And how could we not talk separately about all the new tariffs? Some analysts mistakenly assumed that once Donald Trump began signing trade agreements—especially with such economic giants as Japan, the United Kingdom, or the European Union—the trade war was over. I don't understand what those economists mean by "over." In my view, any war implies certain disagreements that the parties must resolve. After a truce is declared, the existence of both sides returns to its previous course—except for the losses sustained during the war itself.

Trump's trade deals involve the same import tariffs that were in place during the trade conflict. In other words, essentially nothing has changed.

Moreover, Trump is showing that tariffs are not only a tool for eliminating trade imbalances. For example, he's ready to impose tariffs of no less than 100% on all countries that purchase oil, gas, and weapons from Russia—unless Moscow agrees to sit down at the negotiating table and end the war by August 8. It goes without saying that many countries import energy resources from Russia, a country rich in natural resources, for which this is one of the main sources of budget revenue.

Trump wants to end the war, and that is certainly a positive goal—but his actions only generate chaos in the markets. He has already set multiple deadlines for Russia, after which he has threatened to impose tariffs both on Moscow and on all of its trading partners.

And what does it all add up to? As a result, U.S. trading partners will be paying tariffs that Trump imposed in the name of fairness, tariffs introduced as part of trade deals, and—on top of that—tariffs used as a form of political pressure on Russia. Let's also not forget the sector-specific tariffs—on cars, auto parts, and various metals. And in the near future, possibly on pharmaceuticals and semiconductors.

This leads to a situation in which one set of tariffs is layered on top of another. And let me remind you: for U.S. trading partners, these mean nothing but a drop in exports to the United States, since demand for their goods, raw materials, and services will decline. And it will be the American people who ultimately pay those tariffs.

In short, everything written in all three parts of this review points to one conclusion: the dollar is unlikely to attract much interest in the near future.

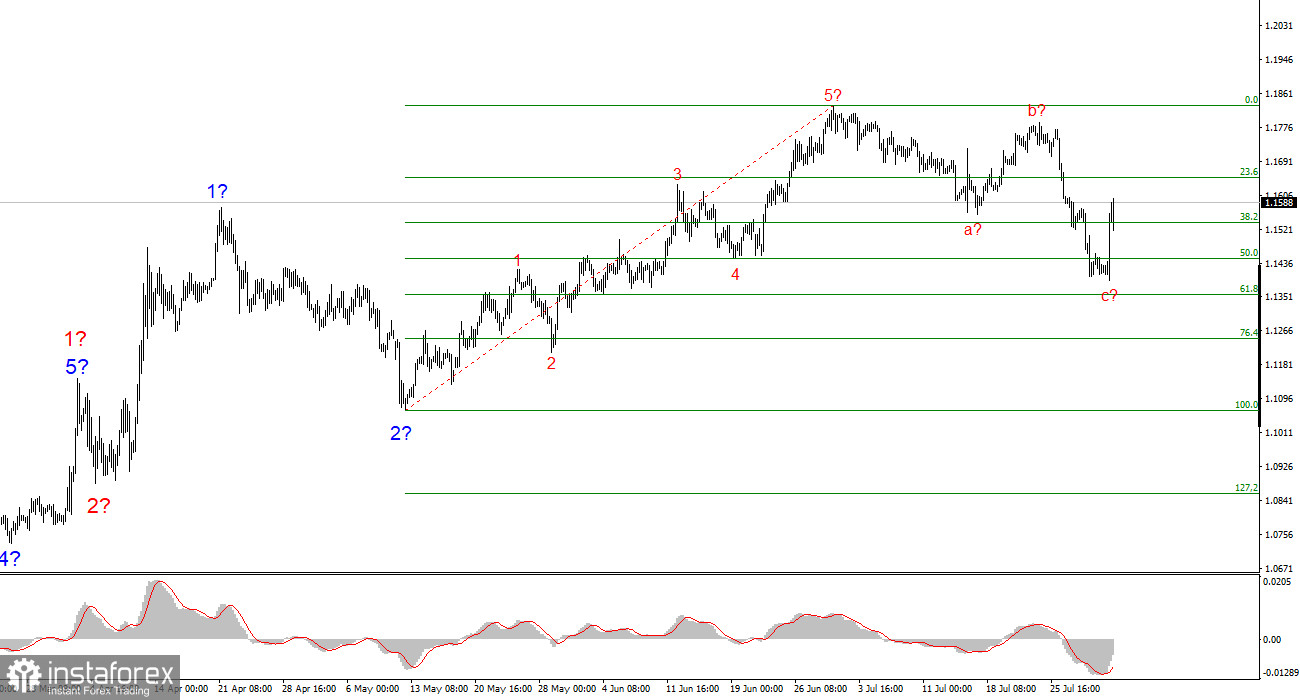

Wave Pattern for EUR/USD:

