For many, the sudden drop in the pound—and alongside it, the euro—came as a complete surprise on Tuesday. In the first hours of this collapse, it was absolutely impossible to understand what was happening in the currency market. Naturally, all market participants immediately began "Googling" the news feeds for high-profile decisions or statements by Donald Trump, since it is the U.S. president who could crash all existing markets with just a word. But no, Trump is quietly playing golf, while the American media, meanwhile, are busy counting how much time the U.S. president spends on the golf course versus the White House. The golf course is currently ahead.

Considerable effort was required to determine the presumed reason behind the pound's drop. It turned out that the yield on 30-year UK government bonds rose on Tuesday by 0.06 points. That might not seem remarkable—except this pushed it to its highest level since 1998: 5.7%. At the same time, the price of the bonds themselves is falling. What does this mean in practice? Confidence in the British economy and the UK government is falling. Bonds are being sold at a discount, offering higher yields, which is, naturally, very bad for the UK budget, especially in the run-up to the 2026 budget proposal.

Recall that several months ago, UK Chancellor Rachel Reeves broke into tears under pressure from criticism at a British Parliament session, triggering a massive drop in the pound. This time, there were no "Reeves tears" on live television, although the problems that may confront the British economy will undoubtedly cause more than a few "streams of tears" for the Finance Minister.

After central banks worldwide used high rates to defeat "Covid inflation," this figure in the UK is rising again. It's been growing for an entire year already, nearly reaching 4%. At the same time, government debt is increasing, resulting in problems with government bonds. I do not consider this problem severe enough for the uptrend to be over. Therefore, I believe the pound's decline will end in the near future.

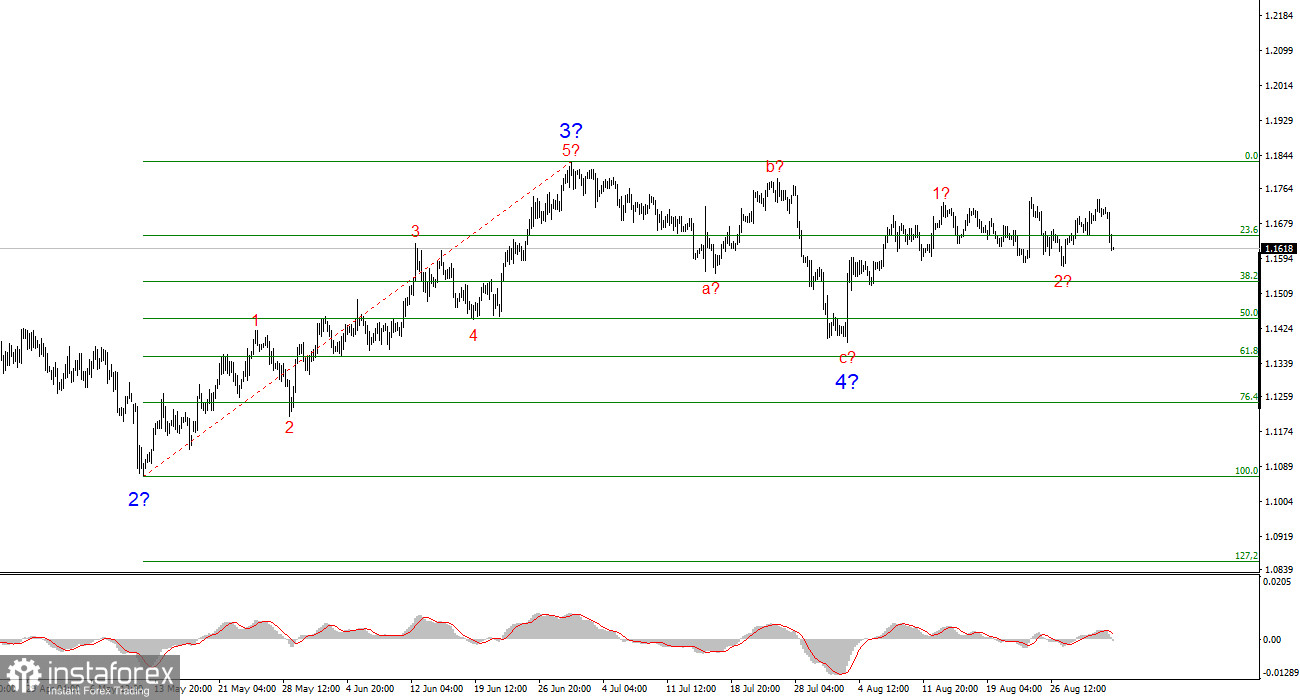

Wave structure for EUR/USD:

Based on my EUR/USD analysis, I conclude that the pair continues to build an upward trend segment. The wave structure still depends entirely on the news flow related to Trump's decisions and US foreign policy. The targets for the current trend segment could extend to the 1.25 area. Accordingly, I continue to consider buys with targets around 1.1875 (which corresponds to 161.8% Fibonacci) and higher. I assume wave 4 is complete. Therefore, now is still a good time to buy.

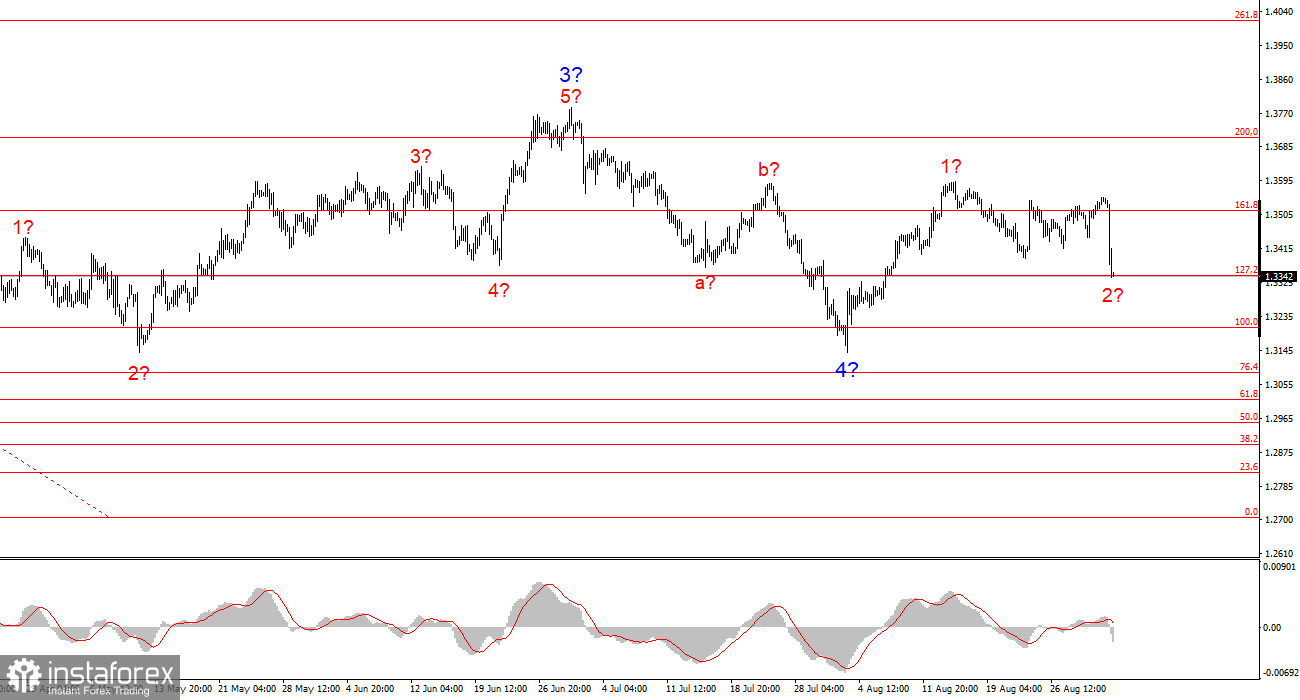

Wave structure for GBP/USD:

The wave pattern for GBP/USD remains unchanged. We are dealing with an upward, impulsive trend segment. Under Trump, the markets may witness many more shocks and reversals that could seriously affect the wave pattern, but for now, the working scenario remains intact. The targets for the upward segment are now located around 1.4017. I currently assume that the corrective wave 4 is complete. Wave 2 in 5 may also be complete or close to completion. Accordingly, I recommend buying with a target of 1.4017.

Core Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often bring changes.

- If you are uncertain about the market situation, it is better not to enter.

- One can never be 100% certain about the direction of movement. Don't forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.