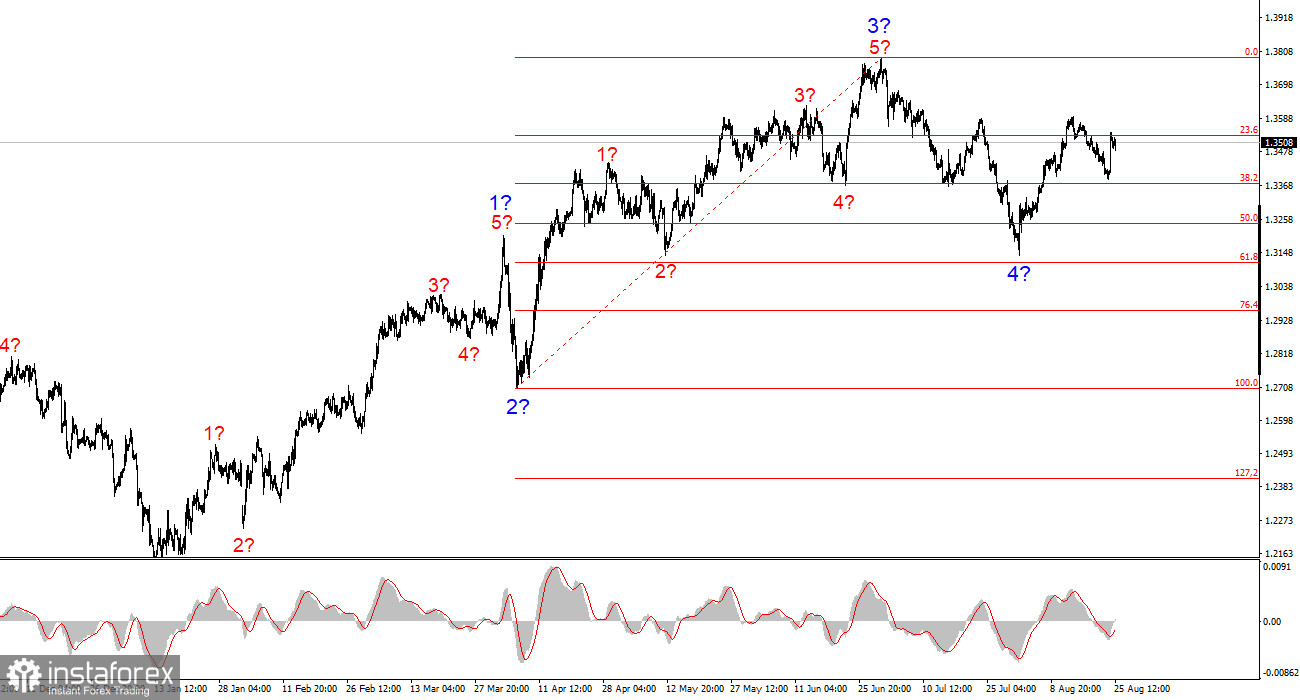

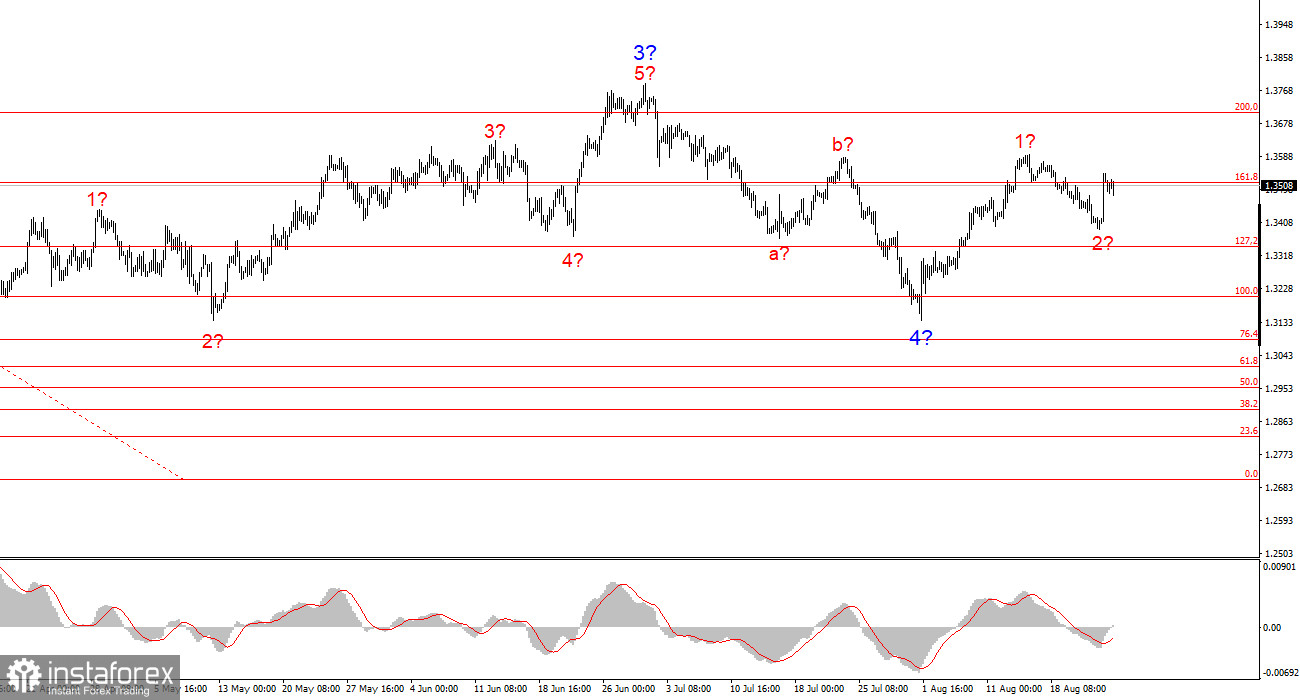

For GBP/USD, the wave pattern continues to indicate the development of a bullish impulse structure. The wave picture is almost identical to EUR/USD since the only "driving force" remains the dollar. Demand for the dollar is declining across the market (in the medium term), so many instruments are showing nearly identical dynamics. At this point, wave 4 is presumably complete. If this is the case, the instrument's rise will continue within impulse wave 5. Wave 4 could still take the form of a five-wave structure, but this is not the most likely scenario.

It should be remembered that much in the currency market now depends on Donald Trump's policies — and not only trade policy. Occasionally, some positive news comes out of the U.S., but the market remains preoccupied with overall uncertainty, contradictory decisions and statements from Trump, and the hostile, protectionist stance of the White House. Global tensions are rising, and, as already noted, the dollar is the main target — and continues to take all the "hits."

The GBP/USD rate gained 120 basis points on Friday and showed little change on Monday. Almost the entire U.S. session still lies ahead, so the amplitude of movements may increase. However, Monday's economic calendar is empty, so nothing significant is expected for the rest of the day. With no news or economic releases, I suggest taking another look at the wave structure.

