The GBP/USD currency pair continued its sluggish downward movement on Wednesday. While the euro has been standing still in recent days, the pound sterling has shown a slight correction. However, this does not change the overall picture. Market volatility remains very low; there is no macroeconomic background, no fundamental background, and the market is in no hurry to draw conclusions about recent geopolitical developments. Thus, as we have already mentioned in previous articles, the market has entered a pause. A simple, ordinary pause. The euro is using this pause for flat trading, while the pound is using it for a minor correction. There is no need to invent explanations for these moves that don't exist. The forex market continues to operate, and trades are still being executed. It's just that volumes are not very high right now, while speculators, who usually drive price movements, have gone quiet.

In the EUR/USD article, we noted that everything does not revolve around Jerome Powell, and in the first half of 2025, the Federal Reserve's monetary policy (just like that of the European Central Bank and the Bank of England) did not concern anyone at all. Otherwise, we would have seen a strong appreciation of the U.S. currency. The market treats every Powell speech as if the Fed Chair announces the central bank's future decisions every single time. But Powell always remains as restrained as possible and does not throw words around lightly. Most likely, that will be the case this time too.

Moreover, if the market expects monetary policy easing, then why does it need Powell? It is now clear to everyone that Donald Trump will pressure the Fed by any means, and Powell will leave his post next year regardless. That means the 3% rate cut Trump wants is only a matter of time. What is preventing the market from selling the dollar further, given that the Fed's monetary policy outlook is already predetermined?

If Powell maintains a hawkish tone on Friday, citing rising inflation, how many market participants will be willing to make medium-term dollar purchases? This would mean that Powell's hawkish remarks might push the dollar up by 50–70 pips, but this will not change anything. We would simply see another round of correction, and that's all. After all, the main factor behind the dollar's decline in the first half of the year was Trump's policies — particularly his trade policy.

In the past week, the market's attention shifted from the trade war to negotiations between Ukraine and Russia. We don't know whether peace is possible or how long negotiations will take, given that they haven't even truly started yet. Let us recall that talks should be held between Kyiv and Moscow, not between Trump and the conflict participants separately. Over the past week, while preoccupied with other matters, Trump has not introduced new tariffs, raised existing ones, or announced fresh sanctions against countries. Meanwhile, India has ignored Trump's threats of "draconian" tariffs over its refusal to stop buying Russian oil and gas. Because everything has its limits, we understand that Trump seeks to solve every issue from a position of strength, but with such policies, the whole world may soon turn against the United States.

