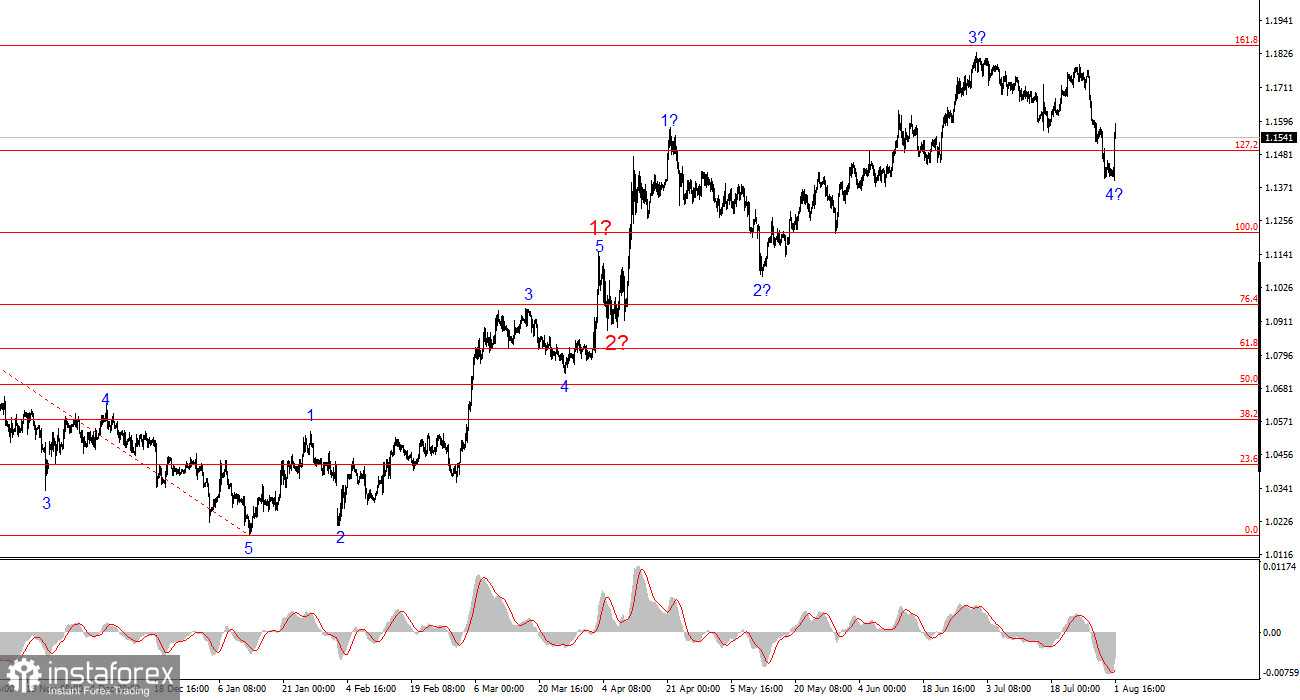

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months. The formation of an upward trend segment continues, and the news background mostly does not favor the dollar. The trade war initiated by Donald Trump aimed to boost budget revenues and eliminate the trade deficit. However, these goals have yet to be achieved, trade deals are being signed with difficulty, and Trump's "One Big Law" is projected to increase the U.S. national debt by 3 trillion dollars in the coming years. The market has a very low opinion of Trump's first six months, viewing his actions as a threat to U.S. stability and prosperity.

