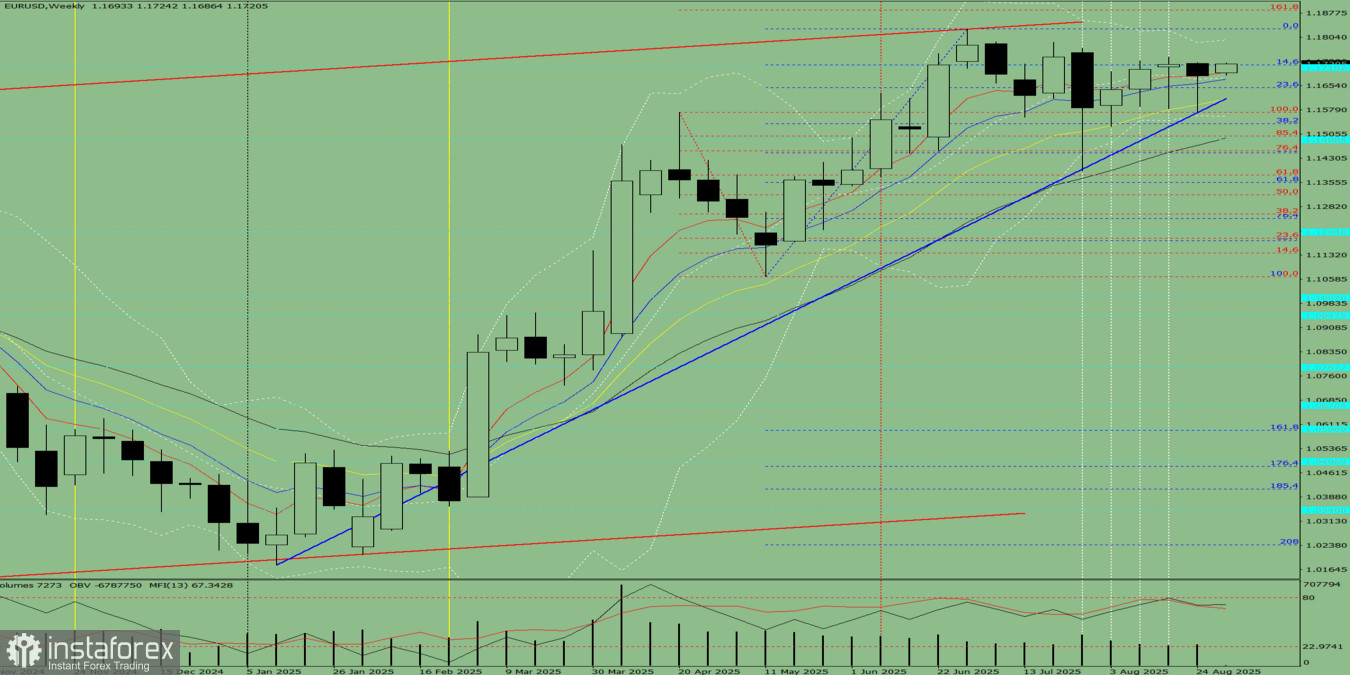

Trend Analysis (Fig. 1).

This week, from the level of 1.1685 (close of the last weekly candle), the market may start moving downward with the target at 1.1536 – retracement level 38.2% (blue dotted line). Upon testing this level, the price may turn upward with the target at 1.1571 – upper fractal (red dotted line).

Fig. 1 (weekly chart).

Comprehensive Analysis:

- Indicator analysis – down;

- Fibonacci levels – down;

- Volumes – down;

- Candlestick analysis – down;

- Trend analysis – down;

- Bollinger Bands – down;

- Monthly chart – down.

Conclusion from comprehensive analysis: downward movement.

Overall weekly outlook for the EUR/USD candle on the weekly chart: the price will most likely show a downward trend during the week, with the first upper shadow on the weekly black candle (Monday – upward) and the second lower shadow (Friday – upward).

Alternative scenario: from the level of 1.1685 (close of the last weekly candle), the pair may start moving downward with the target at 1.1447 – retracement level 50% (blue dotted line). Upon testing this level, the price may then turn upward with the target at 1.1498 – retracement level 85.6% (red dotted line).