The FOMC meeting will take place in two and a half weeks, and I recall no time when so much attention was focused on a Federal Reserve governor's meeting. However, this time, there are very good reasons for this heightened interest. The FOMC paused its monetary policy easing at the end of last year, contrary to market expectations for seven rounds of easing last year and four this year. Thus, market expectations have consistently been excessive and maximalist. It's no surprise the market is eagerly awaiting the next round of easing.

However, I can probably outline a dozen possible scenarios for next year's changes in monetary policy. To start with, even a rate cut in September is not guaranteed. Many FOMC governors continue to follow the "statistics first, decision later" policy. Therefore, we can confidently say that until the next inflation and labor market reports are released, there's no certainty of a rate cut.

And it gets more complicated. Suppose the Fed decides not to cut rates in September—what happens next? Once again, economic statistics will have an enormous influence. As long as Jerome Powell remains Fed Chair and Donald Trump hasn't replaced half of the FOMC members. But that's the problem: nobody knows how quickly Trump will replace all the governors he doesn't like—those who refuse to vote for cuts.

Additionally, it's essential to consider that some current governors may change their views on Fed policy. Naturally, it's impossible to predict when or how someone might come under Trump's radar and be forced to change their stance.

In this situation, the entire process of analysis and forecasting becomes akin to reading tea leaves. There are various scenarios, but their probabilities can range anywhere from 0% to 100%. In my opinion, this is the root cause of the market's recent sluggishness and indecisiveness. Market participants struggle to determine what to expect from the US central bank.

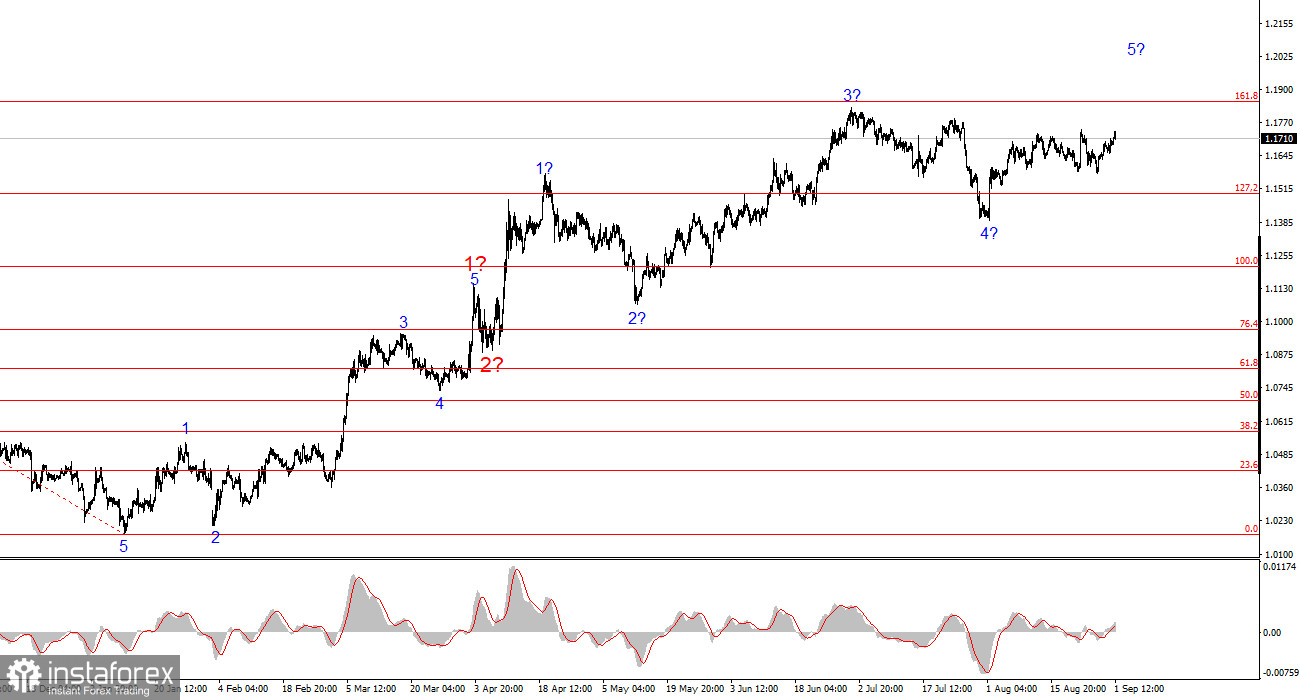

Wave Picture for EUR/USD:

Based on my EUR/USD analysis, I conclude the instrument continues to build a bullish leg of the trend. The wave count still completely depends on the news flow related to Donald Trump's decisions and US foreign policy. The targets for this trend leg may stretch up to the 1.25 area. Therefore, I continue to consider long positions with targets around 1.1875 (which corresponds to 161.8% by Fibonacci) and above. I believe wave 4 is complete. Thus, right now is still a good time to buy.

