It is important to keep in mind that inflation first and foremost affects the wallets of the poorest citizens of any country—the ones who are forced to economize on food and basic personal necessities, those who are mired in debt (especially relevant in the US), and those who need help from the state. However, Donald Trump, who slashed social and medical assistance for those who cannot afford it themselves and enacted the "One Big Beautiful Bill" (which envisions increasing the national debt by $3 trillion in the coming years), is unlikely to be concerned about those struggling to make ends meet.

America is a country of investment and capital. That means, first and foremost, the priority is to care about this capital. And capital is concentrated in the hands of millionaires and billionaires. Therefore, their interests must come first. Since Trump himself is not a poor man, in fact, he is looking after his own interests.

This results in the following reality: world economy debts are increasing, the cost of servicing these debts is rising, and central banks are powerless to influence the situation. All they can do is print new money to buy back part of the government's debt, thereby unleashing a new round of inflation. From this, it follows that the global financial system either needs a global reset or inflation will increase in almost any scenario. Ordinary citizens will bear the brunt of high inflation, while national governments will continue to borrow astronomical amounts to maintain the arms race and compete for economic leadership.

All this boils down to the rich getting richer and the poor getting poorer. But what does all of the above have to do with the forex market right now? If other central banks are also under government pressure, it's much less visible. Open confrontation is only prevalent in the USA. And a public scandal is a reason for many investors to think twice. Trump is not just demanding a rate cut; he demands a rate lower than in many other countries, especially those that are rich and economically developed. Trump wants to outcompete the main rivals, racking up even larger debts that the American population will ultimately cover.

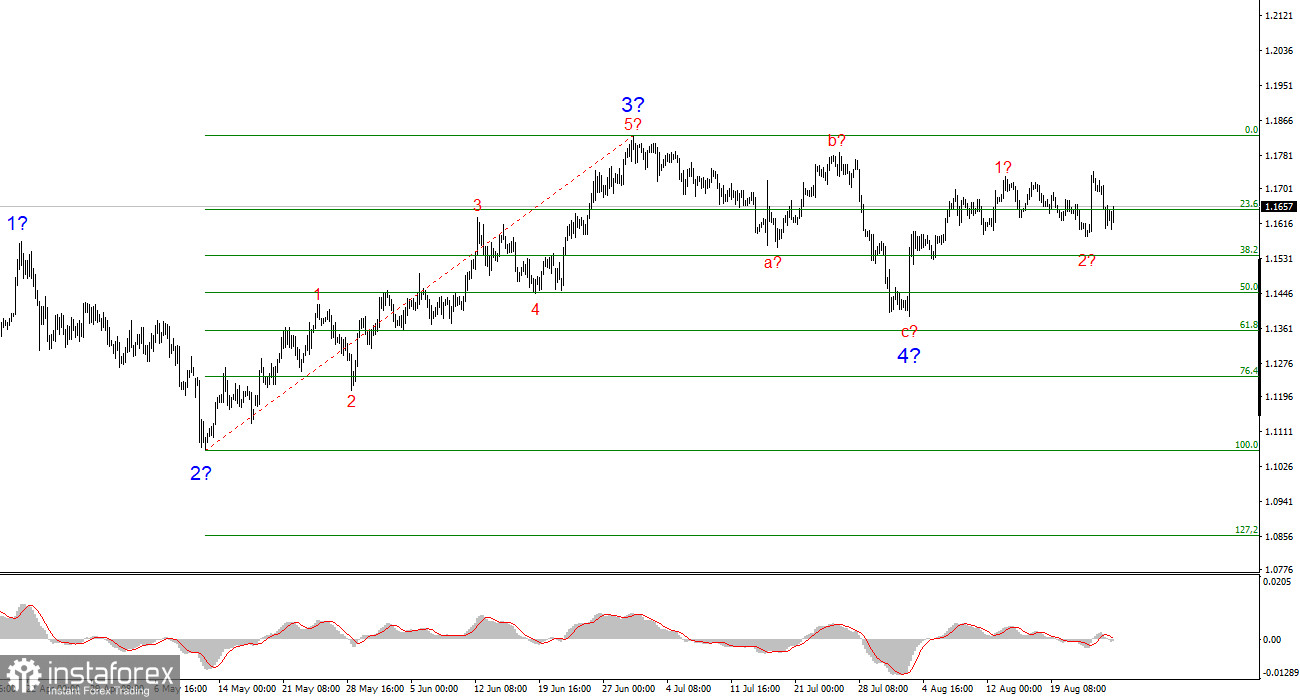

Wave Pattern for EUR/USD:

