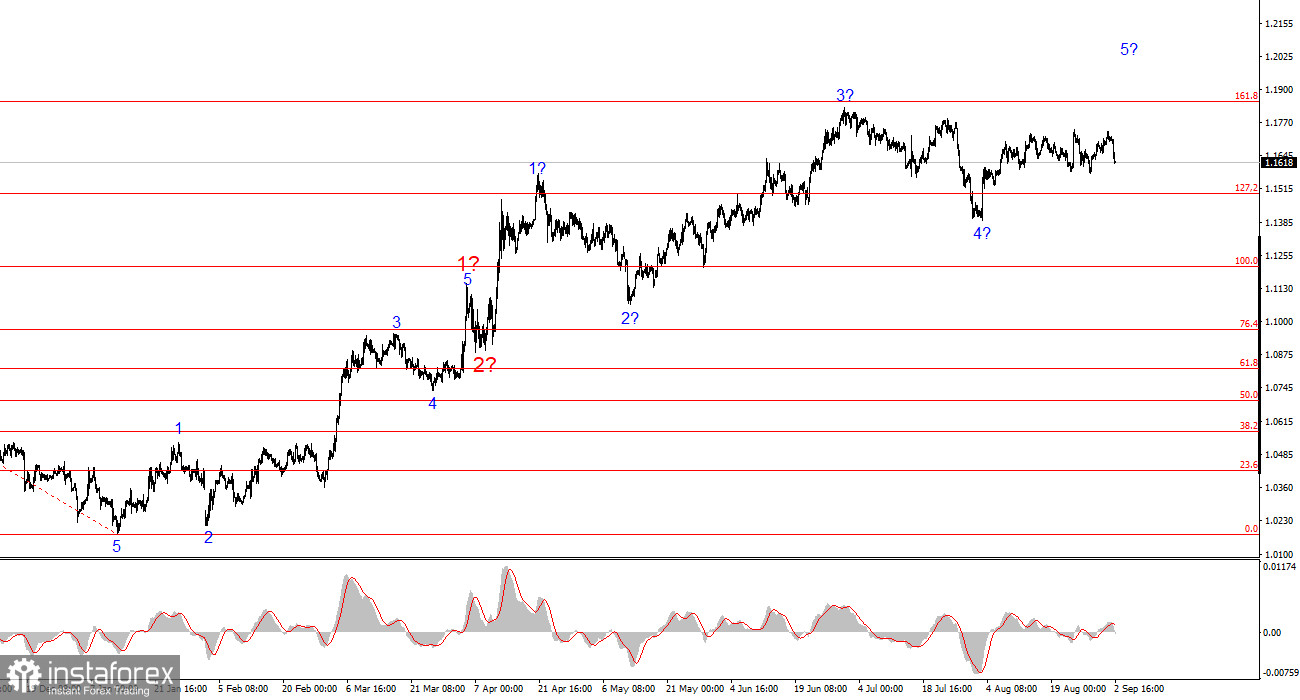

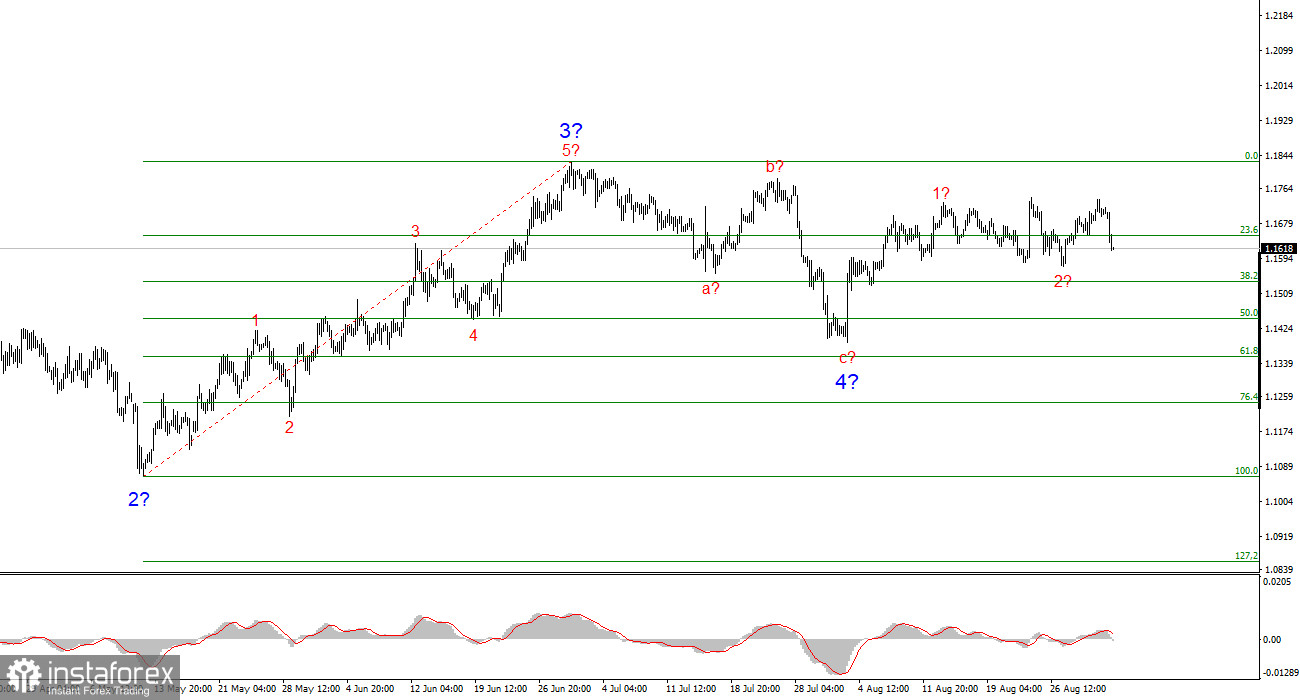

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months, which is very encouraging. Even when corrective waves are formed, the integrity of the structure is preserved. This allows for accurate forecasts. It should be remembered that wave patterns do not always look like textbook examples. Right now, however, the pattern looks very clear.

The upward segment of the trend continues to form, while the news background continues to support mostly not the dollar. The trade war initiated by Donald Trump continues. The confrontation with the Fed continues. Dovish expectations are growing. Trump's "one big law" will increase U.S. government debt by 3 trillion dollars, while the U.S. president keeps raising tariffs and introducing new ones. The market has rated the results of Trump's first six months very poorly, despite the fact that U.S. economic growth in the second quarter reached 3%.

At this stage, it can be assumed that wave 4 is complete. If so, the formation of impulse wave 5 has begun, with targets reaching as far as the 1.25 level. Of course, corrective wave 4 could still take on a longer, five-wave form, but I proceed from the most likely scenario.

The EUR/USD rate fell by 90 basis points on Tuesday. At the time of writing, only one event could have drawn traders' attention—the eurozone consumer price index. Inflation in the eurozone rose in August to 2.1%, while core inflation remained at 2.3%. Since price growth accelerated and the market misjudged the actual figure, I tend to believe that the reaction to this report was logical.

