Last Friday, US stock indices ended the session in decline. The S&P 500 slipped by 0.20%, Nasdaq 100 lost 0.40%, while the Dow Jones Industrial Average managed a modest gain of 0.08%.

Futures on both US and European equities edged lower ahead of Donald Trump's talks with Ukrainian President Volodymyr Zelensky, following his meeting in Alaska with Russian President Vladimir Putin, which wrapped up without an escalation of geopolitical tensions. European stock futures dropped 0.2%, while S&P 500 futures eased 0.1% after Asian indices had risen 0.4%. US Treasuries inched higher, with the 10-year yield down one basis point to 4.30%. Gold rose 0.4%, cryptocurrencies retreated, and oil prices swung as supply concerns eased.

Today, investors are set to focus on Trump–Zelensky talks to gauge market direction after the Putin summit ended without new sanctions against Russia or its oil buyers. The outcome could prove pivotal for US geopolitical strategy in the region and its global economic implications. Any hints of policy shifts—be it a softer stance toward Moscow or firmer pressure on Kyiv—could spark volatility across equity and currency markets, with energy and defense sectors under the spotlight.

The lack of new sanctions after Putin's meeting may offer temporary relief for Russian assets, though the broader geopolitical risk picture remains intact. Market participants will continue weighing potential restrictions down the line alongside ongoing regional instability.

Traders are also treading carefully ahead of the Federal Reserve's annual Jackson Hole symposium. Chair Jerome Powell's remarks will be scrutinized for clues on whether the Fed could cut rates in September. With recent US data softening, a dovish tilt could fuel a rally by bolstering expectations of cheaper borrowing costs and renewed appetite for risk assets. But a hawkish undertone—pointing to US economic resilience—could temper such hopes, triggering equity pullbacks and strengthening the dollar.

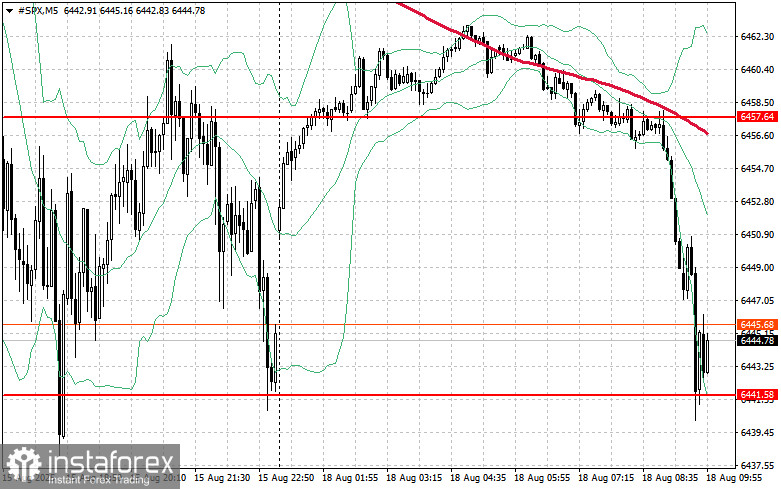

On the S&P 500's technical front, buyers face the immediate task of breaking resistance at 6,457, which would pave the way toward 6,473. Regaining control over 6,490 would further consolidate bullish positions. On the downside, demand is expected to surface near 6,441. A breakdown there could quickly push the index back to 6,428, with an extended slide toward 6,414.