Bitcoin showed upward momentum in the first half of the day but failed to reach the $110,000 mark, triggering an active sell-off during the mid-European trading session.

Meanwhile, according to a report by River, private and public companies are buying Bitcoin at a rate nearly four times higher than its mining pace. This creates persistent demand-side pressure, pushing prices up and reducing the available market supply. Institutional investors, viewing Bitcoin as a hedge against inflation and a potential high-yield asset, continue to increase their crypto holdings.

The impact of large corporations on the Bitcoin market is becoming increasingly pronounced. Companies like MicroStrategy, Tesla, Metaplanet, and others remain highly active, despite Bitcoin's elevated price levels.

According to River's data for 2025:

* Corporate entities are buying an average of 1,755 BTC per day.

* ETFs add approximately 1,430 BTC per day.

* Governments purchase around 39 BTC per day.

* Meanwhile, miners are producing just 450 BTC daily.

This imbalance could trigger a potential supply shock if exchange reserves continue to dwindle and institutions keep holding their coins off-market.

Intraday strategy for the cryptocurrency market

I will continue relying on major dips in Bitcoin and Ethereum as entry points for mid-term long positions, anticipating the continuation of the broader bullish market trend, which remains intact.

For short-term trading, the strategy and setups are outlined below.

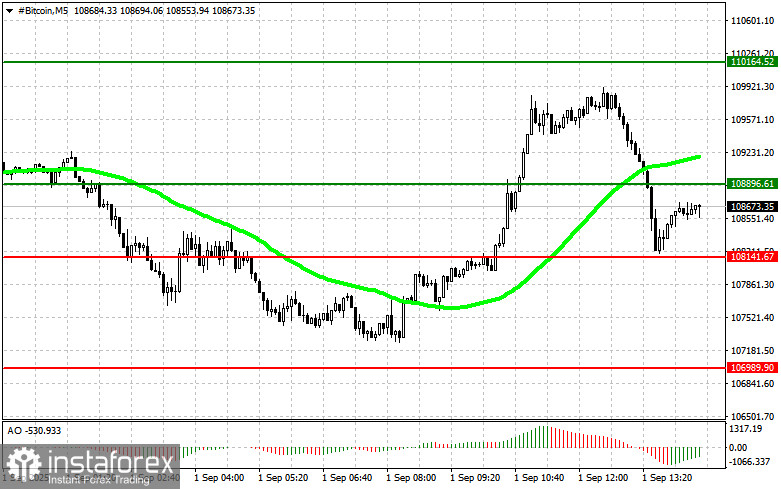

Bitcoin

Buy scenarios

Scenario 1: Buy Bitcoin at the $108,900 entry point with a target of $110,100. At $110,100, exit long positions and consider selling on the bounce.

Conditions: Before a breakout buy, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario 2: Buy from the lower border at $108,100 if there is no bearish breakout reaction, targeting moves back to $108,900 and $110,100.

Sell scenarios

Scenario 1: Sell Bitcoin at the $108,100 entry point with a target of $106,900. At $106,900, exit short positions and consider buying on the dip.

Conditions: Before a breakout sell, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: Sell from the upper border at $108,900 if there's no bullish breakout reaction, aiming for $108,100 and $106,900.

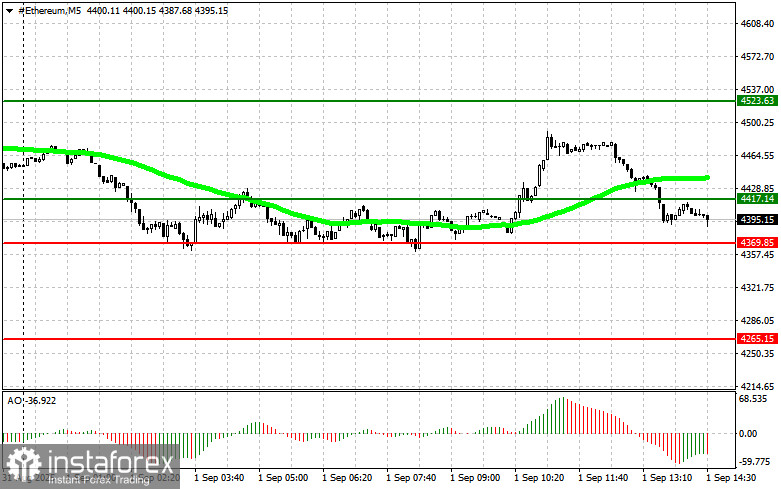

Ethereum

Buy scenarios

Scenario 1: Buy Ethereum at the $4,417 entry point with a target of $4,523. Exit longs at $4,523 and consider shorting on the bounce.

Conditions: The 50-day moving average must be below the current price, and the Awesome Oscillator should be above zero before a breakout buy.

Scenario 2: Buy from the lower border at $4,369 if there's no bearish reaction, targeting moves to $4,417 and $4,523.

Sell scenarios

Scenario 1: Sell Ethereum at the $4,369 entry point with a target of $4,265. Exit shorts at $4,265 and consider buying on the dip.

Conditions: The 50-day moving average should be above the current price, and the Awesome Oscillator should be below zero before a breakout sell.

Scenario 2: Sell from the upper border at $4,417 if there's no bullish breakout reaction, aiming for $4,369 and $4,265.