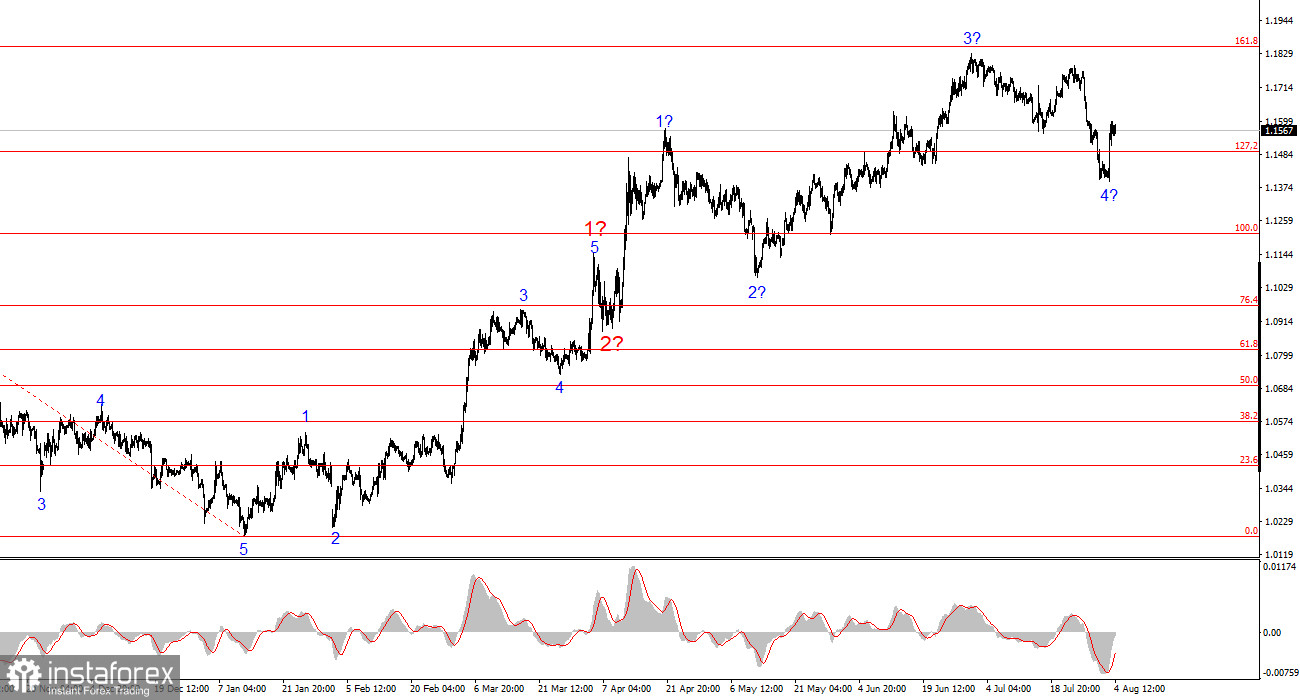

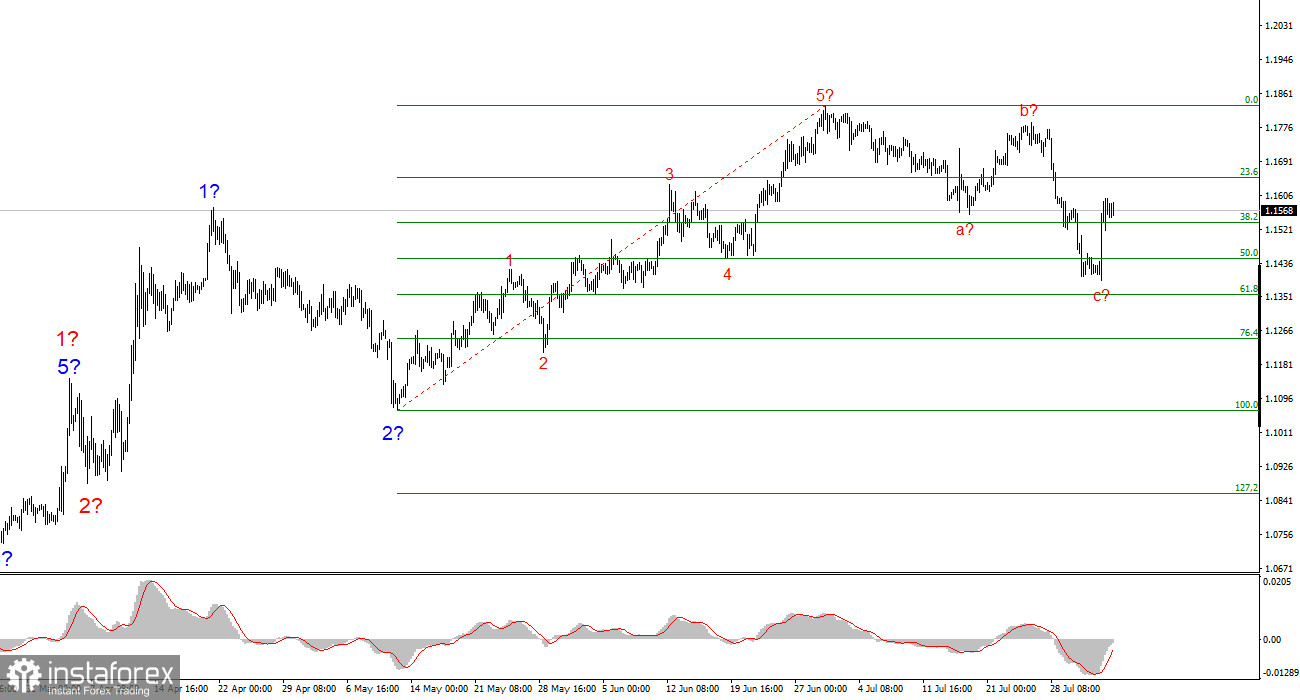

The wave pattern on the 4-hour chart of the EUR/USD pair has remained intact for several months, which is very encouraging. Even during corrective phases, the structure's integrity is preserved, allowing for accurate forecasts. It's worth noting that wave patterns do not always look textbook-perfect.

The formation of the upward trend section continues, and the news background continues to support, for the most part, not the dollar. The trade war launched by Donald Trump aimed to boost budget revenues and eliminate the trade deficit. However, those goals have not yet been achieved. Trump's "One Big Law" will increase U.S. national debt by 3 trillion dollars, and the president continues to raise and impose new tariffs. The market has rated Trump's first six months rather poorly, despite the second-quarter economic growth of 3%.

At this point, we can assume that wave 4 has been completed. If this is indeed the case, then the construction of impulse wave 5 has begun, with potential targets extending up to the 1.2500 level. Of course, wave 4 could still take on a more extended five-wave corrective form, but I base my outlook on the most likely scenario.

The EUR/USD rate barely moved on Monday, with low volatility throughout the day—but we may still see some notable movement before the session ends. Friday's U.S. data was quite impactful—for several reasons. The Nonfarm Payrolls report came in significantly below market expectations. The U.S. Bureau of Labor Statistics also sharply revised data for June and May downward. Six hours after the revised data was released, Donald Trump dismissed the head of the Bureau, Erika McEntarfer. The dismissal followed the publication of data that did not meet expectations.

