Yesterday's downward spike below the daily balance indicator line (with the candle's lower shadow) was a break of support. However, the bears' advance was halted by a rise in equity indices (S&P 500 up 0.41%). But US government bond yields remain pointed downward, so the growth of anti-dollar currencies appears to be a short-term correction.

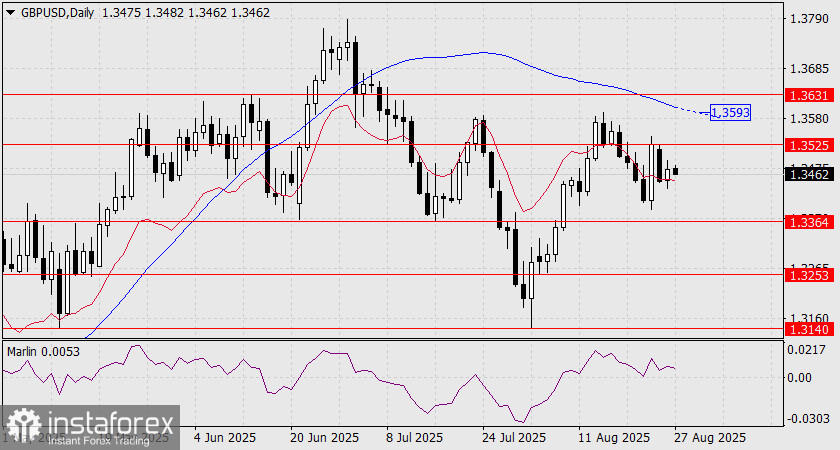

Today, the pound opened above the balance line; thus, its first objective will be to close below it, under 1.3450, which matches Tuesday's opening. The downside target is 1.3364—the support seen on June 23 and July 16.

A bullish alternative will emerge if the price breaks above the 1.3525 resistance level. Growth would then continue toward the MACD line at 1.3593, coinciding with the August 14 high.

On the four-hour chart, the Marlin oscillator's signal line is moving horizontally in positive territory. As a result, the market views yesterday's range (gray rectangle) as a consolidation zone. A breakout from this range in either direction will trigger an ensuing impulse move. The main scenario is a decline; we expect the correction to finish downwards.