Donald Trump continues to reshape the world order. The U.S. President keeps dictating terms to nearly half the world's countries—and his strategy is working so far. The trade agreement with the European Union is important to me not just because it exists, but because Trump has shown that he can beat anyone. At least he believes so—and after Monday, many around the world think so too.

What makes the deal with the EU significant? Trump signed an incredibly favorable agreement for the United States. Under this deal, the U.S. has virtually no obligations toward the EU. America simply grants access to its market for European goods and services in exchange for tariffs, investments, and energy purchases. And even this type of agreement is beneficial for the EU—otherwise, Ursula von der Leyen wouldn't have accepted the terms. Since she agreed, it means the EU will still gain some benefit.

However, many market participants did not expect such an unequivocal—and even easy—victory for Trump. The EU resisted and resisted, but ultimately gave in. Perhaps Trump will succeed in the same way in his battle with the Federal Reserve. Over the first six months, he has proven that if you have strong trump cards, all you need is to play them wisely. And the U.S. does have a trump card—an enormous, lucrative market that producers and suppliers from around the world want access to. Trump isn't opposed—but access comes at a price. That's why the EU agreed to the ultimatums, as did the UK and Japan—and likely, China will as well. If Trump reaches a deal with China, then everything else will be secondary. All that remains is to defeat Powell and bring rates down by 3%.

And Trump will defeat Powell no matter what. If the Fed Chair doesn't step down voluntarily, he will still leave the position in May of next year. After that, "Trump's person" will take over, and Trump will be able to steer monetary policy the way he sees fit. Of course, implementing this in practice will be harder than saying it, but securing such a favorable deal with the EU wasn't easy either.

