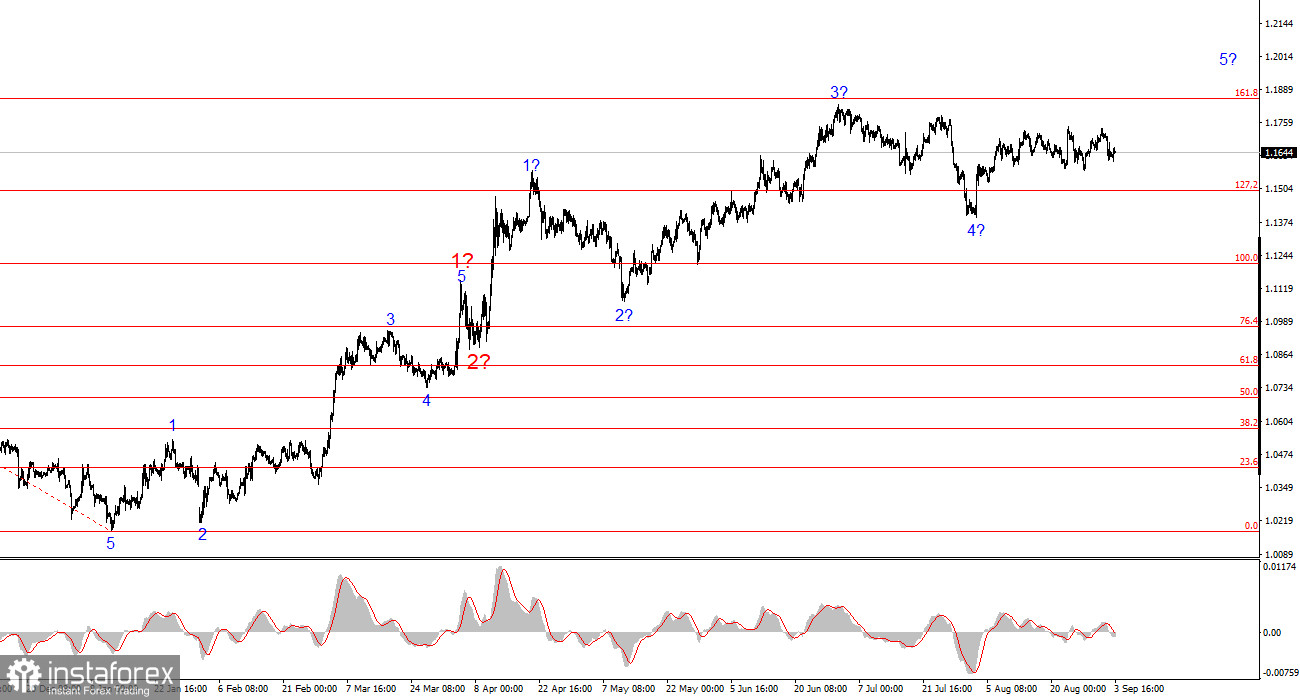

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months now, which is very encouraging. Even when corrective waves are developing, the structure remains intact. This allows for accurate forecasting. I would remind you that the wave pattern does not always look textbook-perfect. Currently, it looks very favorable.

The construction of the bullish segment of the trend continues, and the news background remains largely unsupportive for the dollar. The trade war initiated by Donald Trump continues. The confrontation with the Fed continues. Dovish expectations are rising. Trump's "One Big Law" will increase the US national debt by $3 trillion, while the US president is steadily raising tariffs and introducing new ones. The market gives a very low rating to Trump's first six months, even though economic growth in the second quarter was 3%.

At this time, it can be assumed that wave 4 is likely complete. If this is indeed the case, the construction of impulse wave 5 has begun, with potential targets all the way up to the 1.25 level. Of course, wave 4's corrective structure could take a more extended, five-wave form, but I am proceeding from the most probable scenario.

The EUR/USD rate declined by 70 basis points on Tuesday and changed little on Wednesday. In my opinion, it is very important that the instrument's decline has either ended or at least paused at this stage. Obviously, if the remaining US reports this week show strong readings, demand for the US dollar will continue to rise. I do not believe this will break the current bullish phase of the trend, since that would require a stable and persistent news background favorable for the US dollar. There is nothing of the sort at the moment. Therefore, the US currency can continue to count only on corrective waves.

I would also note that the most important US report published this week—the ISM Manufacturing PMI—turned out to be quite weak. Its value once again came in below 50.0, while markets had expected a more positive result for August. Additionally, the euro area inflation report exceeded market expectations, which is very positive for the European currency.

Based on all the above, the two most important reports from both economies supported the euro and buyers, not the dollar and sellers. Yesterday, something extraordinary happened on the market, but this was quickly reversed. In the meantime, we continue to observe the development of a sideways stretch within the bullish wave set. Thus, the wave pattern has not changed, and there are still grounds to expect renewed growth for the instrument. Tomorrow attention should be paid to the ISM Services Index, and on Friday to unemployment and labor market reports. These could push market participants towards new EUR/USD purchases or slightly sweeten the bitter pill for the dollar.

General Conclusions

Based on my EUR/USD analysis, I conclude that the instrument continues to build a bullish segment of the trend. The wave pattern still depends entirely on the news background related to Trump's actions and US foreign policy. The targets of this trend segment may extend up to the 1.25 level. Accordingly, I continue to consider buying opportunities with targets around 1.1875, which corresponds to the 161.8% Fibonacci extension, and higher. I believe that wave 4 is likely complete. Therefore, now is still a good time to buy.

My main analysis principles:

- Wave structures should be simple and clear. It is hard to trade complex structures; they often bring changes.

- If you are not confident about the current market situation, it is better not to enter.

- One can never be 100% sure of the direction. Never forget your protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.