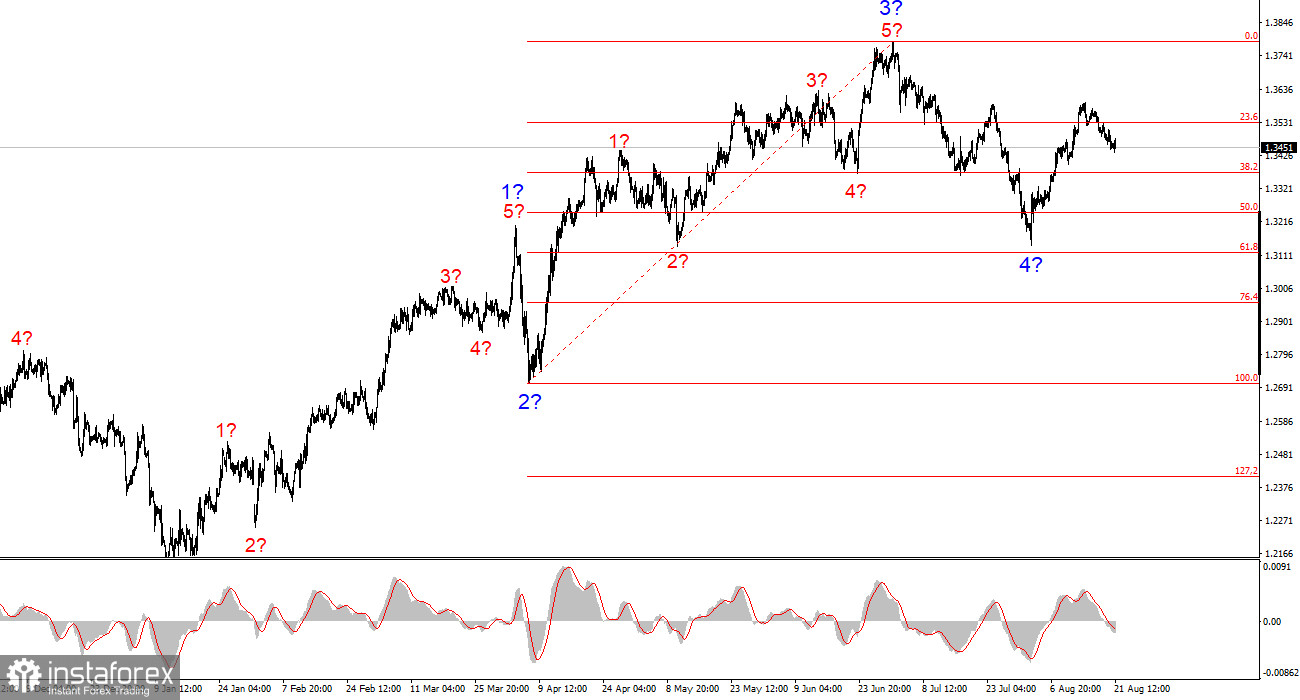

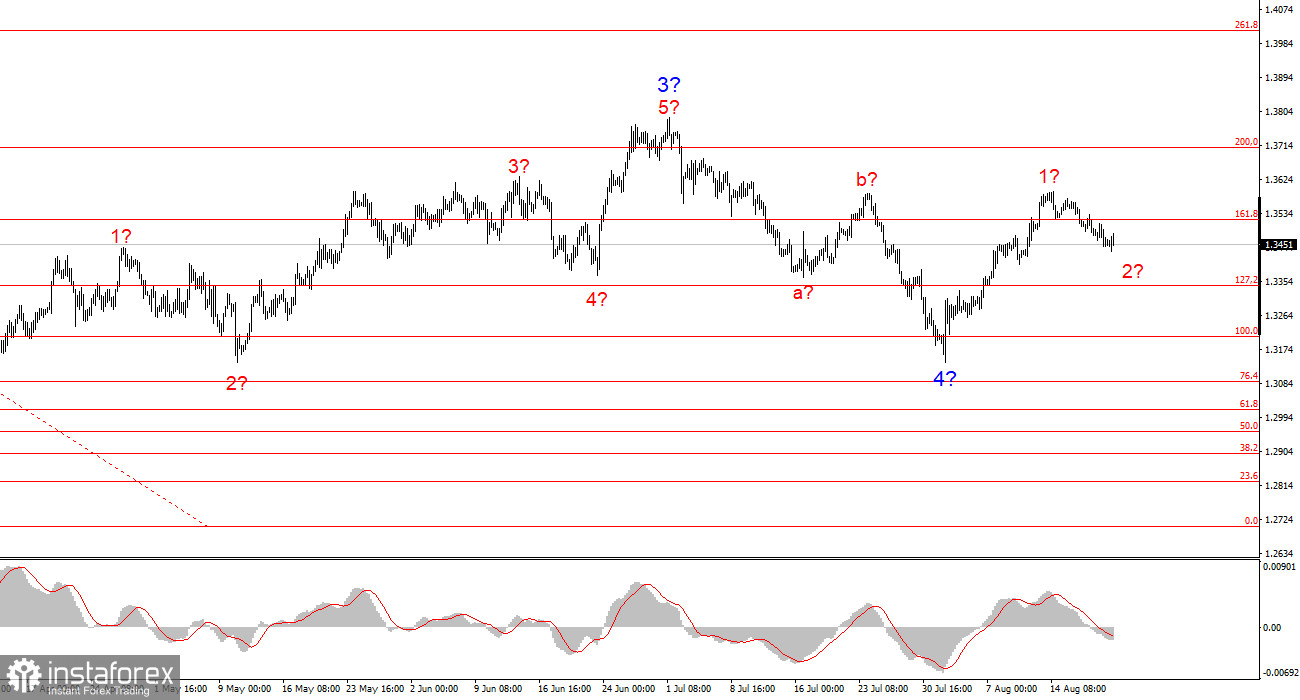

The wave pattern for GBP/USD continues to indicate the formation of a bullish impulse structure. The wave picture is nearly identical to that of EUR/USD, as the only "driving force" remains the U.S. dollar. Demand for the dollar has been falling across the market (in the medium term), which is why many instruments are showing nearly the same dynamics. At present, wave 4 is assumed to be complete. If that is indeed the case, the instrument will continue rising within the framework of impulse wave 5. Wave 4 could take the shape of a five-wave structure, but that is not the most likely scenario.

It should be remembered that much in the currency market now depends on Donald Trump's policies — and not only trade-related ones. From time to time, decent news comes out of the U.S., yet the market remains fixated on overall uncertainty in the economy, Trump's contradictory decisions and statements, and the White House's hostile and protectionist stance. Global tensions are rising and, as I have already said, the main "culprit" remains the dollar, which is why it continues to take all the hits.

The GBP/USD pair once again showed almost no change on Thursday. The pair has been gradually declining throughout the week, but I cannot say that sellers have the upper hand. The current wave pattern allows for the formation of a small corrective wave 2 within wave 5 before new growth begins. Most likely, we are still observing the development of this wave.

This morning, there were chances for increased market activity. The UK released business activity indices for services and manufacturing, and UK PMIs usually carry more weight for market participants than European or U.S. ones. However, the reporting structure turned out to be similar to that in the EU and Germany: one report beat market