If wave 3 of the upward trend did not have a completely classic internal wave structure, then wave 4 looks nearly perfect. At the moment, a new upward sequence of waves is forming within the expected wave 5. Wave 1 of 5 did not form a clear five-wave structure, so I do not expect a three-wave structure within wave 2 of 5. If this assumption is correct, the instrument should continue to rise from current levels.

What could prevent this? Today — nothing. Tomorrow — the U.S. durable goods orders report. However, judging by forecasts, this report is likely to disappoint dollar buyers once again. Orders are expected to fall by 2.5–4%. With such a wide range of negative forecasts and not a single positive one, the actual figures could turn out even worse. I believe tomorrow's report may be weaker than market expectations, and its significance could lead to a sharp intraday decline in the U.S. currency. This week may not bring many news releases, but any new tariffs announced by Donald Trump would be another reason to sell the dollar.

General Conclusions

The GBP/USD wave pattern remains unchanged. We are dealing with a bullish impulse segment of the trend. Under Donald Trump, markets may face many more shocks and reversals that could significantly affect the wave structure, but for now the working scenario remains intact. The targets for the bullish trend segment are now near 1.4017. At this point, I assume that the corrective wave 4 is complete. Wave 2 of 5 may also be complete. Therefore, I recommend buying with a target at 1.4017.

Main Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If there is no confidence in the market situation, it is better to stay out.

- Absolute certainty in market direction does not and cannot exist. Always remember to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.