The U.S. dollar's biggest fears have not materialized. Could this be a basis for a correction in EUR/USD? For a long time, the main currency pair was rising, as the market discussed capital outflows from the United States and increased currency risk hedging by foreign investors holding U.S. assets. Neither driver is troubling the greenback anymore.

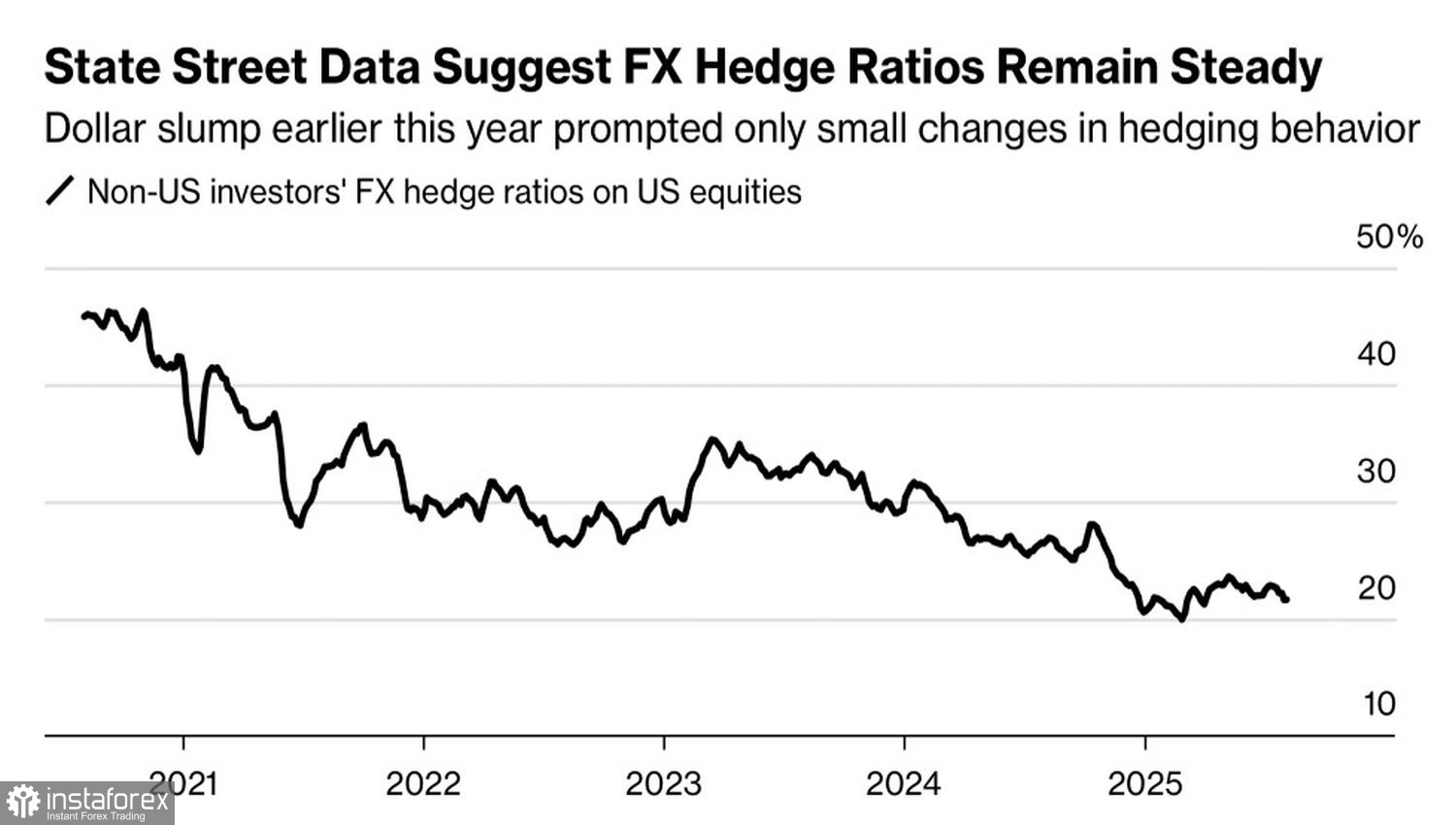

According to research by State Street Markets, non-U.S. investors have reduced their hedge ratios for U.S.-issued securities from 23.6% in May to the current 21.6%. The indicator has returned to levels last seen before America's Liberation Day, when uncertainty over Donald Trump's policies forced nonresidents to hedge against the risk of dollar weakness.

Hedging ratio dynamics

An important factor in this process was the increase in hedging costs. For European investors, expenses rose from 1.31% in September to 2.40%. The figure remains above April's 2.20%. It seems the market no longer sees serious reasons for U.S. dollar weakness.

