Buy the rumor, sell the fact. The S&P 500 hit a new all-time high on expectations of earnings from market leader, tech giant NVIDIA. Many metrics, including expected revenue and sales volumes, beat Wall Street forecasts. However, data center growth came in below expectations, and the company reported no shipments to China. This disappointed investors and will likely lead the broad market index to open with a gap down on the last trading day of summer.

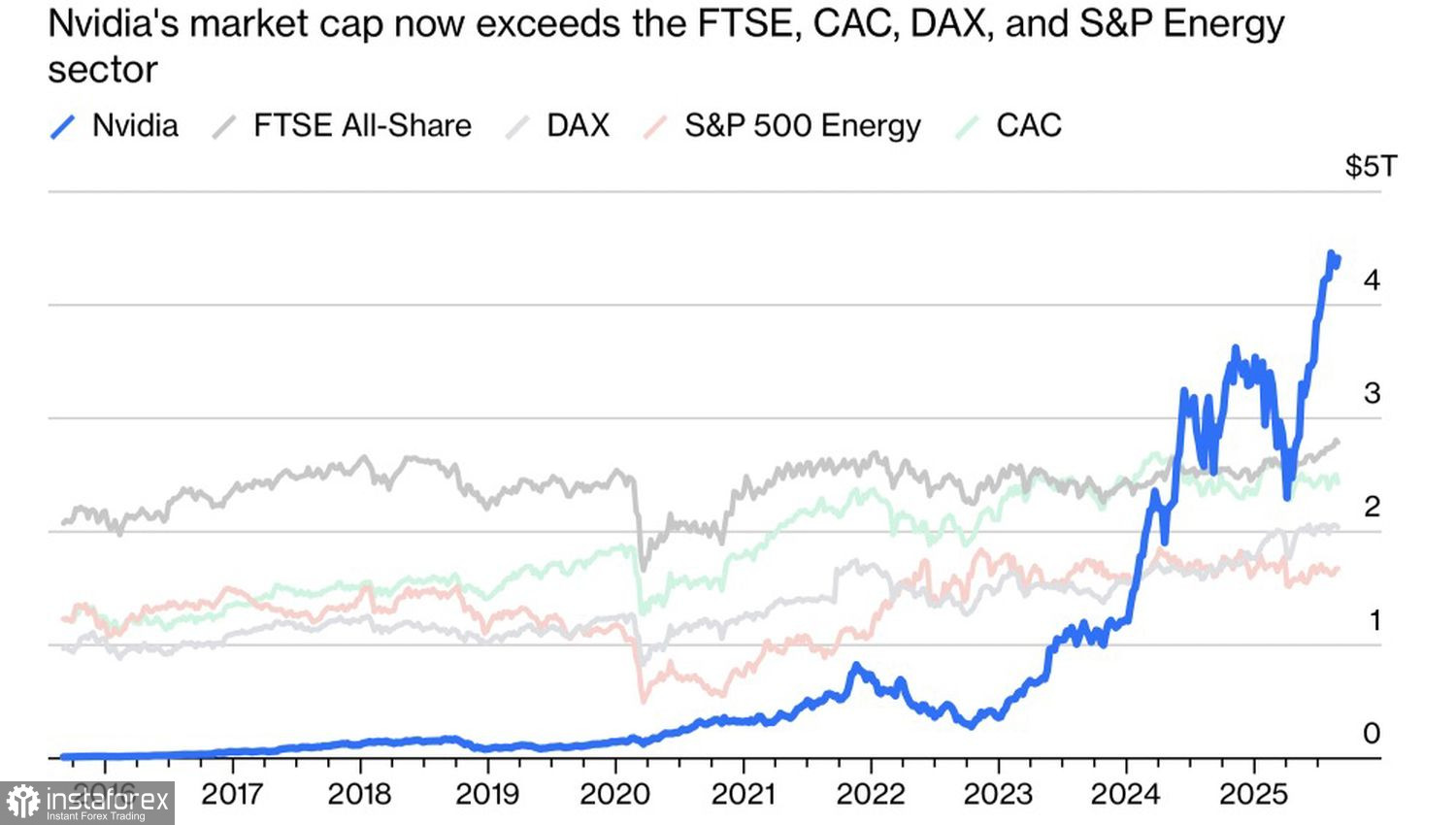

Artificial intelligence technology has been a key driver of the S&P 500 rally from 2022 to 2025. NVIDIA is the undisputed leader and flagship of the entire market. The rally in its shares has vastly outperformed both the US and non-US stock indices. For the first time in US history, the company reached a market capitalization of $4 trillion. Its current market value is about $650 billion, greater than Microsoft, which holds second place. NVIDIA's share in the broad market index now exceeds 8%.