Based on my analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. The wave structure still entirely depends on the news background related to Trump's decisions and US foreign policy. The targets of this trend section could extend all the way to the 1.25 area. Therefore, I continue to look at buying with targets near 1.1875, which corresponds to 161.8% on the Fibonacci scale, and above. I believe that Wave 4 has been completed; therefore, it is still a good time to buy.

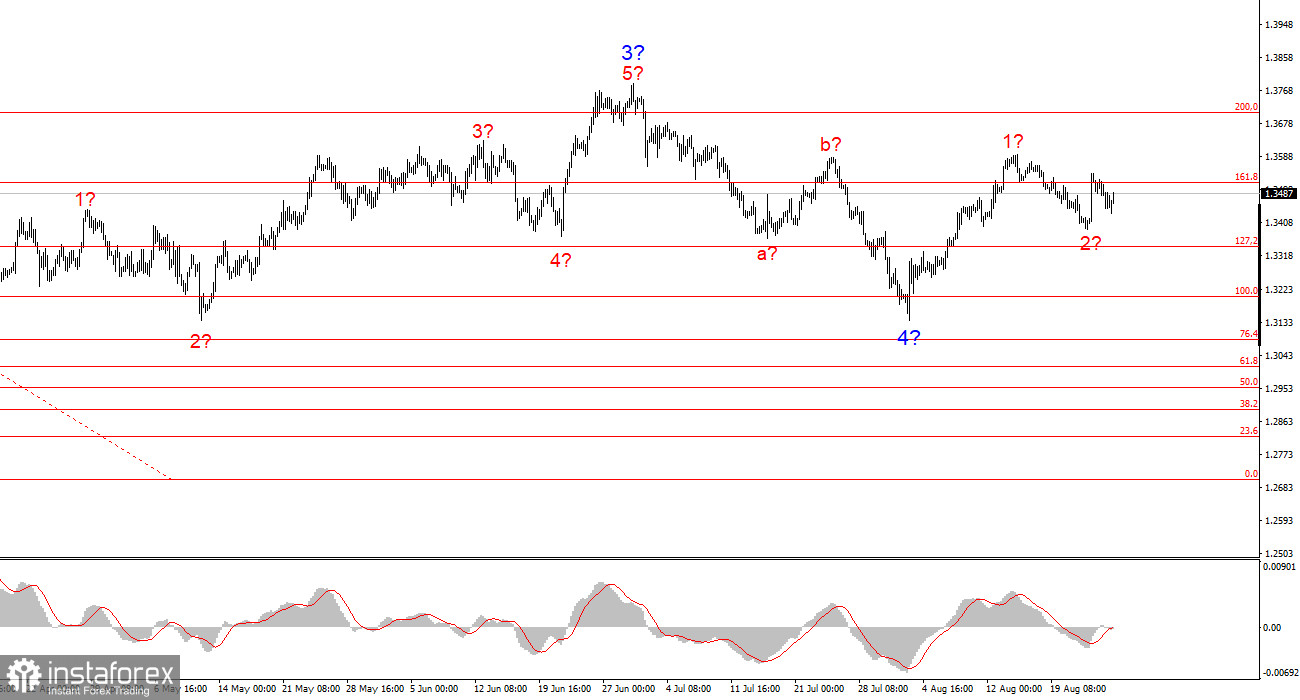

Wave Pattern for GBP/USD:

The wave pattern for GBP/USD remains unchanged. We are dealing with an upward, impulsive portion of the trend. With Trump, the markets could face many more shocks and reversals that could seriously impact the wave picture, but for now, the base scenario remains intact. The targets for the upward trend section are now located near 1.4017. At this point, I assume that the downward wave 4 has been completed, and that wave 2 in 5 may also be finished. Therefore, I recommend buying with a target of 1.4017.

Main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often undergo changes.

- If you're not confident about what's happening in the market, it's better to stay out.

- There can never be 100% certainty about the direction of movement. Don't forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.