Donald Trump's policies are a double-edged sword for EUR/USD. On one hand, the U.S. president's attacks on Jerome Powell and the dismissal of the head of the Bureau of Labor Statistics undermine trust in the U.S. dollar. On the other hand, the United States is winning the trade war. It collects tariff revenues and attracts investment from other countries, while also narrowing its trade deficit—just as the Republican promised during his presidential campaign.

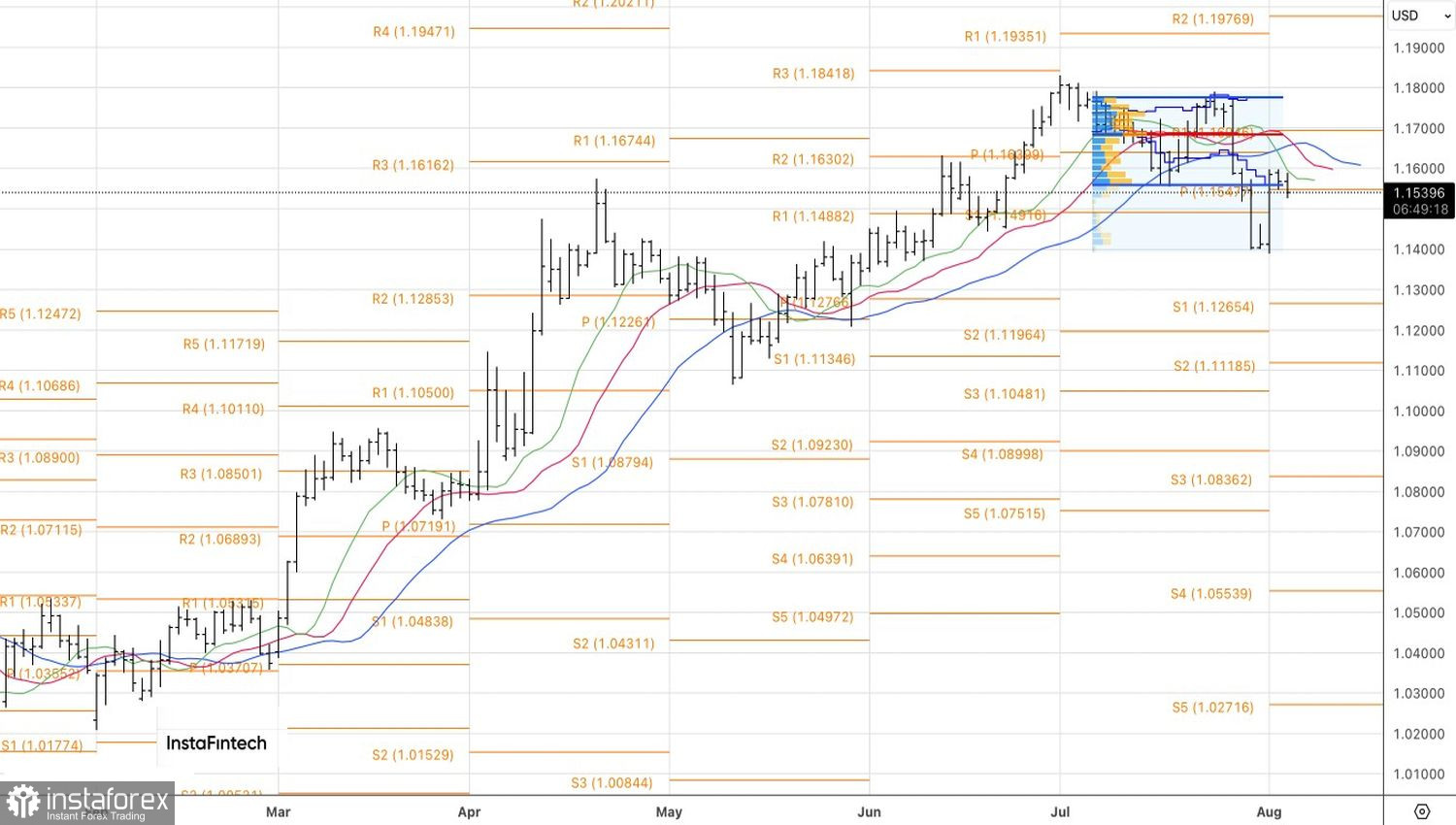

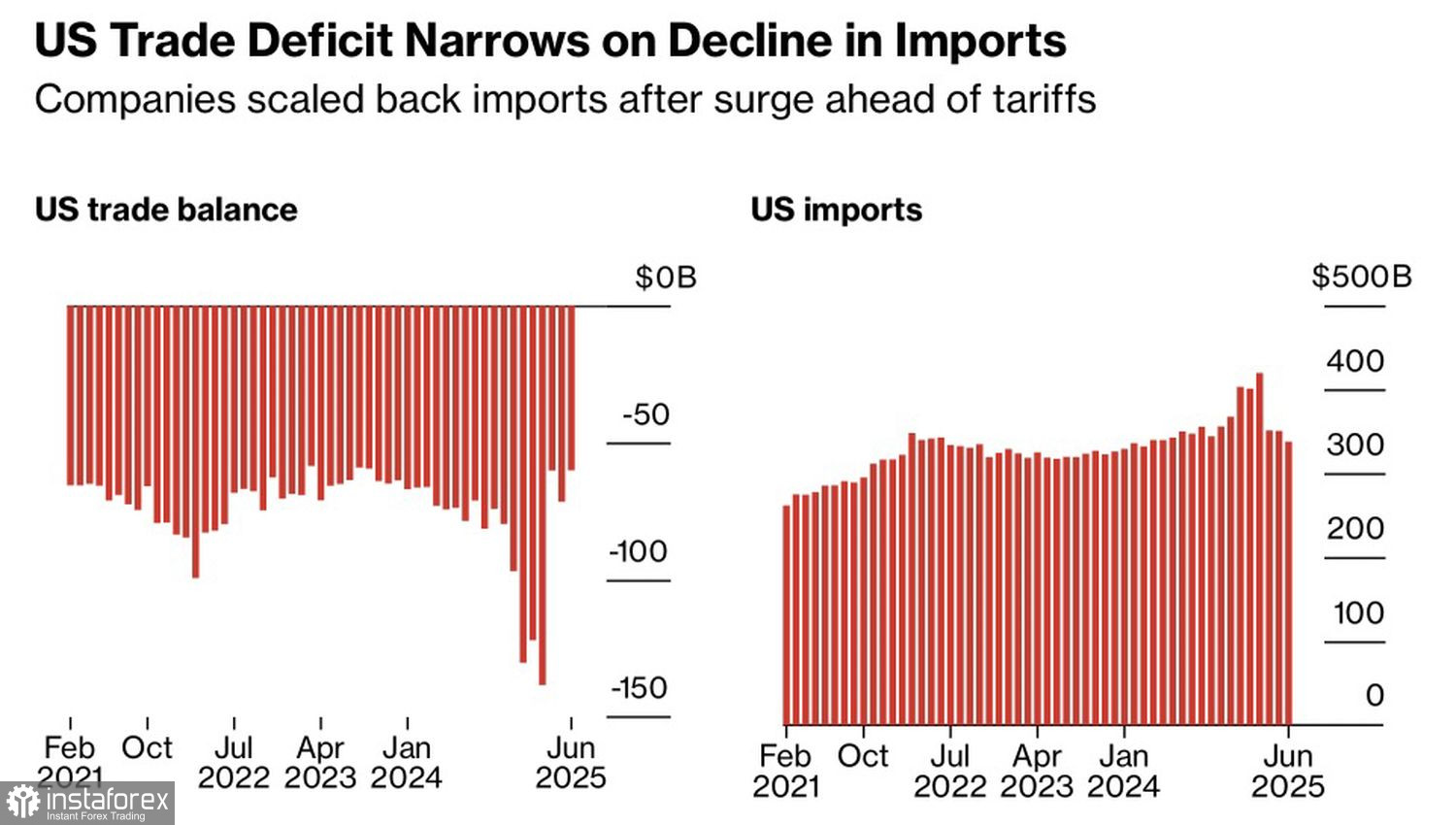

In July, the U.S. trade deficit narrowed by 16% month-over-month to 60.2 billion dollars. This figure was better than Bloomberg experts had forecast and was achieved due to a faster decline in imports compared to exports. This is likely a result of tariffs, indicating that Trump's policies are bearing fruit.

U.S. Import and Trade Balance Dynamics

But everything comes at a cost. Disruptions in supply chains are leading to job losses. Combined with anti-immigration measures and mass layoffs of government employees, this significantly cools the labor market and results in stagnation of the services sector. The U.S. Non-Manufacturing PMI is hovering on the edge of contraction—it came in at 50.1 in July. None of the Bloomberg experts had predicted such a sharp decline in this indicator.