NVIDIA and Global Stock Index Dynamics

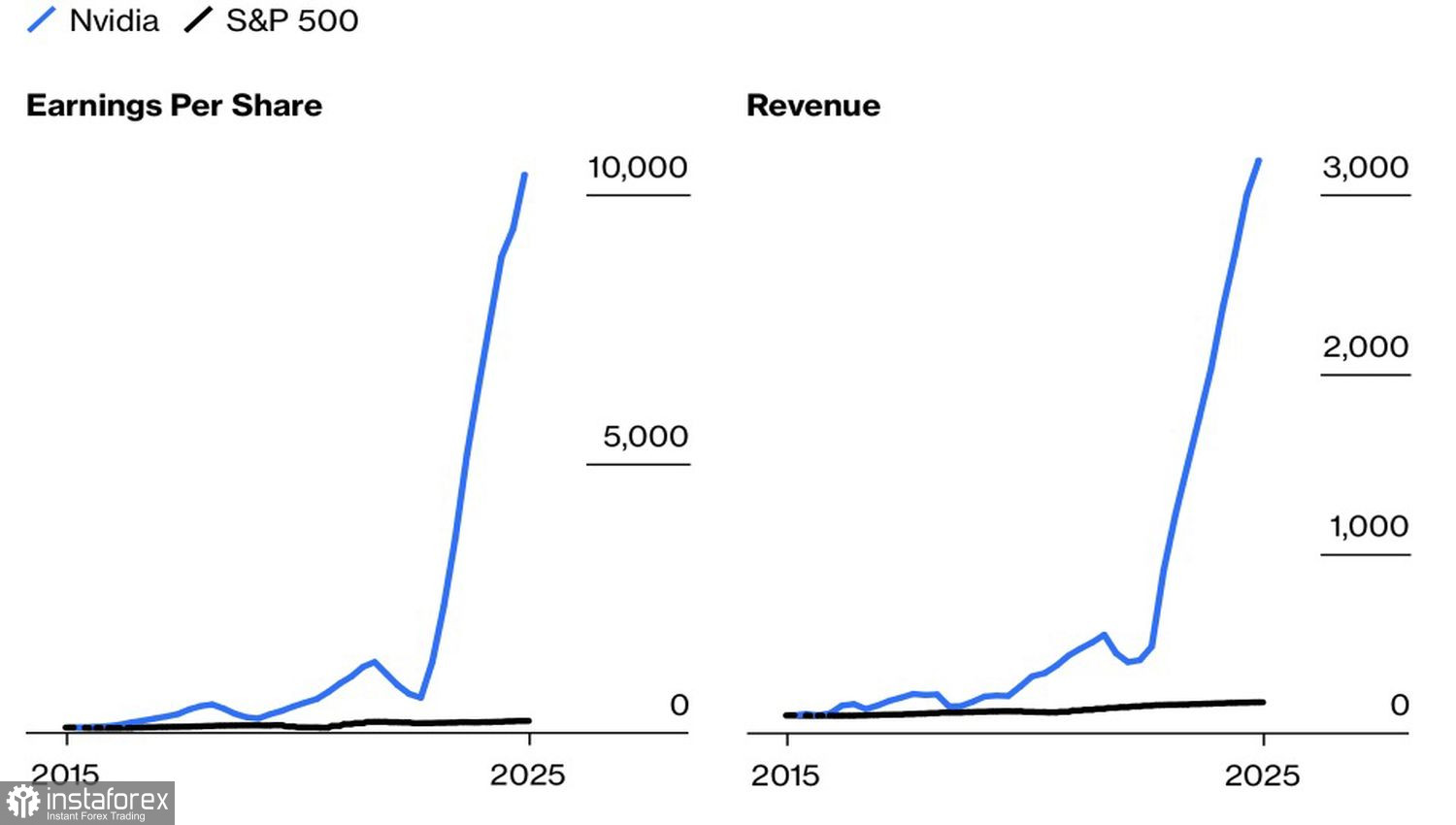

It was AI technology that propelled NVIDIA to become a stock market star. Revenue and profits had been growing exponentially. The problem is, this can't go on forever. For the tech giant to sustain such growth, it would need to start selling its products on other planets.

Sooner or later, everything returns to normal. Bitcoin evolves from a speculative asset to a traditional one and isn't likely to boast 100%+ annual growth in the future. Consumers get used to artificial intelligence technologies. China closes off its markets at the US government's directive. Everything changes. So do NVIDIA's growth rates for key performance metrics.

