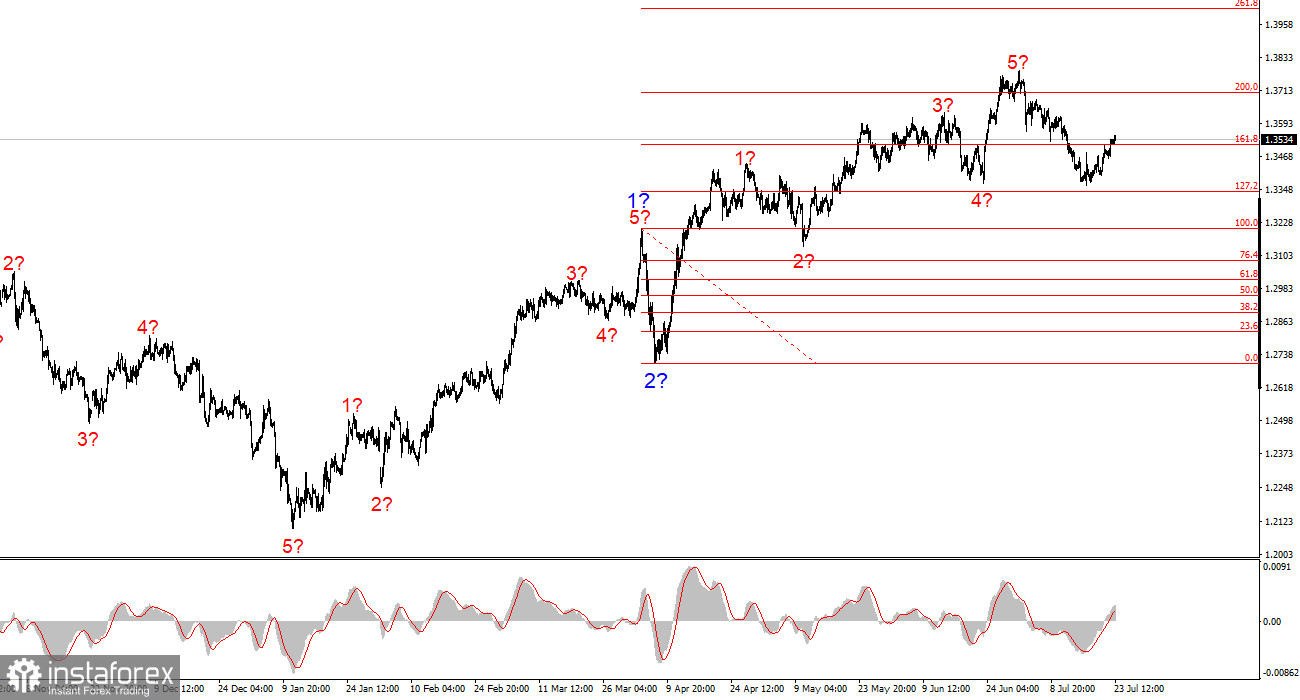

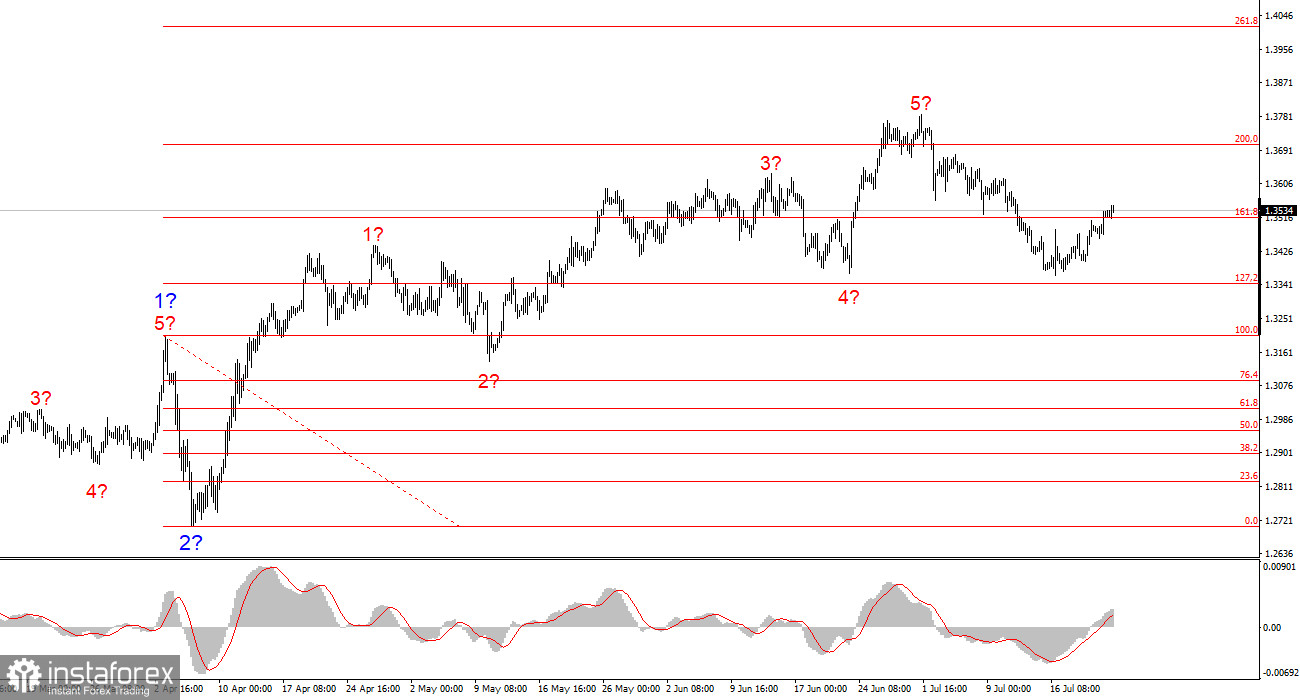

The wave pattern for GBP/USD continues to indicate the formation of a bullish impulsive wave structure. The wave picture is nearly identical to that of EUR/USD, as the U.S. dollar remains the only factor driving the market. Demand for the greenback is declining across the board, leading many instruments to display similar dynamics. Wave 2 of the upward trend segment has taken the form of a single wave. The presumed wave 3 appears strong and complete, so I now expect the formation of a corrective structure, with its first wave possibly already finished.

It's important to note that much of the currency market right now depends on Donald Trump's policies—not just trade-related ones. From time to time, decent data comes out of the U.S., but the market remains wary due to overall uncertainty in the economy, conflicting decisions and statements by Trump, and the White House's hostile and protectionist foreign stance. Therefore, the dollar has to work hard even to convert positive news into increased demand.

GBP/USD edged slightly higher on Wednesday, but the intraday movement was very limited. I can say that Wednesday's price action had no impact on the wave structure—though it could have. Today, Donald Trump announced a trade deal with Japan, calling it "historic." However, demand for the U.S. dollar did not increase—even during the U.S. session. Unlike Trump, the market felt no euphoria. But tomorrow should be more eventful.

Let's start with the ECB meeting, which may influence the euro. Since the euro and the pound are closely correlated, any strong move in the euro could pull the pound along with it. Therefore, while the ECB's interest rate decisions don't directly affect the pound, the euro's behavior could influence GBP/USD. In my opinion, the ECB won't make any major decisions—but it's worth noting that all previous dovish moves by the regulator did not push the euro lower. Hence, a neutral outcome could even support the euro, and by extension, the pound.