Another encouraging factor for EUR/USD bears is the increase in foreign purchases of U.S. Treasuries by 508.1 billion dollars in the first half of the year. The most active buyers were the UK and Belgium. In contrast, India and Ireland reduced their holdings, while China kept theirs almost unchanged. Back in April, Forex discussions suggested that U.S. opponents in trade wars would offload Treasuries, weakening the dollar. In practice, this is not happening.

Meanwhile, investors are preparing for the Jackson Hole central bankers' meeting. Jerome Powell now has a unique opportunity to announce a shift in the Federal Reserve's outlook. The only problem is that U.S. economic data is getting in his way. It almost seems as though the statistics are mocking the Fed Chair. Following the last FOMC meeting, he spoke of a strong labor market and risks of accelerating inflation. In reality, employment has dropped sharply, while consumer prices have stalled.

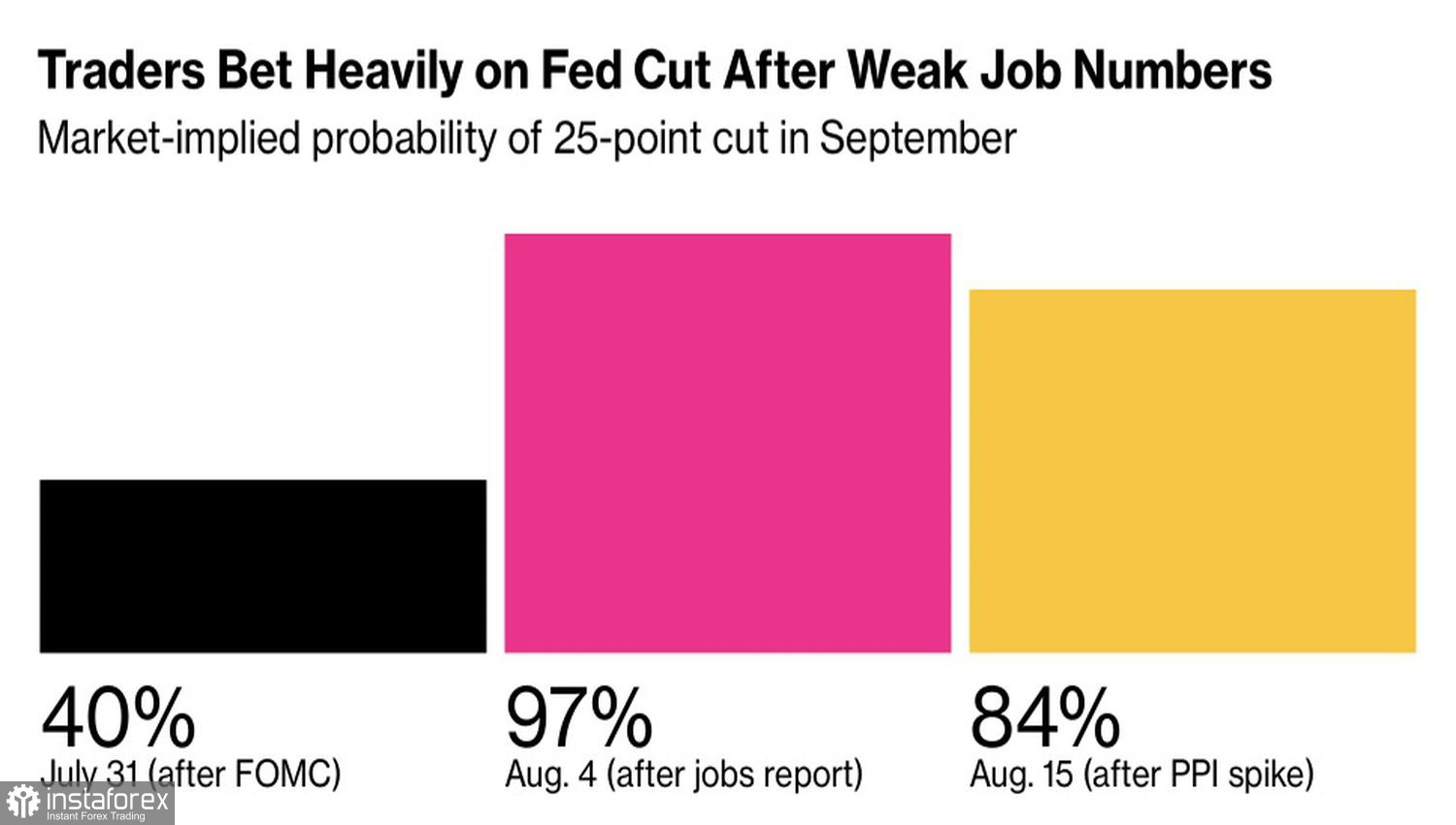

Chances of Fed monetary policy easing

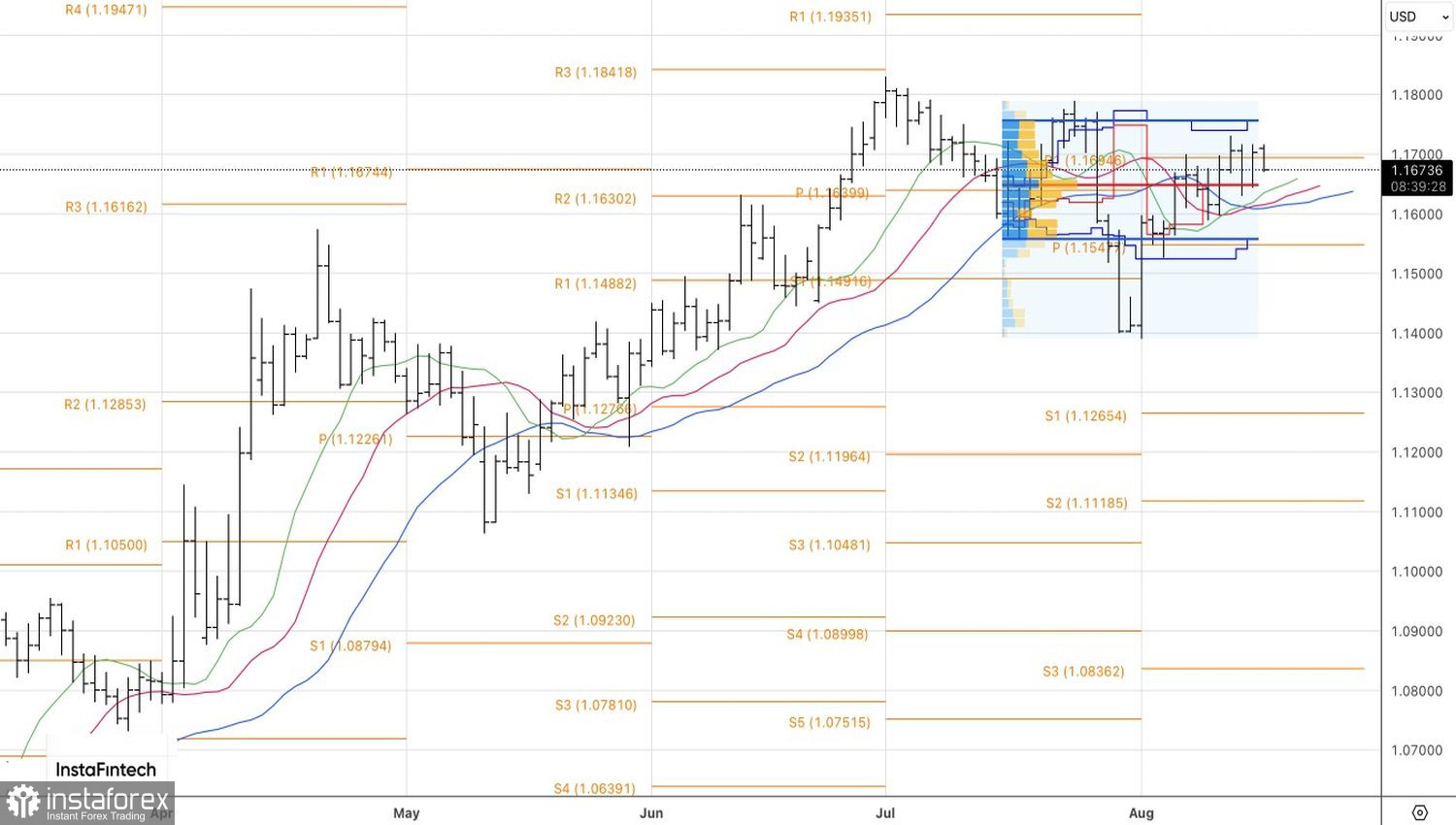

As a result, expectations for a Fed monetary easing cycle in September are on a rollercoaster. After the July U.S. labor market data, they jumped from 40% to 97%. Following the release of producer price figures, they fell back to 84%. Unsurprisingly, the main currency pair has been swinging between extremes, moving within a short-term consolidation range. Without breaking out of this channel, it will be challenging to clarify the euro's prospects.

From a technical standpoint, on the daily EUR/USD chart, repeated attempts by bulls to hold above the 1.170 pivot level have failed. This signals buyer weakness and increases the risk of a pullback. However, bears first need to break through the fair value at 1.165. If they succeed, it will generate a sell signal.