Naturally, Trump immediately needed a "scapegoat" to shift all the blame. The person who suffered was, "oddly enough," the head of the Bureau of Labor Statistics, Erica McEntarfer. She was simply dismissed. Of course, the Bureau issued official explanations as to why the data for the previous two months turned out to be so distorted. However, by then, no one was particularly interested in those justifications.

But it wasn't just the Nonfarm Payrolls report. The Bureau also revised the June unemployment report — now showing 4.1%. As a result, the July figure rose to 4.2%, although initial expectations pointed to the rate remaining unchanged. But in July, this indicator also worsened. The "cherry on top" was the ISM Manufacturing report, which, contrary to forecasts, dropped from 49 points to 48.

So what's the bottom line? After strong ADP, JOLTS, and GDP reports, along with several favorable trade deals, market participants discovered that the U.S. economy had grown solely due to a drop in imports, business activity was declining, job creation was shrinking, and the unemployment rate was rising. Meanwhile, the U.S. budget is being filled with cash. But what good is that money when inflation has also been accelerating in recent months?

Yet Donald Trump decided not to stop there. Last week, he released a list of 60 countries against which he imposed new tariffs. In addition, import duties on copper were increased, and targeted tariffs were imposed on Brazil. Another "cherry on top" came in the form of nuclear threats directed at the Russian Federation. Trump is determined to end the war in Ukraine and, for roughly the fifth time, has set a "final deadline" by which Russia must cease hostilities and sit down for negotiations with Ukraine. However, Moscow does not respond well to ultimatums.

The Russian authorities say they are not against peace talks, but do not understand why the U.S. is interfering in the process and imposing unclear deadlines and conditions. As we can see, there's been a flood of news, and if we analyze it carefully, the U.S. dollar once again finds itself left with nothing.

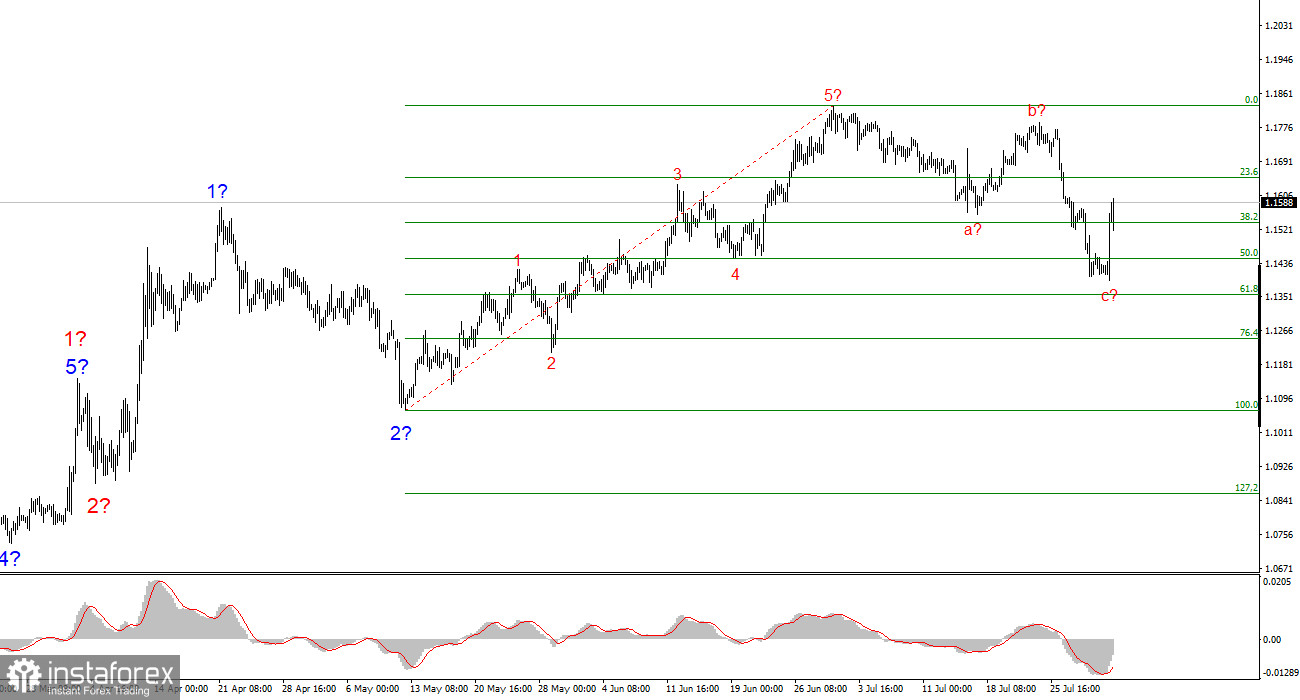

Wave Pattern for EUR/USD:

Based on my analysis, EUR/USD continues to form an upward trend segment. The wave structure is still entirely dependent on news developments related to Trump's decisions and U.S. foreign policy. The targets of this trend segment could extend as far as the 1.25 area. Therefore, I continue to consider buying, with targets near 1.1875 (which corresponds to the 161.8% Fibonacci level) and beyond. Presumably, Wave 4 has been completed. Therefore, this is a good time to buy.

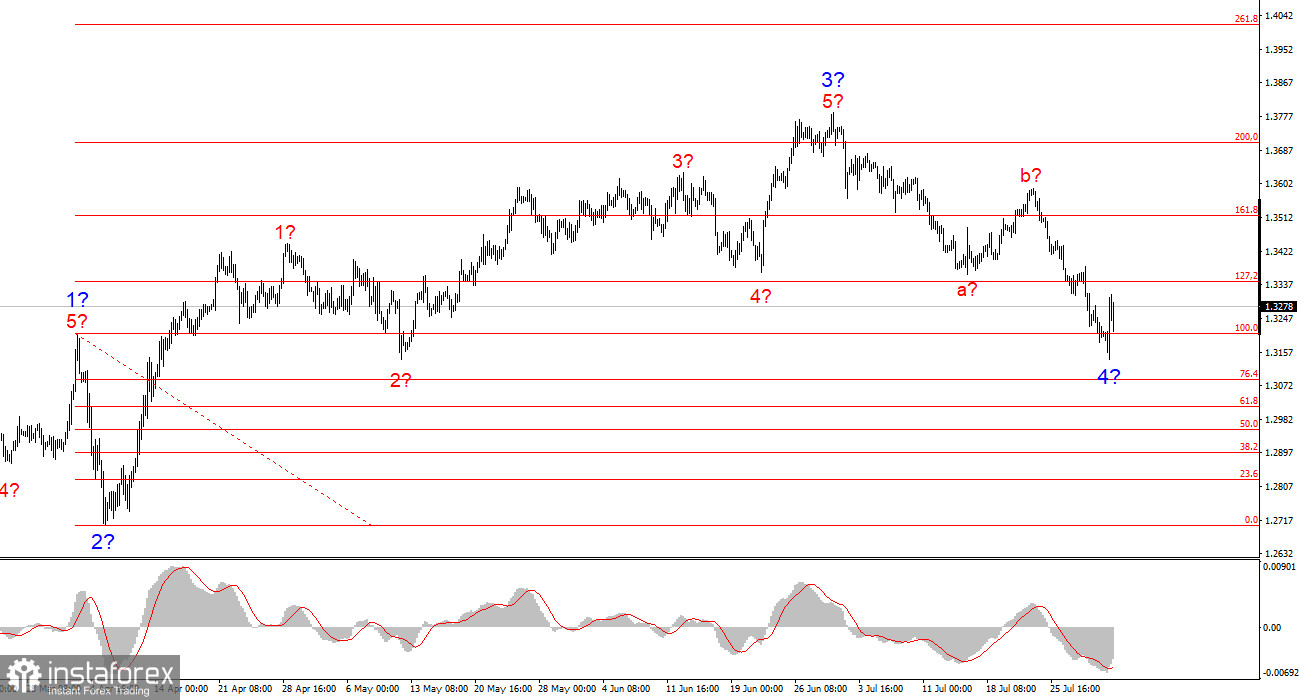

Wave Pattern for GBP/USD:

The wave pattern of GBP/USD remains unchanged. We are dealing with an upward, impulsive trend segment. Under Trump, markets could face many more shocks and reversals that may significantly affect the wave structure, but for now, the main scenario remains intact. The targets of this upward trend segment are now located near the 1.4017 mark. I currently assume that the corrective Wave 4 has been completed. Accordingly, I expect the upward wave formation to resume and am considering buy positions.

My Key Analytical Principles:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often subject to change.

- If you are unsure of what is happening in the market, it's better to stay out.

- You can never have 100% certainty about the market's direction. Don't forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.