On Thursday, the GBP/USD currency pair also traded very weakly, despite the entry of macroeconomic and fundamental information into the market during the day. We will cover the macroeconomic releases in "neighboring" articles. Meanwhile, the market continues to build strength ahead of a new trend, and this trend is likely to be upward again.

When Federal Reserve Monetary Committee member Adriana Kugler resigned, we suspected that something was off. The situation looks very strange: as soon as Donald Trump became president and resumed pressure on the central bank that is not under his control, Jerome Powell immediately turned into an "idiot," "slow," and simply a "fraud." When Trump realized that Powell would not resign voluntarily, his strategy changed. Now the pressure shifted not to Powell (what would be the point?) but to the members of the FOMC themselves. Trump reasonably decided that if he could not remove the head of the Fed, then he needed to change the composition of the Committee so that by a simple majority vote, it would make the decisions he wanted, regardless of Powell's opinion.

And so, Kugler left her post early, and Trump immediately announced that "he had a couple of suitable candidates." No one doubts that these candidates have already received instructions in the form of requirements to vote only for rate cuts. After that, Trump called on another FOMC member, Lisa Cook, to resign voluntarily. Naturally, she also suddenly became a "fraud," since, according to the U.S. president, Cook falsified banking and real estate documents to obtain more favorable mortgage lending terms. At this pace, soon half of the Monetary Committee will turn into "frauds," which is comical in itself.

However, everything happening in the U.S. now is both laughable and sad at the same time. We do not doubt that all these accusations are just part of Trump's plan, who now simply wants to replace half of the FOMC with his people. He already has three at his disposal: Michelle Bowman, Christopher Waller (only these two voted for a rate cut at the last meeting), and newly appointed governor Steven Miran. Thus, we are waiting to see on whom the "sword of Damocles" will fall next week.

How should the U.S. dollar react to all these events? In our view, only by falling. If half of the Fed's members are fraudsters, then what can we even talk about? Either "frauds" or "fools" are sitting in the central bank. What kind of confidence can investors have in the national currency? Although everyone understands perfectly well that confidence in the dollar will decline, not because of the Fed, but because of Trump and his policies. Trump continues to interfere with the work of agencies beyond his control. By the way, how can we not recall the dismissal of Erica McEntarfer simply because Trump didn't like the latest NonFarm Payrolls reports? This is what modern America looks like. You can be fired simply because the president wants it. There may be no grounds, unions don't work, and if you suddenly want to defend your rights, you immediately become a "fraud." In our view, another sentence has already been passed on the dollar. All that remains is to wait for its execution.