Based on my analysis, EUR/USD continues to form an upward trend segment. The wave structure is still entirely dependent on news developments related to Trump's decisions and U.S. foreign policy. The targets of this trend segment could extend as far as the 1.25 area. Therefore, I continue to consider buying, with targets near 1.1875 (which corresponds to the 161.8% Fibonacci level) and beyond. Presumably, Wave 4 has been completed. Therefore, this is a good time to buy.

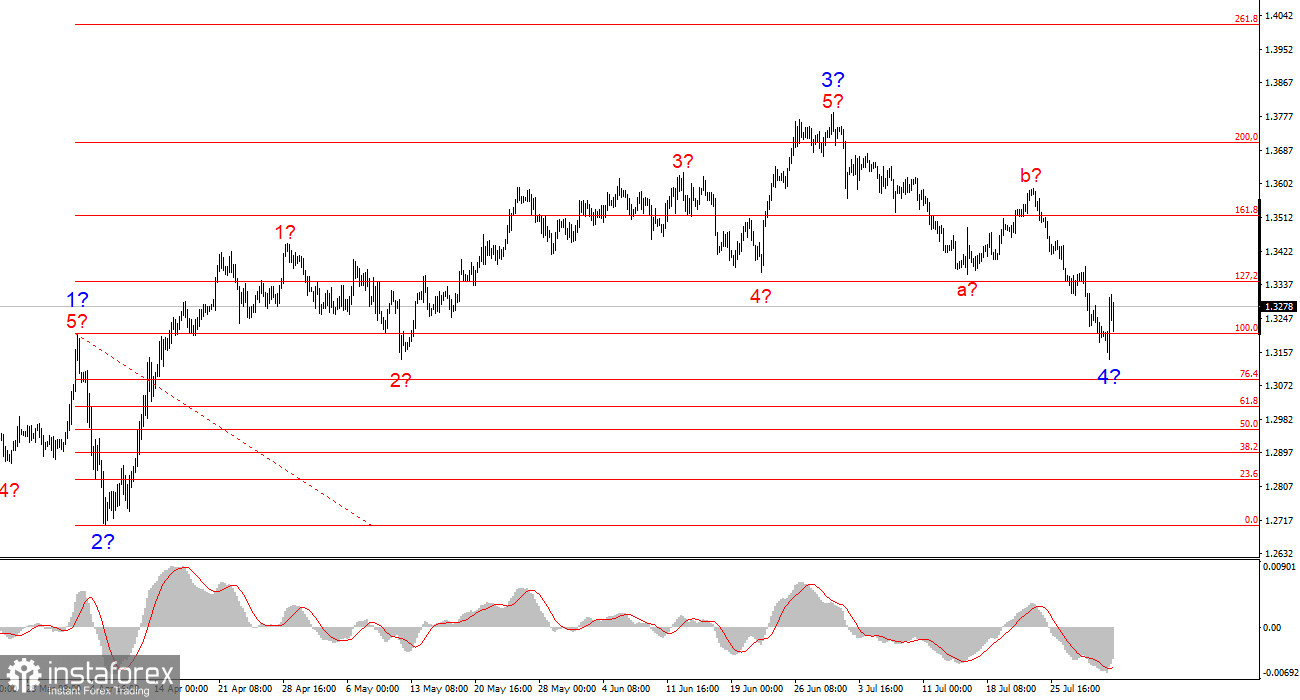

Wave Pattern for GBP/USD:

The wave pattern of GBP/USD remains unchanged. We are dealing with an upward, impulsive trend segment. Under Trump, markets could face many more shocks and reversals that may significantly affect the wave structure, but for now, the main scenario remains intact. The targets of this upward trend segment are now located near the 1.4017 mark. I currently assume that the corrective Wave 4 has been completed. Accordingly, I expect the upward wave formation to resume and am considering buy positions.

My Key Analytical Principles:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often subject to change.

- If you are unsure of what is happening in the market, it's better to stay out.

- You can never have 100% certainty about the market's direction. Don't forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.