The euro, pound, and Australian dollar were traded today through the Momentum strategy. I did not trade anything through Mean Reversion.

The euro, pound, and other risk assets fell sharply against the dollar today. There were no strong fundamental reasons for this. Even the figures showing inflation growth in the eurozone in August this year could not have triggered such a strengthening of the dollar and a fall in the euro. In any case, market expectations, fueled by mixed signals from the European Central Bank, show that investors are becoming nervous about tighter monetary policy. In theory, this should have supported the euro, but given the eurozone's weak economy, many market participants think otherwise. After the inflation data, which came out above forecasts, the euro's decline accelerated.

In the second half of the day, data are expected on the growth of the manufacturing PMI and the ISM Manufacturing Index, as well as positive figures on U.S. construction spending. These data represent important indicators of the U.S. economy and may significantly affect the dollar's exchange rate and overall market sentiment.

An increase in the manufacturing PMI signals higher production volumes, new orders, and an overall improvement in business conditions. In turn, growth in the ISM Manufacturing Index, considered a leading indicator, points to potential growth in employment and investment in the industrial sector. Expected strong construction spending data confirm the recovery of the construction industry, which is an important driver of economic growth.

In the case of strong statistics, I will rely on the Momentum strategy. If there is no market reaction to the data, I will continue using the Mean Reversion strategy.

Momentum Strategy (breakout) for the second half of the day:

For EUR/USD

- Buying on a breakout of 1.1650 could push the euro toward 1.1680 and 1.1715;

- Selling on a breakout of 1.1628 could push the euro down toward 1.1604 and 1.1575.

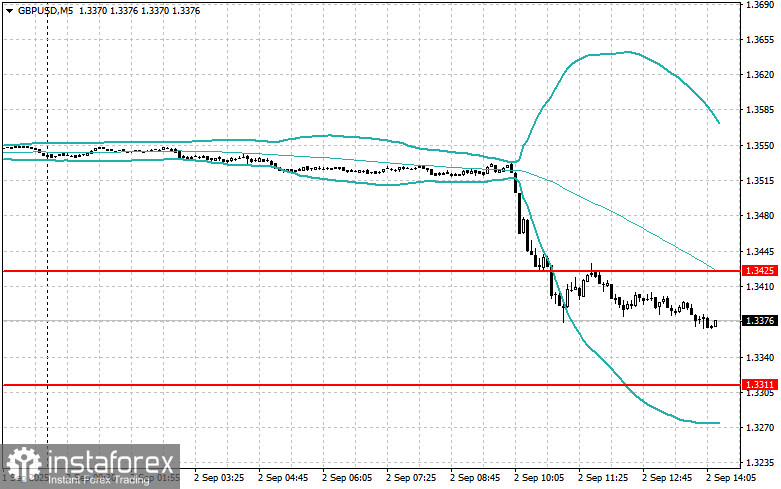

For GBP/USD

- Buying on a breakout of 1.3400 could push the pound toward 1.3440 and 1.3470;

- Selling on a breakout of 1.3365 could push the pound down toward 1.3345 and 1.3310.

For USD/JPY

- Buying on a breakout of 148.75 could push the dollar toward 149.05 and 149.32;

- Selling on a breakout of 148.50 could push the dollar down toward 148.15 and 147.85.

Mean Reversion Strategy (reversal) for the second half of the day:

For EUR/USD

- I will look for sales after a failed breakout above 1.1656 and a return below this level;

- I will look for purchases after a failed breakout below 1.1577 and a return to this level.

For GBP/USD

- I will look for sales after a failed breakout above 1.3425 and a return below this level;

- I will look for purchases after a failed breakout below 1.3311 and a return to this level.

For AUD/USD

- I will look for sales after a failed breakout above 0.6535 and a return below this level;

- I will look for purchases after a failed breakout below 0.6481 and a return to this level.

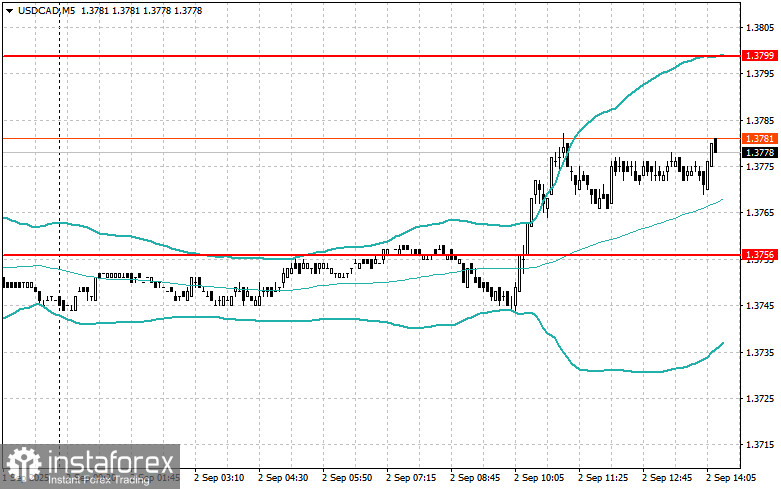

For USD/CAD

- I will look for sales after a failed breakout above 1.3799 and a return below this level;

- I will look for purchases after a failed breakout below 1.3756 and a return to this level.