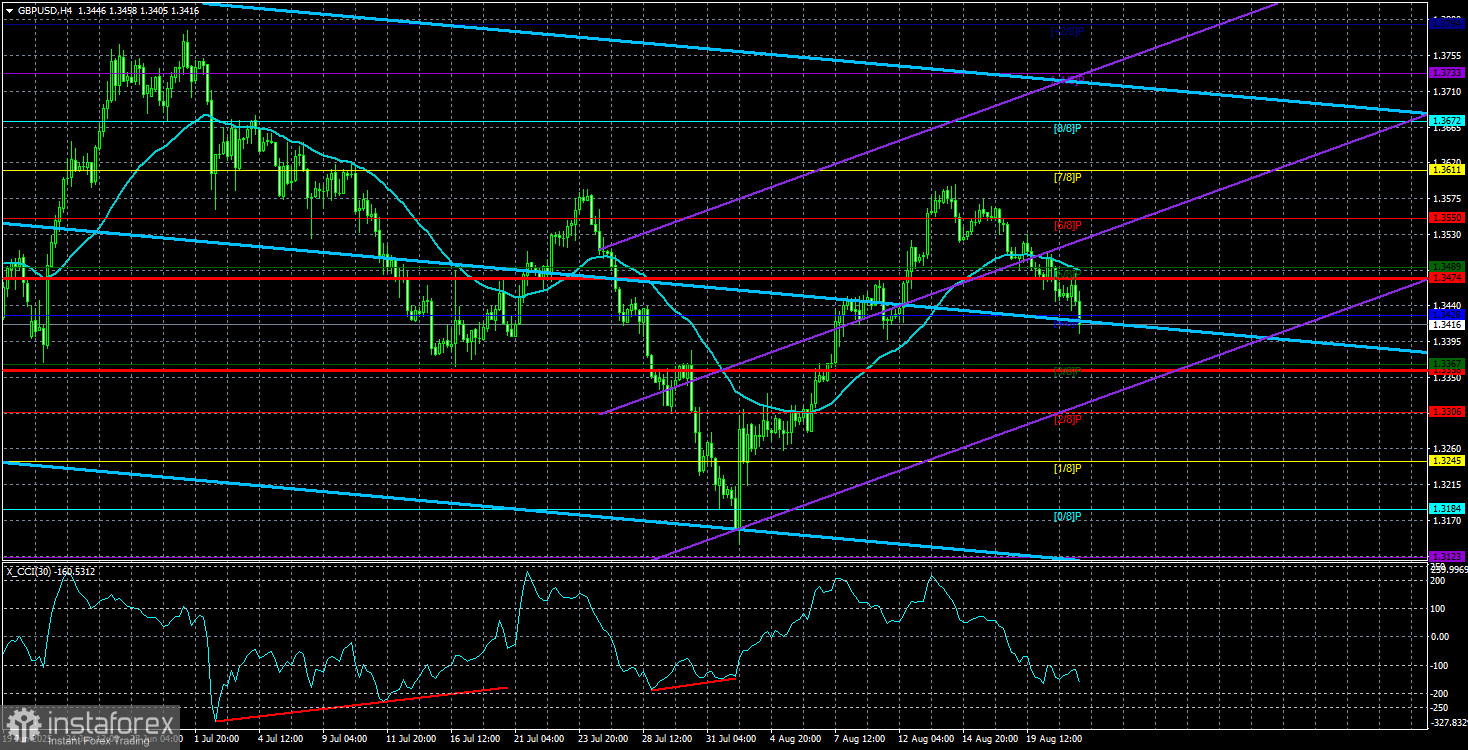

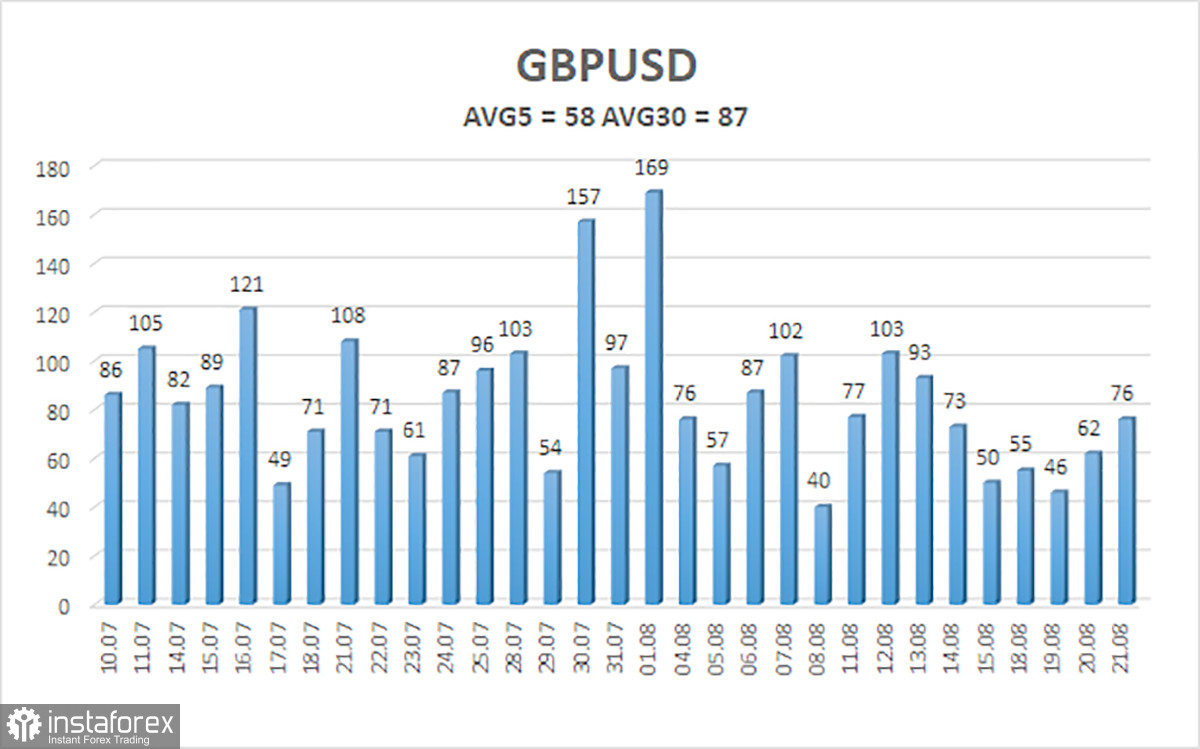

The average volatility of the GBP/USD pair over the past five trading days is 58 pips. For the pound/dollar pair, this figure is "medium-low." Therefore, on Friday, August 22, we expect movement within the range limited by the levels of 1.3358 and 1.3474. The long-term linear regression channel is pointing upward, which indicates a clear uptrend. The CCI indicator has twice entered the oversold area, signaling the resumption of the upward trend. Several bullish divergences were also formed before the new upward wave began.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest Resistance Levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading Recommendations:

The GBP/USD currency pair has completed another round of downward correction. In the medium term, Trump's policies will likely continue to pressure the dollar. Thus, long positions with targets at 1.3611 and 1.3672 remain much more relevant if the price is above the moving average. If the price is below the moving average line, small short positions with a target at 1.3367 can be considered on purely technical grounds. From time to time, the U.S. currency shows corrections, but for a trend-based strengthening, it needs real signs of the end of the global trade war.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.