By the end of yesterday, US stock indices closed higher. The S&P 500 rose by 0.41%, while the Nasdaq 100 added 0.44%. The Dow Jones Industrial Average strengthened by 0.30%.

Technology stocks rose in Asia ahead of Nvidia Corp.'s earnings release, as investors anticipated the company's outlook on chip demand to gauge the resilience of the global equity rally observed since April this year. Clearly, the theme of artificial intelligence remains in focus. Shares of China's AI leader Cambricon Technologies Corp. jumped by 10% to an all-time high after record profits. Shares of Nikon Corp. surged by 21% after Ray-Ban glasses maker EssilorLuxottica SA decided to increase its stake. The index of Asian technology companies rose by 0.7%. US and European stock index futures also moved higher ahead of Nvidia's report, which was released after the market close.

The dollar gained 0.2%, recovering losses from Tuesday following President Donald Trump's attempt to remove Federal Reserve Chair Liza Cook. Gold fell by 0.6%, while Treasury bonds stabilized after a sharp decline in US, French, and UK long-term bond prices on Tuesday. Oil remained flat after higher US tariffs for India took effect.

Although Trump's move drew much of the market's attention, traders are awaiting key events later this week relating to Nvidia's earnings report as wellas Friday's inflation and GDP data. Even amid turbulent political developments, investors remain tuned to an optimistic market scenario: a likely rate cut in September, steady economic growth, and robust corporate earnings that continue to support positive sentiment in equities.

This optimistic perception, however, is not without its nuances. Inflationary pressures, while easing, still represent a potential threat. Uncertainty in the global economic environment, related to trade wars and geopolitical risks, also has a restraining effect. In this context, investors should carefully weigh risks and opportunities, constructing balanced investment portfolios.

A key factor influencing the future dynamics of the markets will be the policy of central banks. In particular, actions by the US Federal Reserve (Fed) will have far-reaching consequences for the global economy. The accommodative monetary policy expected by all, aimed at supporting economic growth, could stimulate capital inflows into equities and other risk assets.

Today, traders will be closely monitoring Nvidia's upcoming earnings report to determine whether the current rally will continue or stall. Nvidia is expected to provide updated information on the growth of AI expenditures and how US-China competition is constraining the company's internal growth. Analysts estimate that the largest buyers of AI equipment continue to actively invest in new hardware, and that the company's sales will grow by more than 50% this year. However, the excitement is clouded by uncertainty about how much business Nvidia can conduct in China.

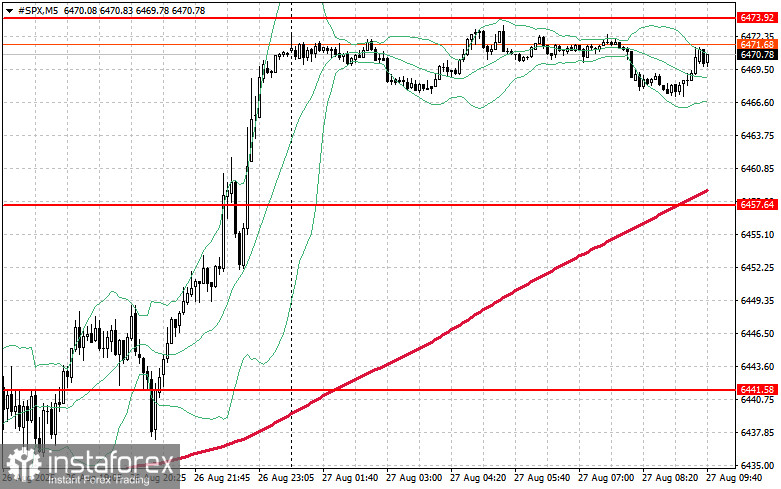

As for the technical picture of the S&P 500, the main task for buyers today will be to break through the nearest resistance at $6,473. This would help drive further growth and open the way for a rally to the next level at $6,490. No less important for bulls will be maintaining control over $6,505, which would strengthen buyers' positions. In the event of a downward movement amid waning risk appetite, buyers must assert themselves in the $6,457 area. A break below this level would quickly push the instrument back to $6,441 and open the way to $6,428.