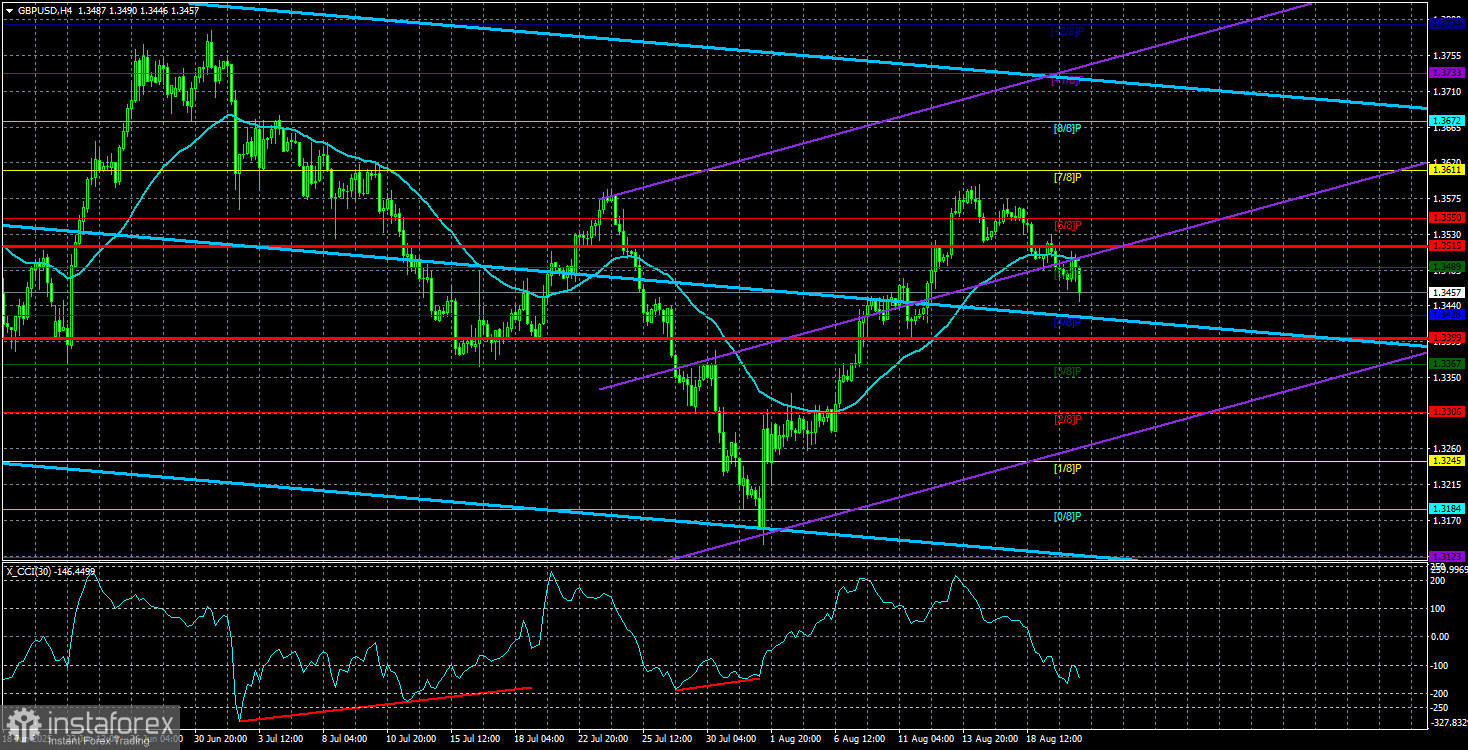

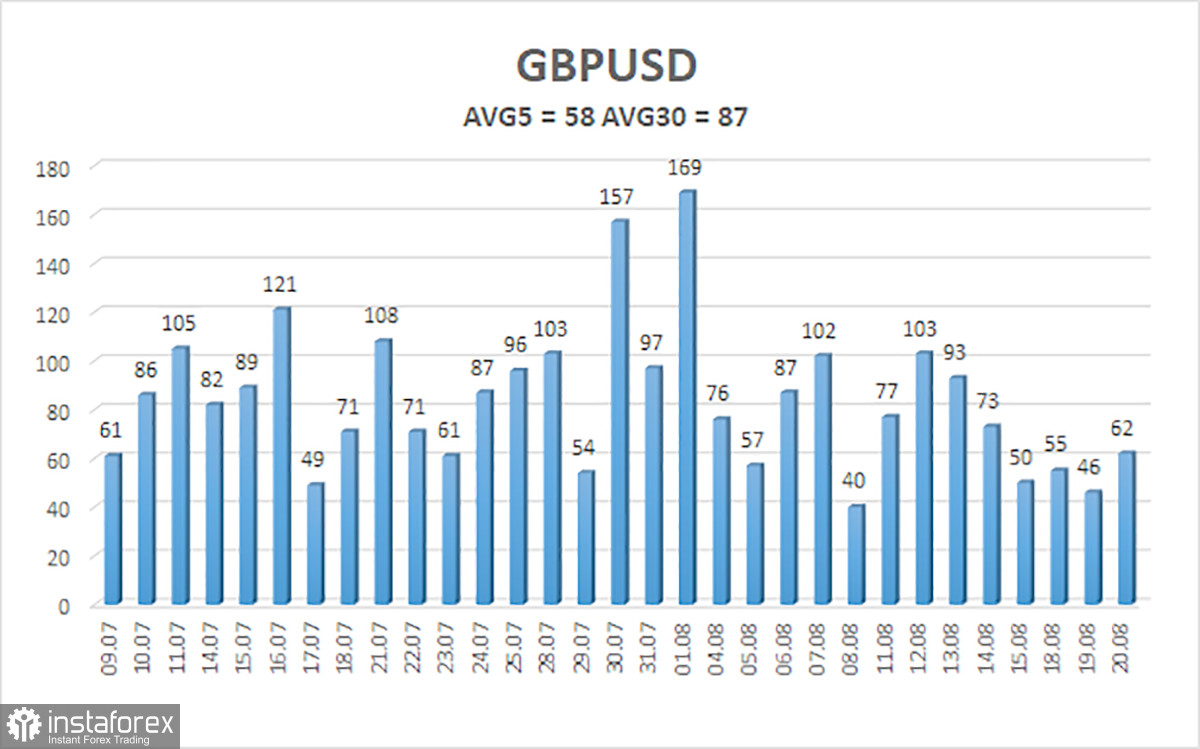

The average volatility of the GBP/USD pair over the last five trading days is 58 pips. For the pound/dollar pair, this is classified as "medium-low." Thus, on Thursday, August 21, we expect movement within the range bounded by the levels 1.3399 and 1.3515. The long-term linear regression channel is directed upward, which indicates an uptrend. The CCI indicator has entered oversold territory twice, warning of the resumption of the upward trend. Several bullish divergences also formed before the start of a new growth cycle.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest Resistance Levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading Recommendations:

The GBP/USD pair has completed another round of downward correction. In the medium term, Trump's policies are likely to continue putting pressure on the dollar. Thus, long positions with targets at 1.3611 and 1.3672 remain much more relevant if the price is above the moving average. If the price is below the moving average, small short positions with a target at 1.3399 can be considered purely on technical grounds. From time to time, the U.S. currency shows corrections, but for a trend-based strengthening, it needs real signs of the end of the Global Trade War.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.