EUR/USD

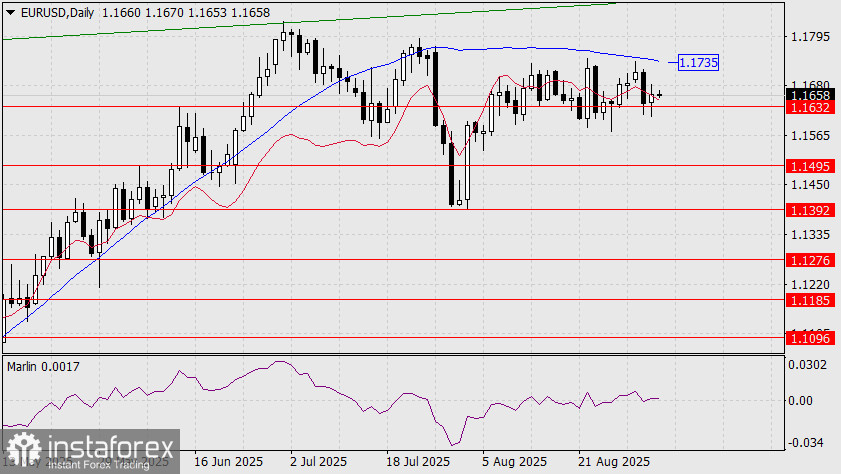

As of Wednesday, the euro rose by 20 points, postponing the consolidation below the 1.1632 level to a slightly later time. Possibly, today's candle will close below support, since the ISM Services PMI for August is expected to rise from 50.1 to 50.9.

However, this optimistic scenario may be disrupted by the release of ADP data on new private sector jobs. The August forecast is 73,000 versus 104,000 in July. Following the D. Trump scandal with the Department of Labor Statistics Bureau a month ago, this data could increase market volatility. The upper boundary for this volatility is the MACD line at 1.1735.

It's possible the data will be neutral and the euro will continue consolidating above the 1.1632 level. The question is—in what range will the market prefer to await an eventual Fed rate cut? For now, that range looks like 1.1495–1.1632.

On the H4 chart, euro growth was stopped by the MACD line. The Marlin oscillator, on its first attempt, couldn't break out into positive territory. Thus, we wait for today's employment data with the euro likely trading within a 1.1632–1.1683 range—the latter being yesterday's high.