Analysis of Macroeconomic Reports:

Only two macroeconomic releases are scheduled for Wednesday. The UK and the eurozone will publish consumer price indices for July. The European report is released in two estimates, so the second estimate has virtually no chance of impressing traders. The UK report is much more important and could support the British currency if it shows that inflation has accelerated again. This would further reduce the likelihood of a Bank of England key rate cut in the near term.

Analysis of Fundamental Events:

Among Wednesday's fundamental events, the speeches by Federal Reserve representatives Christopher Waller and Raphael Bostic stand out. Recall that the Fed is rushing toward a key rate cut in September. The rate will likely be lowered several times before the end of the year. Roughly half of the FOMC committee adheres to the view that a gradual rate cut is necessary. The more dovish opinions we hear, the greater the chances of renewed weakness in the U.S. dollar.

The trade war remains the top concern for traders. We still believe that any trade deals that preserve tariffs are essentially the same trade war "in a different wrapper." For the U.S., deals like those concluded with the European Union or Japan are certainly beneficial. Therefore, each new agreement of this type could provoke a rise in the U.S. dollar. However, on a global and fundamental level, the market will keep in mind the new trade architecture and Donald Trump's protectionist policies. Against this background, the dollar is unlikely to show convincing growth. Recently, Trump has not introduced new tariffs, as he is occupied with resolving the conflict between Ukraine and Russia. Therefore, this issue has gone somewhat quiet.

Conclusions:

