Bitcoin and Ethereum are feeling malaise today, showing no signs of recovery even after yesterday's major sell-off. This points to a wait-and-see stance from large players who are hoping for more attractive entry prices at lower levels.

Meanwhile, media reports suggest that China is considering, for the first time, allowing the use of yuan-backed stablecoins in an effort to encourage wider adoption of its currency globally.

If implemented, this move would mark a turning point in the global competition of digital currencies. Beijing, aiming to strengthen the yuan's position as an alternative to the US dollar, could leverage stablecoins as a tool to simplify international transactions and attract foreign investors. However, such a decision comes with risks. Managing the circulation of yuan-backed stablecoins would require Chinese regulators to establish a strict legal framework and effective monitoring mechanisms. Without them, there is a danger of capital outflows and weakened control over the currency market.

China's State Council is expected to review and possibly approve a roadmap for expanding the use of its currency worldwide later this month, including catching up with the US in stablecoin development. The plan will likely set targets for the yuan's use in global markets and define the responsibilities of domestic regulators, as well as include recommendations to mitigate risks. According to sources, top leadership will convene for a briefing session by the end of the month, placing particular focus on the internationalization of the yuan and the growing global momentum of stablecoins.

If China reenters the digital asset market, even in this limited form, it could serve as a strong driver for the crypto market in the medium term.

As for an intraday crypto trading strategy, I continue to rely on sharp dips in Bitcoin and Ethereum to position for a continuation of the medium-term bull market, which is still intact. The short-term trading strategy is outlined below.

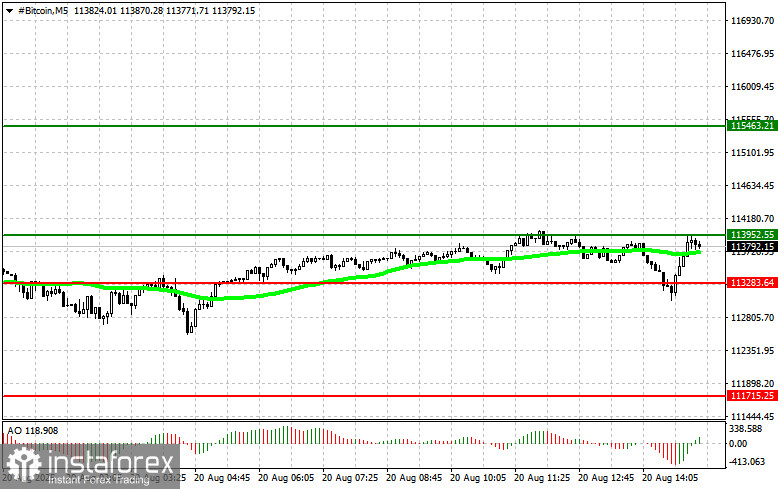

Bitcoin

Buy scenario

Scenario #1: I will look to buy Bitcoin around the $113,900 entry point with an upside target at $115,400. I plan to close longs and sell immediately on a rebound from $115,400. Before a breakout buy, it's important to confirm that the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Another option is to buy from the lower border at $113,200, if there is no downside breakout reaction, targeting a move back to $113,900 and $115,400.

Sell scenario

Scenario #1: I will sell Bitcoin at the $113,200 entry point with a downside target at $111,700. I plan to close shorts and buy immediately on a rebound from $111,700. Before a breakout sell, it's important to confirm that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Alternatively, Bitcoin can be sold from the upper boundary at $113,900, if there is no breakout reaction, targeting $113,200 and $111,700.

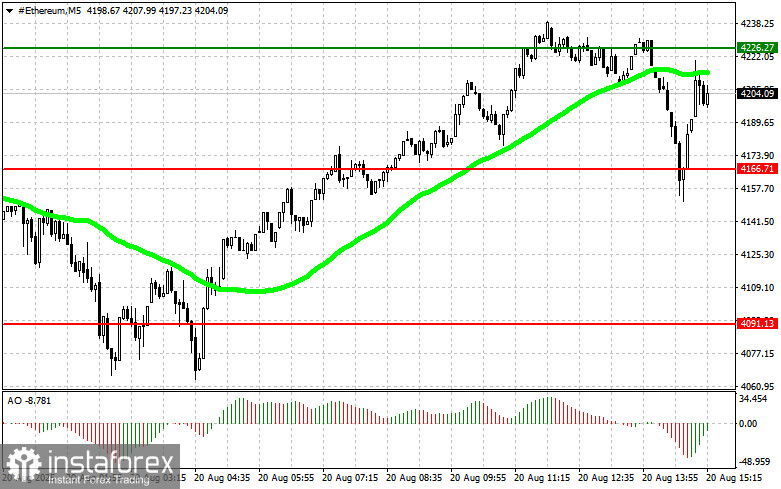

Ethereum

Buy scenario

Scenario #1: I will look to buy Ethereum at the $4,226 entry point with an upside target at $4,323. I plan to close longs and sell immediately on a rebound from $4,323. Before a breakout buy, it's important to confirm that the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Another option is to buy from the lower border at $4,166, if there is no downside breakout reaction, targeting a move back to $4,226 and $4,323.

Sell scenario

Scenario #1: I will sell Ethereum at the $4,166 entry point with a downside target at $4,091. I plan to close shorts and buy immediately on a rebound from $4,091. Before a breakout sell, it's important to confirm that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Alternatively, Ethereum can be sold from the upper border at $4,226, if there is no breakout reaction, targeting $4,166 and $4,091.