The euro and the pound continued their decline at the very beginning of the week. Demand for the U.S. dollar returned against the backdrop of an important meeting between representatives of the U.S., Ukraine, and the European Union.

Despite the absence of key economic data from the U.S., the dollar showed strength. As I mentioned earlier, the trigger for this growth may have been the meeting between Donald Trump, Volodymyr Zelensky, and representatives of the European Union. The market perceived this meeting as a signal of possible stabilization of the geopolitical situation in the region, which in turn increased the attractiveness of the dollar as a more reliable asset. However, the effect of the meeting may be short-lived. Without support from fundamental economic indicators, a sustainable dollar rally is unlikely.

Traders' attention will now shift to upcoming macroeconomic releases, which will determine the further dynamics of currency pairs. However, today, only the European Central Bank's current account balance data is expected. This indicator is not a key measure of economic stability in the euro area, but it reflects the difference between capital inflows and outflows. A surplus, where inflows exceed outflows, indicates the eurozone's attractiveness to foreign investment, which typically supports the euro. Conversely, a deficit may trigger weakening of the European currency. Still, even a slight decline in the balance does not necessarily lead to a sharp euro sell-off. Much will depend on the market's reaction to the data. If the figures are better than expected, the euro could strengthen in the short term. Otherwise, an increase in bearish sentiment is quite likely.

If the data matches economists' forecasts, it is better to act based on a Mean Reversion strategy. If the data turns out to be much higher or lower than expectations, the best option is to use a Momentum strategy.

Momentum Strategy (Breakout):

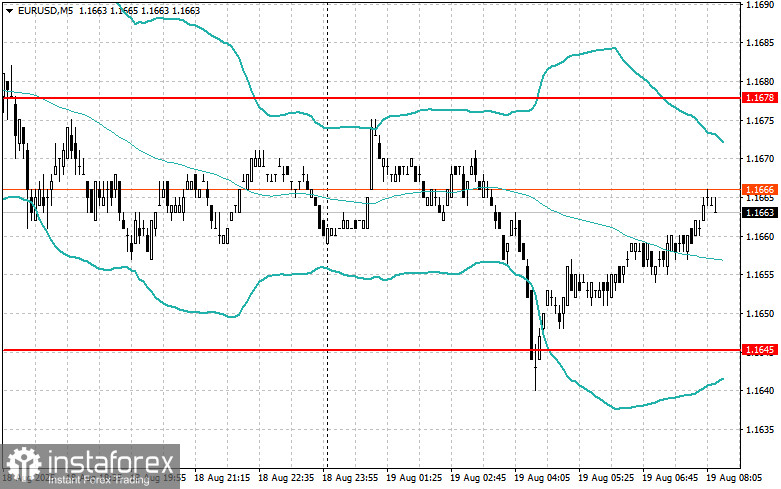

EUR/USD

Buy on a breakout above 1.1670, with targets at 1.1695 and 1.1730.

Sell on a breakout below 1.1650, with targets at 1.1630 and 1.1600.

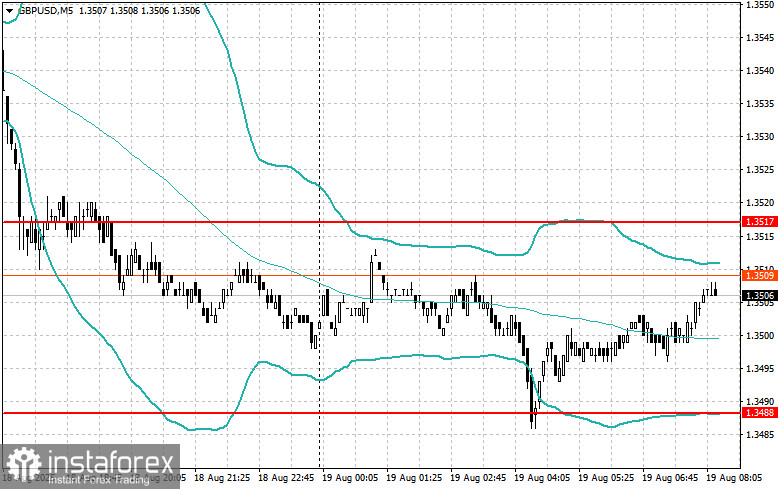

GBP/USD

Buy on a breakout above 1.3520, with targets at 1.3555 and 1.3587.