expectations, the other disappointed. While activity in the services sector rose significantly (to 53.6 points), activity in manufacturing fell even further below the previous value. As a result, the pound is entering the U.S. session at the same levels where it started the European and Asian sessions.

In my view, the wave pattern currently provides an exhaustive answer to the question of what to expect next. We saw a clear three-wave corrective structure within wave 4 of the higher degree. Only very strong news in favor of the dollar could turn it into a five-wave a-b-c-d-e structure. Such strong news is unlikely, as even under the most favorable circumstances, Jerome Powell is not expected to change his position on monetary policy tomorrow due to rising inflation. Therefore, I do not expect any significant increase in demand for the U.S. dollar under any circumstances. Thus, the key question now is: from which exact level will the pound begin its new ascent and the dollar its decline?

General conclusions

The wave pattern for GBP/USD remains unchanged. We are dealing with a bullish, impulse segment of the trend. Under Donald Trump, markets may face many more shocks and reversals, which could significantly affect the wave picture, but at this stage the working scenario remains intact. The targets for the bullish segment of the trend are now located around 1.4017. At present, I assume that the formation of corrective wave 4 has been completed. Wave 2 within wave 5 is also nearing completion. Therefore, I recommend long positions with the target at 1.4017.

Key principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If there is no confidence in what is happening in the market, it is better not to enter.

- Absolute certainty about the direction of movement does not and cannot exist. Always remember to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.