The news background for the British pound this week will be more interesting than for the euro. The main difference lies in the fact that this week, the Bank of England will be the last of the "big three" central banks to hold a meeting. Surprisingly, markets believe the British central bank is preparing to cut the interest rate by another 25 basis points. Let me remind you that the BoE has already lowered the rate twice in the first half of the year.

Inflation in the UK has significantly increased in recent months, which makes me doubt that the central bank is ready for a new round of monetary policy easing. In one of his recent speeches, Andrew Bailey questioned the need for another rate cut in the near future and once again emphasized that price stability remains the central bank's main objective. I would also point out that during the last meeting, three MPC members voted in favor of a cut, while six voted against. Therefore, if just two members shift from a hawkish to a dovish stance, we will see the third round of easing this year.

A new round of monetary easing in the UK could put pressure on the British pound, but the current wave structure, Donald Trump's policy, and the recent performance of the U.S. economy all suggest that the GBP/USD pair should continue rising. It's also worth noting that by year-end, the Federal Reserve may match the Bank of England in the number of policy easing rounds. Following the release of poor labor market data, the FOMC may be compelled to lower interest rates. As a result, the dollar's position also appears uncertain.

Taking all of this into account, I believe that a rise in the pound's quotes this week is the most likely scenario. I'd also point out that we have seen a three-wave corrective structure for the British currency, which implies the formation of a new impulsive wave sequence. Of course, any wave structure is subject to changes under the pressure of news flow. But at this point, everything looks clear and technically convincing.

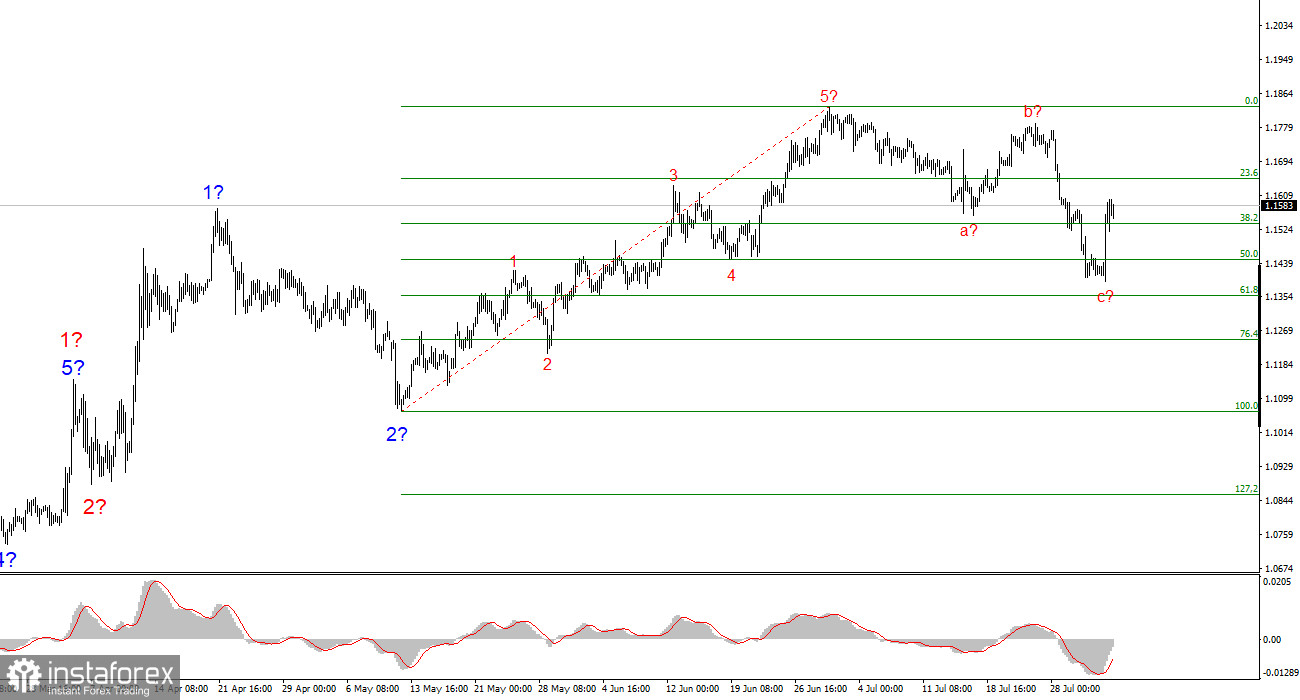

Wave Picture for EUR/USD:

Based on the EUR/USD analysis, I conclude that the pair continues forming an upward trend segment. The wave structure remains entirely dependent on the news background related to Trump's decisions and U.S. foreign policy. The targets for this trend segment may extend up to the 1.25 level. Therefore, I continue to consider buying opportunities with targets around 1.1875, which corresponds to 161.8% Fibonacci, and higher. Presumably, wave 4 has been completed. Therefore, this is a good time to buy.

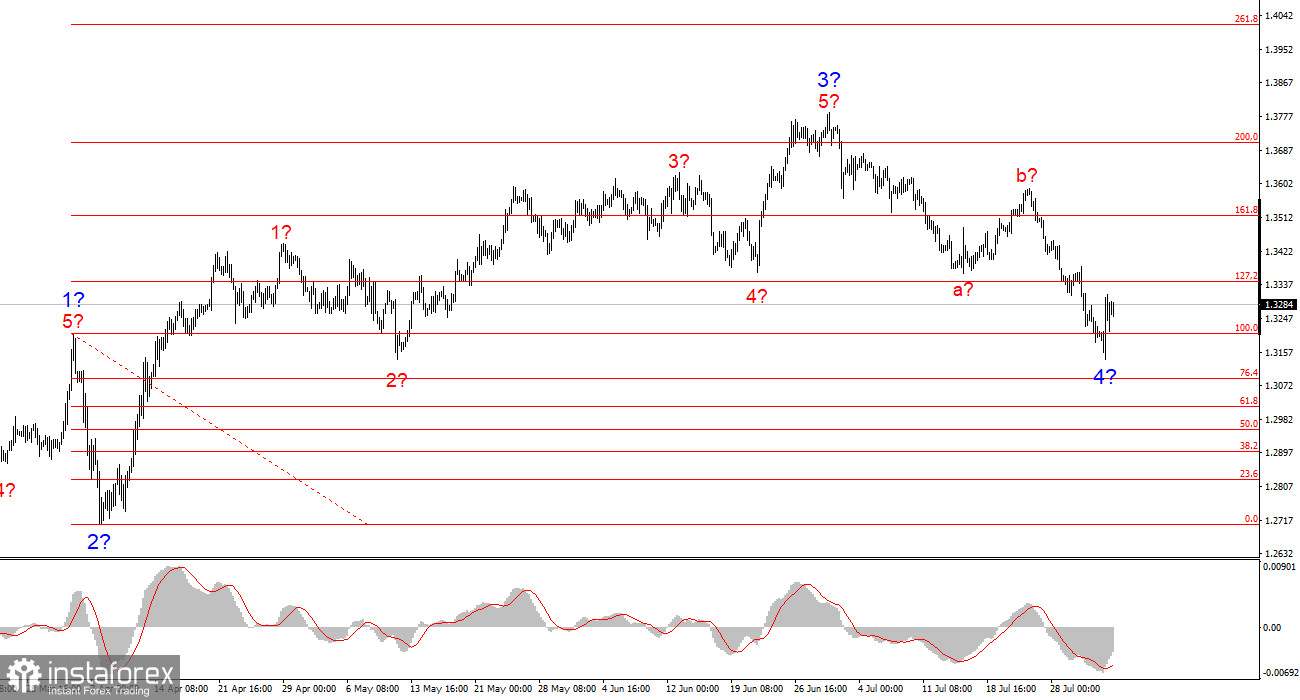

Wave Picture for GBP/USD:

The wave picture for GBP/USD remains unchanged. We are dealing with an upward, impulsive segment of the trend. Under Donald Trump, markets could still face many shocks and reversals, which may significantly affect the wave pattern, but at this point, the working scenario remains intact. The targets for the upward segment of the trend are now located around 1.4017. Currently, I assume that the construction of the corrective wave 4 has been completed. Therefore, I expect the upward wave sequence to resume, and I am considering long positions.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often prone to changes.

- If you're unsure about what's happening in the market, it's better not to enter.

- Absolute certainty in market direction does not and cannot exist. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.