Analysis of Trades and Trading Tips for the British Pound

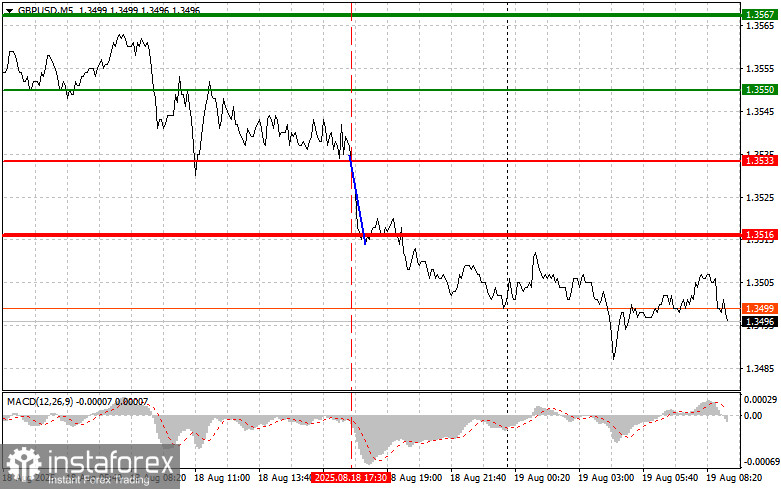

The price test of 1.3533 coincided with the moment when the MACD indicator had just begun moving downward from the zero mark, confirming the correct entry point for selling the pound. As a result, the pair declined toward the target level of 1.3516.

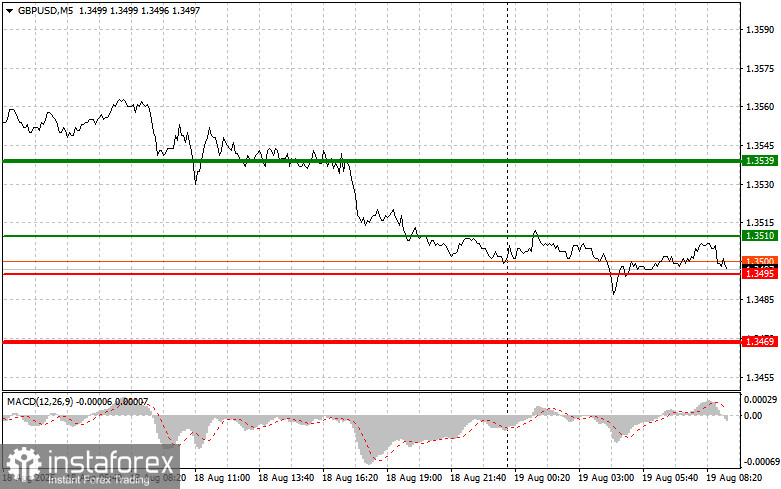

Yesterday's decline in the pound sterling against the U.S. dollar still fits within the framework of the expected correction that had been building over the past several days. Today, in the first half of the day, no economic data releases are scheduled in the United Kingdom. However, the influence of external factors should not be ruled out. Sentiment in global markets, as well as the dynamics of the U.S. dollar against other currencies, including the euro and yen, may affect the current movement of GBP/USD. In particular, unexpected statements from representatives of the U.S. Federal Reserve or the Bank of England could significantly impact the balance of power in the currency market.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: I plan to buy the pound today when the entry point reaches around 1.3510 (green line on the chart), targeting growth toward 1.3539 (thicker green line on the chart). Around 1.3539, I intend to exit the buys and open sell positions in the opposite direction (looking for a 30–35-point reversal from the level). Growth of the pound today is possible, though it is unlikely to be strong. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario #2: I also plan to buy the pound today in the case of two consecutive tests of the 1.3495 price level at the moment when the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to an upward reversal. Growth toward the opposite levels of 1.3510 and 1.3539 can be expected.

Sell Scenario

Scenario #1: I plan to sell the pound today after the price breaks below 1.3495 (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 1.3469, where I intend to exit sales and immediately open buys in the opposite direction (looking for a 20–25-point reversal from the level). Sellers of the pound may return at any moment today, taking advantage of low trading volumes. Important! Before selling, ensure the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario #2: I also plan to sell the pound today in the case of two consecutive tests of the 1.3510 price level at the moment when the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.3495 and 1.3469 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.