NVIDIA's and S&P 500's EPS and Revenue Dynamics

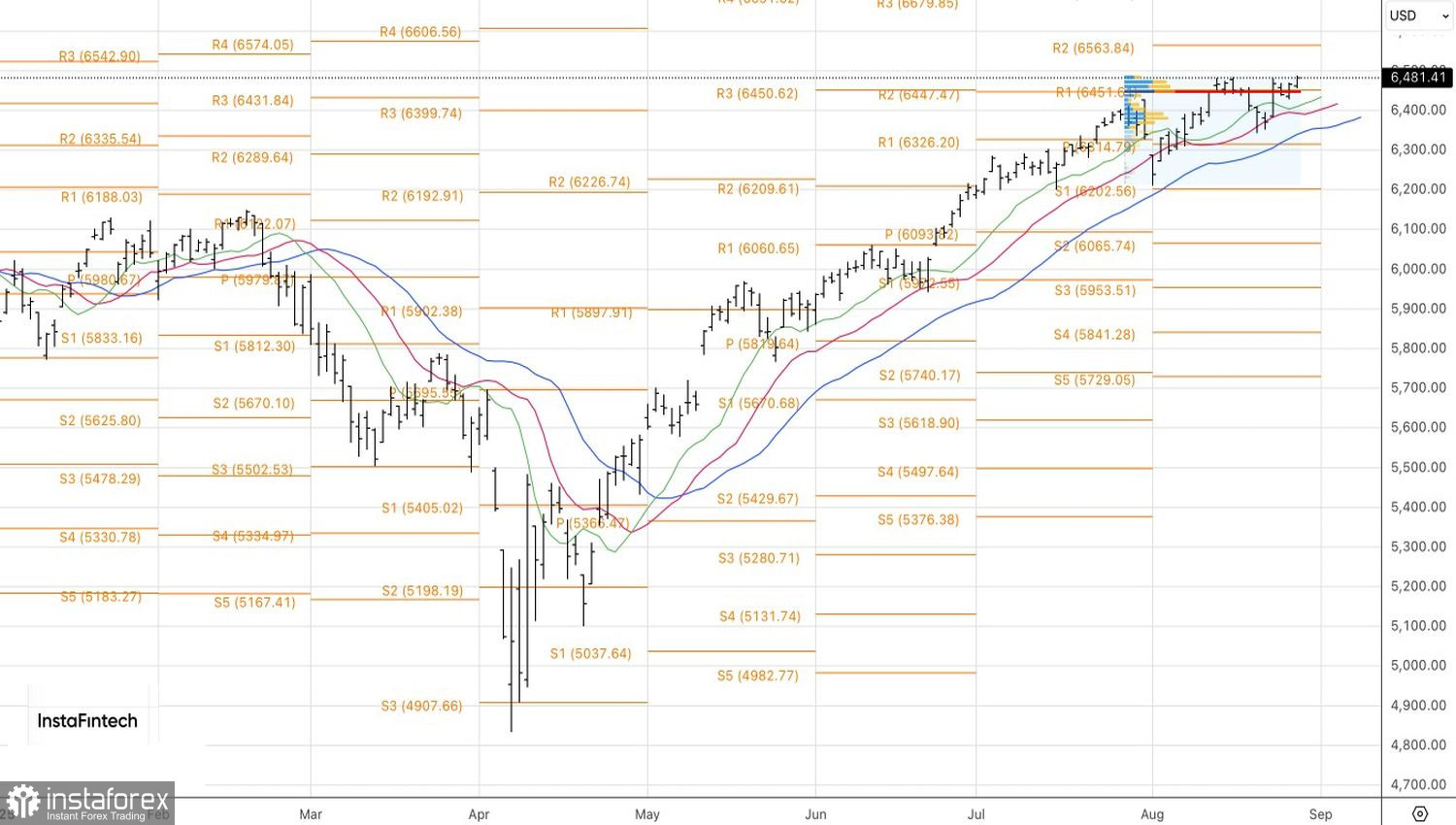

AI technology will continue to support the S&P 500, albeit to a lesser extent. This factor is already largely priced into the broad market index, increasing the risk of a pullback. Still, the overall backdrop remains favorable for the US stock market: the American economy is on a firm footing, Q2 earnings were strong, and the Federal Reserve is set to resume monetary policy easing. The probability of a federal funds rate cut in September is estimated at 87%.

In such conditions, after "buy the rumor, sell the fact" plays out and the S&P 500 pulls back, investors will roll up their sleeves and do what they do best—buy the dip. This suggests that any correction will likely be limited.

Technically, on the daily S&P 500 chart, a drop below fair value at 6450 will increase pullback risks. It makes sense to lock in profits from earlier long positions and alternate short-term sales with long-term purchases.