The US dollar gained significantly against most risk assets. The euro and the British pound were hit particularly hard.

At first, weak data on US manufacturing activity softened the dollar's position, after which pressure on EUR/USD and GBP/USD pairs returned. As the report showed, the ISM Manufacturing PMI remained below 50, sparking a brief wave of dollar sales. However, the market reaction was short-lived, and by the end of the trading session, the dollar had regained its lost ground.

Today, macroeconomic data and speeches by key political figures will be in the spotlight. Fresh figures for the eurozone services PMI and producer price index are expected. These numbers will definitely impact trader sentiment and could lead to volatility in the currency markets. Equally interesting will be the speech by European Central Bank President Christine Lagarde. The market is closely watching her rhetoric, trying to catch signals on the central bank's future monetary policy. Traders are hoping to get answers about the pace of rate cuts and plans for fighting inflation. Any hints of the complete end of the easing cycle could support the euro.

As for the pound, important data on the UK services PMI, the composite PMI, and a speech by Bank of England Financial Policy Committee member Sarah Breeden are expected in the first half of the day. Since the services PMI is a key indicator of the state of the British economy and remains above the 50-point mark, indicating expansion, good data could stop the fall in GBP/USD. The composite PMI, combining manufacturing and service sector data, offers a more complete picture of economic activity.

Sarah Breeden's speech will attract special attention. Her comments on the current economic situation, risks to the financial system, and the Bank of England's monetary policy outlook could have a significant impact on the currency market.

If the data aligns with economists expectations, it's advisable to adopt a Mean Reversion strategy. If the data comes in much higher or lower than expected, it is best to use a Momentum strategy.

Momentum Strategy (Breakout):

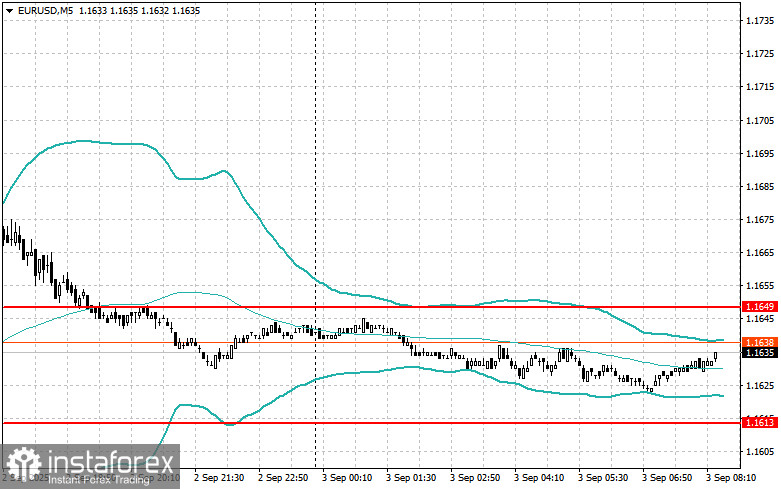

EUR/USD

Buying on a breakout above 1.1641 could lead to euro growth towards 1.1665 and 1.1690

Selling on a breakout below 1.1625 could lead to euro falling towards 1.1600 and 1.1575

GBP/USD

Buying on a breakout above 1.3375 could lead to a rise in the pound towards 1.3405 and 1.3430

Selling on a breakout below 1.3345 could lead to a decline in the pound towards 1.3315 and 1.3280

USD/JPY

Buying on a breakout above 148.76 could lead to dollar strength towards 149.05 and 149.35

Selling on a breakout below 148.50 could lead to a dollar decline towards 148.15 and 147.85

Mean Reversion Strategy (Pullbacks):

EUR/USD

I'll look for selling opportunities after a failed breakout above 1.1649 and a return below this level

I'll look for buying opportunities after a failed breakout below 1.1613 and a return above this level

GBP/USD

I'll look for selling opportunities after a failed breakout above 1.3394 and a return below this level

I'll look for buying opportunities after a failed breakout below 1.3351 and a return above this level

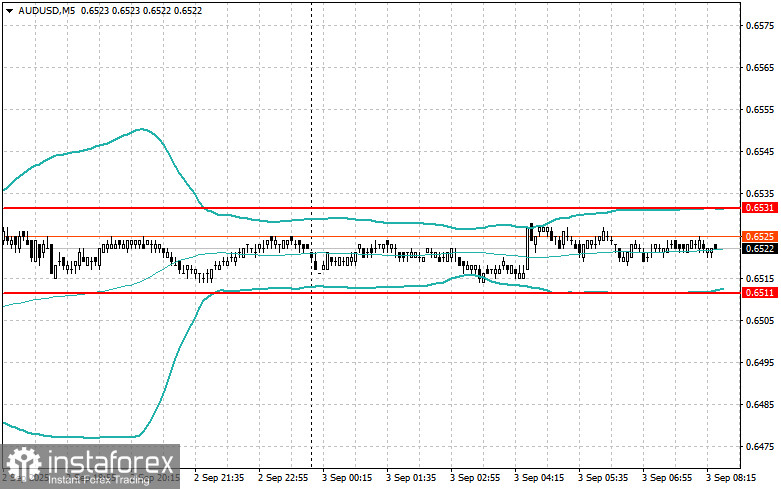

AUD/USD

I'll look for selling opportunities after a failed breakout above 0.6531 and a return below this level

I'll look for buying opportunities after a failed breakout below 0.6511 and a return above this level

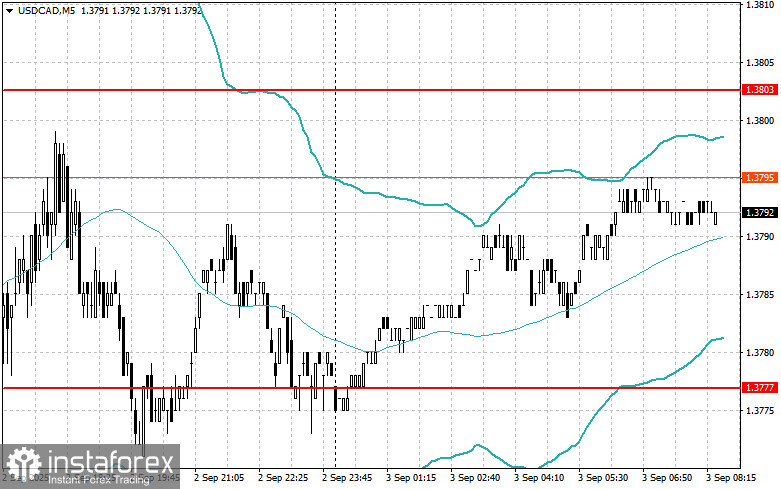

USD/CAD

I'll look for selling opportunities after a failed breakout above 1.3803 and a return below this level

I'll look for buying opportunities after a failed breakout below 1.3777 and a return above this level