Additionally, tomorrow will see the release of PMI data for services and manufacturing across the Eurozone, the UK, and the U.S. For the past six months, markets have viewed economic reports through the lens of the trade war, so I don't expect a strong reaction. That said, a total of nine reports (including composite PMIs) will be released, which is enough to slightly boost market activity compared to the first half of Wednesday.

In the UK, business activity is expected to show a slight improvement in July, though forecasts are a fairly vague concept. Tomorrow, the market could easily see figures opposite to expectations. Just as with the euro, the only clear bearish potential stems from the wave count. If a third wave of the corrective structure begins, it could originate from the 1.3570–1.3620 range.

General Conclusions

The wave pattern for GBP/USD remains unchanged. We are dealing with a bullish, impulsive segment of the trend. Under Donald Trump, markets may face more shocks and reversals that could significantly impact the wave structure. However, for now, the main scenario remains intact. The targets for the upward trend segment are now located near the 1.4017 level, which corresponds to the 261.8% Fibonacci extension from the presumed global wave 2. Currently, the corrective wave sequence is still forming. Classically, it should consist of three waves, but the market may settle for just one.

Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex formations are hard to trade and often require adjustments.

- If you're uncertain about the market, it's better to stay out.

- There can never be 100% certainty in directional movement. Always use protective Stop Loss orders.

- Wave analysis can be combined with other analytical tools and trading strategies.