Sell on a breakout below 1.3480, with targets at 1.3440 and 1.3400.

USD/JPY

Buy on a breakout above 147.90, with targets at 148.20 and 148.50.

Sell on a breakout below 147.55, with targets at 147.30 and 147.00.

Mean Reversion Strategy (Pullbacks):

EUR/USD

Look for selling opportunities after a failed breakout above 1.1678 and a return below this level.

Look for buying opportunities after a failed breakout below 1.1645 and a return above this level.

GBP/USD

Look for selling opportunities after a failed breakout above 1.3517 and a return below this level.

Look for buying opportunities after a failed breakout below 1.3488 and a return above this level.

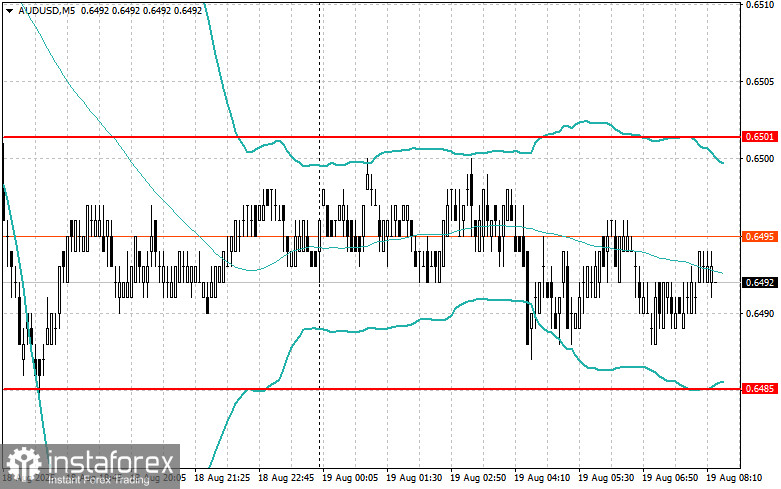

AUD/USD

Look for selling opportunities after a failed breakout above 0.6501 and a return below this level.

Look for buying opportunities after a failed breakout below 0.6485 and a return above this level.

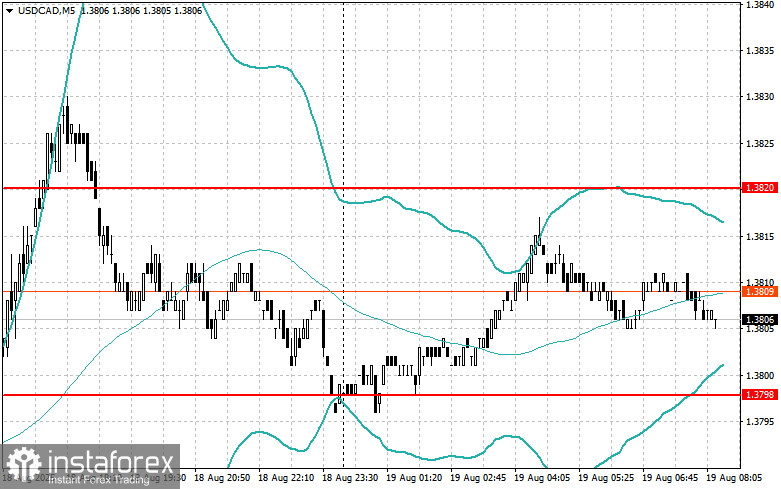

USD/CAD

Look for selling opportunities after a failed breakout above 1.3820 and a return below this level.

Look for buying opportunities after a failed breakout below 1.3798 and a return above this level.