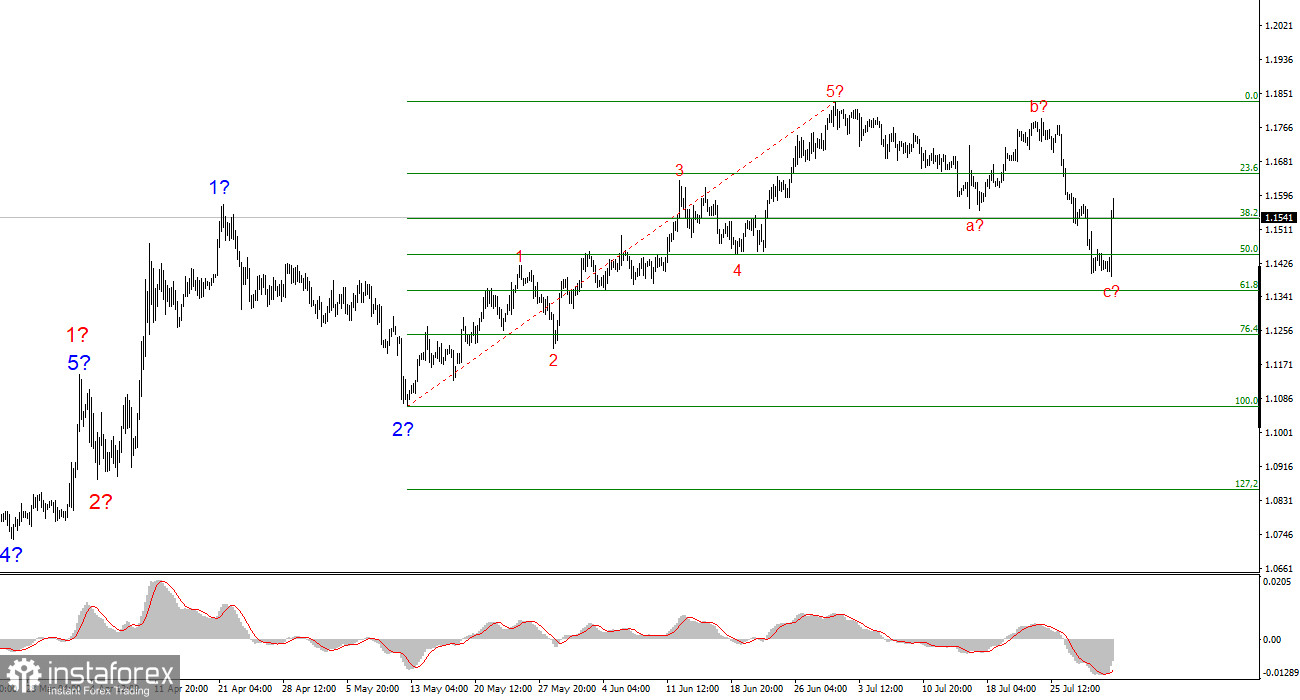

At present, the pair continues forming wave 4 within wave 3, which may take the form of a three-wave structure. If this is the case, wave 4 could soon be completed. However, the news background plays a significant role in shaping corrective waves. If the U.S. dollar continues to receive support, the corrective pattern could extend further or transform into an impulse wave.

The EUR/USD pair unexpectedly gained 130 basis points on Friday. This move was surprising given that few expected such weak U.S. statistics following a series of strong reports and generally positive data. Earlier in the week, several economic indicators had been encouraging, and in addition to the reports, Donald Trump announced the signing of several important and favorable trade deals for the U.S. On top of that, Jerome Powell once again disappointed the dovish market by refusing to commit to any monetary policy easing in September.

So, despite the dollar riding high for most of the week, one Nonfarm Payrolls report was enough to trigger a sell-off. Not only did the July figure fall short of market expectations (73,000 vs. 110,000), but the June figure was also sharply revised down from 147,000 to 14,000. Considering that only 19,000 new jobs were created in May, it's clear the U.S. labor market is facing significant challenges—making the July number seem relatively high by comparison.

Given all this, the other reports were practically irrelevant. In my view, the instrument is now at a very important point. The three-wave downward structure (a-b-c) looks complete and fully formed. Accordingly, a new upward impulse wave should begin forming from current levels. If this assumption is correct, we may soon see the increase I've been forecasting in recent weeks. To be fair, the corrective structure could take on a more extended and complex form, but that would require renewed support for the dollar in the coming weeks.

General conclusions:

Based on the EUR/USD analysis, I conclude that the pair is still in the process of forming an upward trend segment. The wave structure continues to depend heavily on the news background, particularly decisions made by Trump and U.S. foreign policy. The targets for this trend segment may extend as far as the 1.2500 level. Therefore, I continue to consider long positions with targets around 1.1875 (the 161.8% Fibonacci level) and higher. Wave 4 may complete (or may already have completed) in the coming days, so traders should look for new buying opportunities next week.

Core principles of my analysis:

- Wave structures should be simple and clear. Complex patterns are difficult to trade and are often subject to revision.

- If you're uncertain about the market, it's better to stay out.

- Absolute certainty about market direction does not exist. Always use protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.