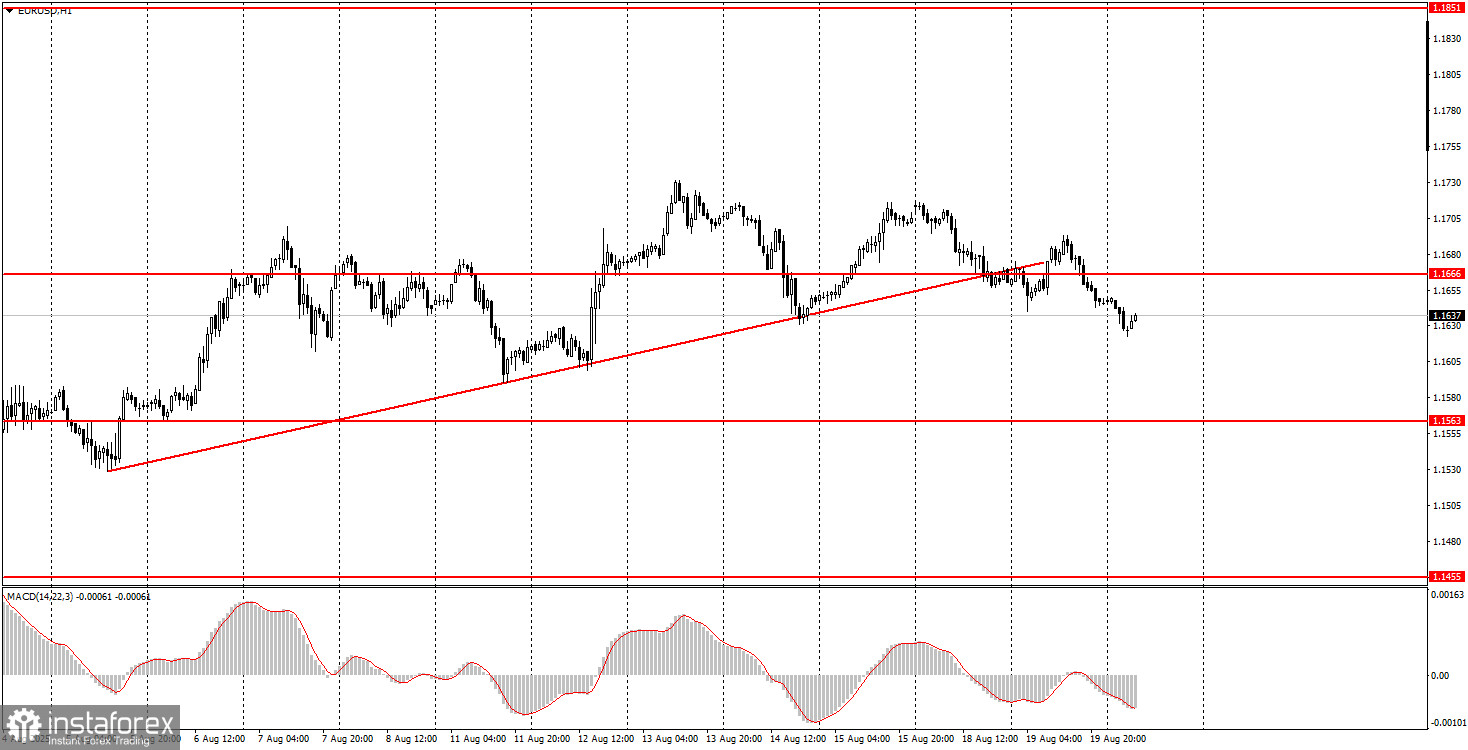

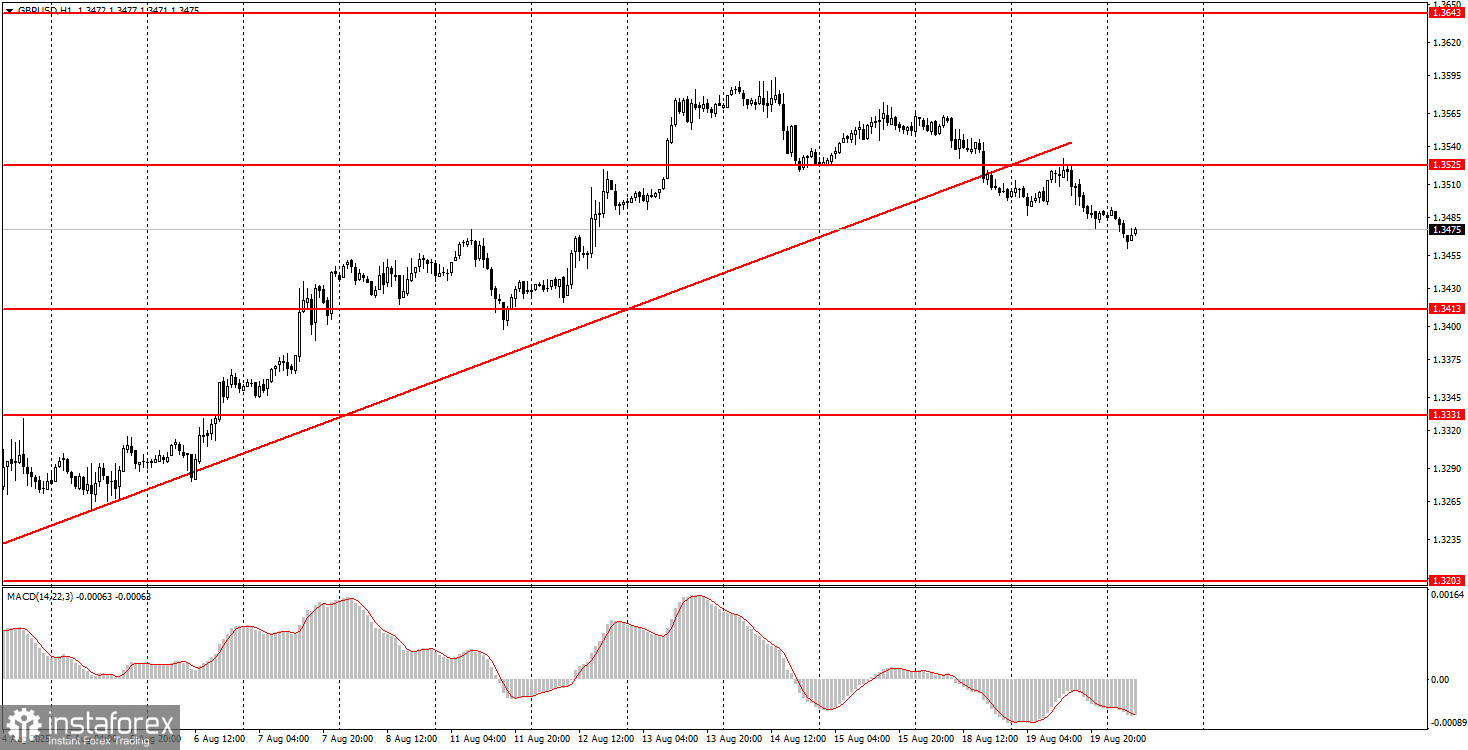

On the third trading day of the week, both currency pairs may move in either direction, as fundamentals and macroeconomics will again be weak today. The euro may continue its sluggish decline after breaking through the 1.1655–1.1666 area, while the pound sterling can be traded from the 1.3466–1.3475 area.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.