As a result, the chances of a Federal Reserve rate cut in September jumped to 88%, and EUR/USD bears retreated. According to Goldman Sachs, this is just the beginning. The upward trend in the main currency pair is likely to resume for two reasons. First, the European Central Bank is the first G10 central bank to end its monetary easing cycle. The Fed is likely to resume easing at the next FOMC meeting. This monetary policy divergence favors the euro.

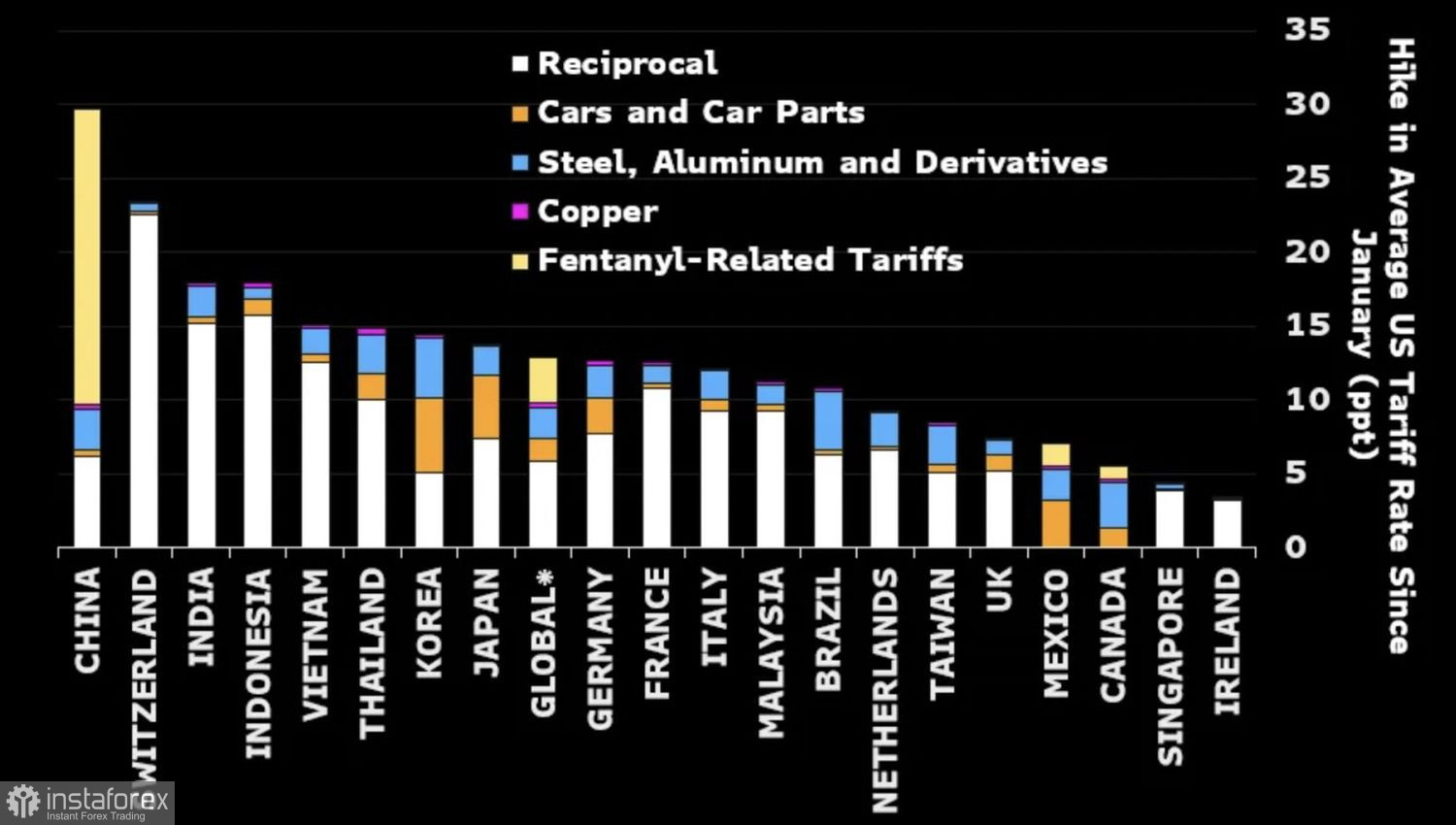

Meanwhile, trade tensions persist. The President of Switzerland is flying to the White House uninvited to negotiate a reduction in a draconian 39% import tariff, which is higher than that imposed on most other U.S. trade partners—except China.

U.S. Tariff Levels

According to Trump, the United States is close to reaching a deal with China and is demanding that India reduce its purchases of Russian oil. Otherwise, U.S. import tariffs could rise from 25% to significantly higher levels.