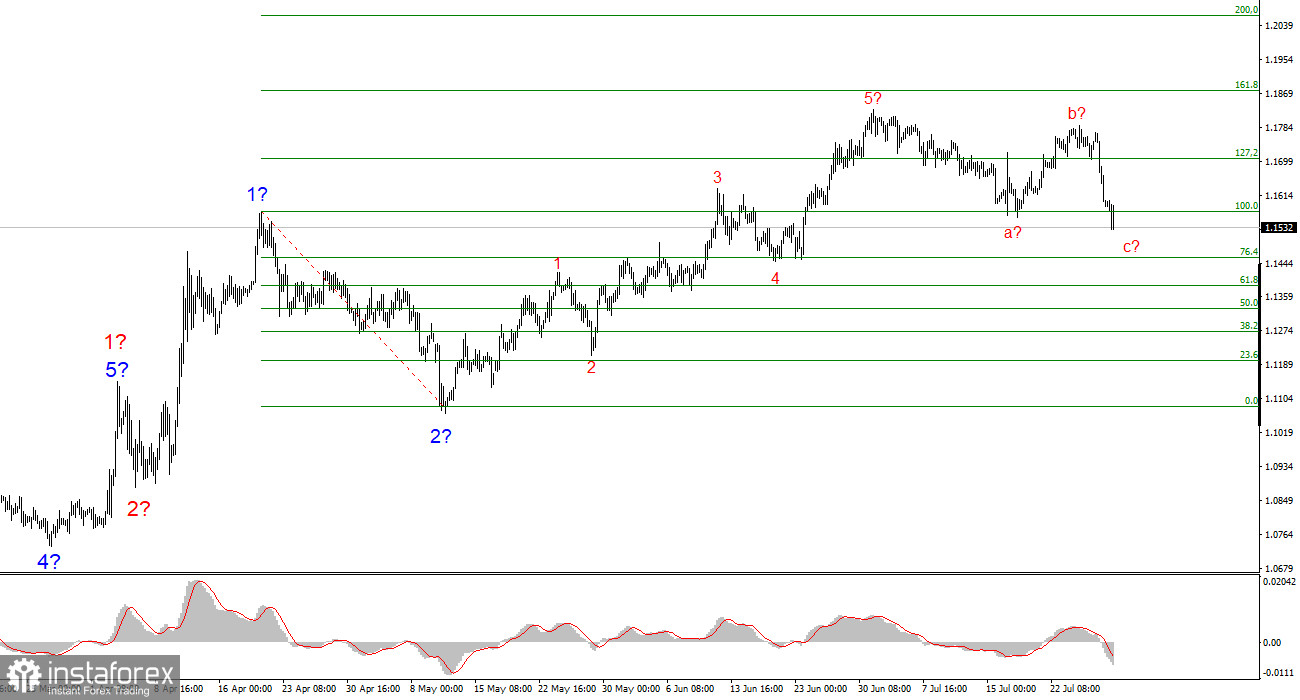

Wave Outlook for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the pair is continuing to build a bullish trend segment. The wave structure still entirely depends on the news background, particularly Trump's decisions and U.S. foreign policy. The targets of this trend segment may extend as far as the 1.25 area. Accordingly, I continue to consider buying positions with targets around 1.1875, which corresponds to the 161.8% Fibonacci level, and beyond. The formation of wave 4 may conclude in the coming days, so this week is a good time to look for new buying opportunities and closely monitor the news.

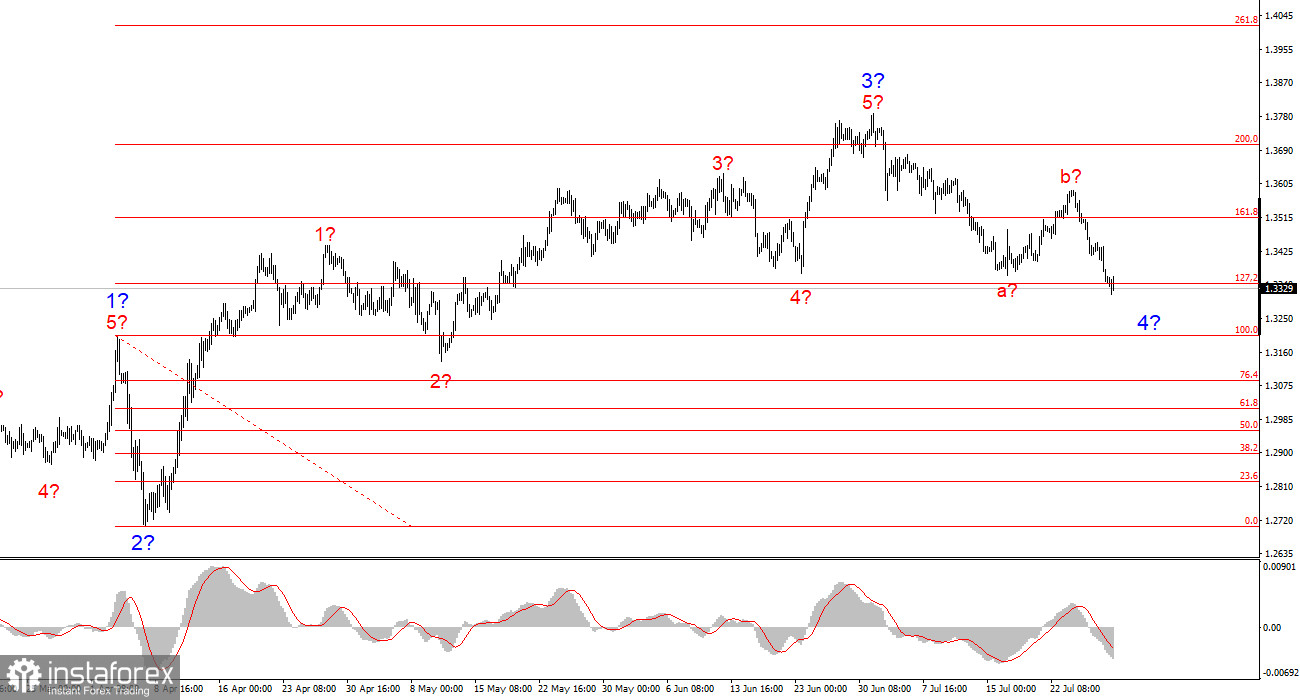

Wave Outlook for GBP/USD:

The wave structure for GBP/USD remains unchanged. We are dealing with a bullish, impulsive segment of the trend. Under Trump, the markets may face a large number of shocks and reversals that could significantly affect the wave picture. But at present, the working scenario remains intact. The targets of the bullish segment are now around the 1.4017 level. Currently, a corrective set of waves within wave 4 is unfolding. According to classic theory, it should consist of three waves, and we are now seeing the development of wave C.

My Key Principles for Analysis:

- Wave structures should be simple and clear. Complex patterns are hard to trade and often subject to revision.

- If you're unsure about market conditions, it's better to stay out.

- One can never be 100% certain about the direction of movement. Always use protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.