First, the euro's decline began before the inflation report was released. Second, the decline was disproportionate to the report's importance. Third, higher inflation increases the likelihood of the ECB ending its easing cycle, which is a bullish, not bearish, factor. Fourth, the instrument has been trading sideways for more than two weeks, and even after today's drop, it remains in a sideways channel.

As we can see, there are many inconsistencies, so I do not believe the EU inflation report caused the euro's collapse. Perhaps the problem lies in France's political crisis, but no news about the dissolution of parliament or elections appeared today. At this point, it is impossible to say what exactly caused the sharp drop in the euro and the pound.

However, we may not need to explain this movement. The EUR/USD wave pattern has not changed, even after a 100-basis-point decline. The presumed wave 2 may still be complete, or it may extend further. But this will not alter the overall wave structure.

General Conclusions

Based on the EUR/USD analysis, I conclude that the instrument continues to form an upward trend segment. The wave pattern still depends entirely on the news background linked to Trump's decisions and U.S. foreign policy. The targets for this upward segment may extend up to the 1.25 level. Accordingly, I continue to consider buying with targets near 1.1875, which corresponds to the 161.8% Fibonacci level, and higher. I assume that wave 4 has been completed. Therefore, this is still a good time to buy.

Basic principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often change.

- If there is no confidence in what is happening in the market, it is better to stay out of it.

- One can never have absolute certainty about the direction of movement. Always remember to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.