More and more economists and politicians (especially those outside the Republican camp) are speaking out about authoritarian trends in the U.S. I've already written that Trump makes most major and consequential decisions on his own, constantly finding loopholes to bypass legislation that otherwise requires him to get Congressional approval. But why go through Congress if it's Republican anyway? In reality, Trump is simply saving himself time—without technically breaking any laws.

But the trend is hard to miss. Officials and politicians who disagree with Trump or oppose his decisions are deemed traitors and blamed for everything. Now even the U.S. Bureau of Labor Statistics may become completely controlled by Trump—after all, someone must be appointed as the new director. And that director will likely report figures favorable to Trump. Remember George Orwell's 1984? The Ministry of Truth in full effect. Only data that prevents criticism of the government will be published. Frankly, this fact alone makes me believe that the U.S. dollar will continue to lose demand in the forex market.

Summary

Based on this analysis of EUR/USD, I conclude that the instrument continues forming the upward section of the trend. The wave pattern remains heavily dependent on the news background, particularly related to Trump's decisions and U.S. foreign policy. The trend's targets may extend to the 1.2500 level. Therefore, I continue to consider buy positions with targets around 1.1875 (corresponding to the 161.8% Fibonacci level) and higher. Wave 4 is presumably complete, meaning now is a good time to buy.

Core principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to shifts.

- If you're not confident in what's happening in the market, it's better not to enter.

- There is never 100% certainty about market direction. Always use Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.