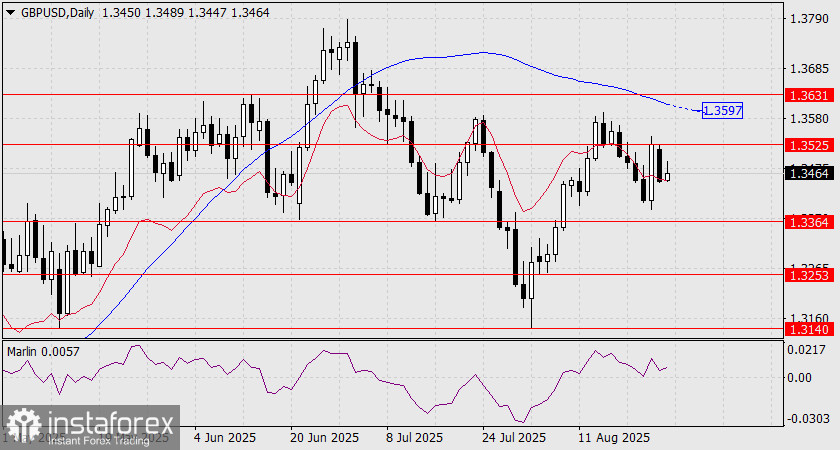

The British pound yesterday failed to break through the support of the daily balance line, and today began with growth. The Marlin oscillator is anchored in positive territory, helping the price move above the resistance level of 1.3525. If this happens, the target at 1.3597 (the MACD line) will open. Beyond that, the next level could be 1.3631 (the June 13 high).

However, we cannot call the bullish scenario the main one, since U.S. Treasury yields are declining along with American stock indices, which indicates that investors continue to move out of risk. There is also an element of anticipation around the quarterly earnings reports of major "AI" companies (Nvidia and others). Nvidia's earnings per share are forecast at $1.01. If investor expectations are disappointed, stock indices—and with them anti-dollar currencies—will worsen their position.

On the four-hour chart, the probability of growth is 55%. In the heat of the battle, the balance could shift. If the price falls below yesterday's low of 1.3445, the Marlin oscillator will return to negative territory, immediately increasing the probability of further decline to 60%.

For growth, the price must overcome not only the resistance level of 1.3525 and the MACD line but also Monday's high of 1.3543. Therefore, we are waiting to see how events develop.