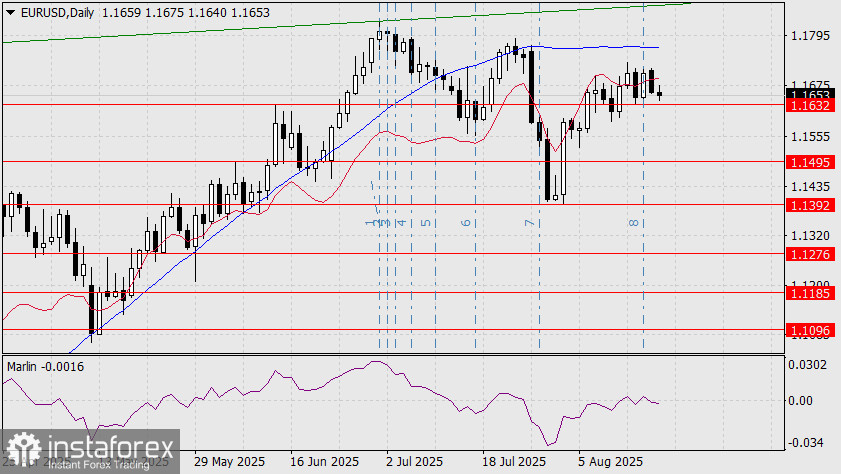

Yesterday's black candlestick in the euro, about 50 pips, formed right after the Fibonacci time line. This means the situation is unfolding according to our main scenario. Now, consolidation below the 1.1632 level opens the target at 1.1495. The Marlin oscillator has crossed into negative territory.

Trading volumes in the euro, however, remain below average. The same is true for energy futures. This indicates cautious sentiment. There are no hidden signs of smoldering fears. But there may be preparation for a breakout of a different kind – if the September Federal Reserve rate cut is already priced in, the market could turn downward on the actual news. The Fed meeting is still a month away, but "preparation" could be made by selling the euro on Jerome Powell's speech at the Jackson Hole symposium on August 22.

If we look at the euro's behavior without the dollar component, we see a rise in European government bond yields (while U.S. yields are not increasing). Yesterday, the yield on 5-year German bonds rose from 2.278% to 2.336%. This anxiety among German investors began on August 6, when yields were at 2.216%. The yield on 5-year UK bonds has also risen since August 6, from 3.961% to 4.127%. A similar picture is observed with French bonds. Genuine anxiety is building in Europe, and this only increases the likelihood of the euro (and the pound) declining after the Fed's rate cut.

On the four-hour chart, the price has consolidated below the MACD line, and the Marlin oscillator has firmly settled in bearish territory. The first and primary signs of further decline have been established.