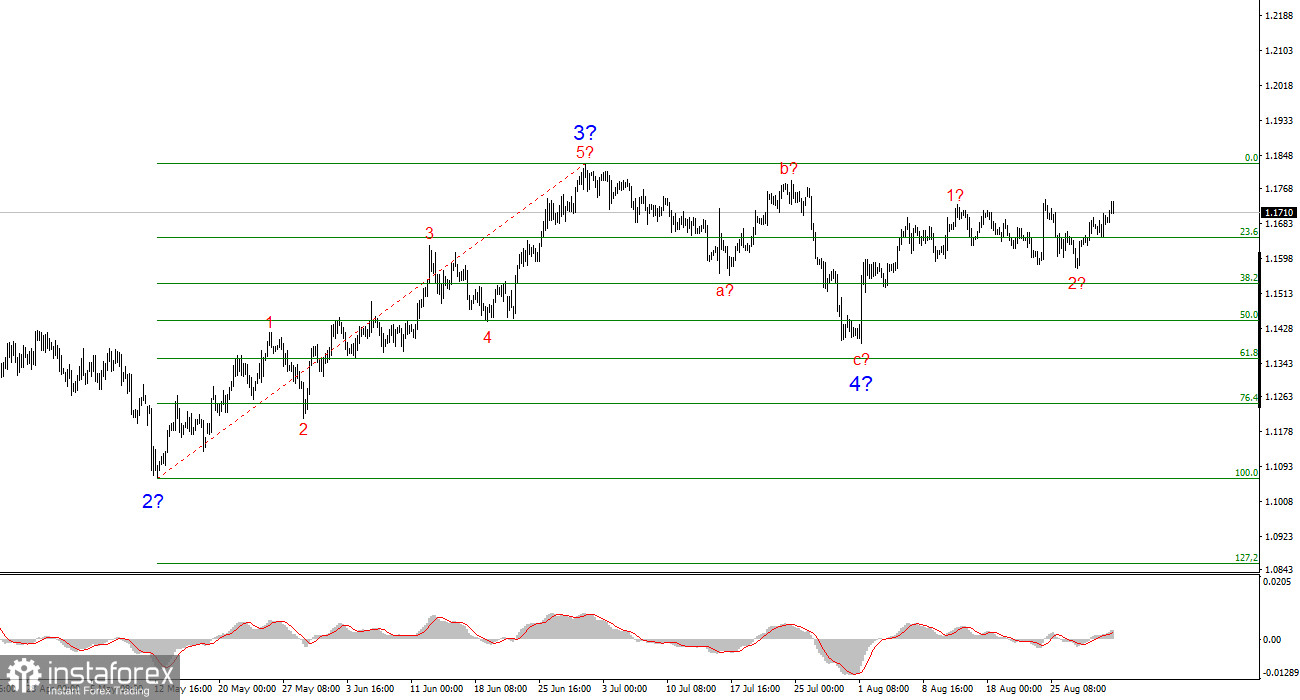

Wave Picture for GBP/USD:

The wave picture for GBP/USD remains unchanged. We are dealing with a bullish, impulsive segment of the trend. Under Trump, markets could still face numerous shocks and reversals that could significantly impact the wave picture, but at this point, the working scenario remains intact. The bullish leg's targets now lie around the 1.4017 level. Currently, I believe the corrective wave 4 is finished. Wave 2 within 5 may also be complete. Therefore, I advise buying with a target at 1.4017.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and prone to change.

- If you're not confident in what's happening on the market, it's better to stay out.

- There is never 100% certainty about market direction. Don't forget your stop-loss protective orders.

- Wave analysis can be combined with other types of analysis and trading strategies.