Macroeconomic Report Review:

There are again very few macroeconomic reports scheduled for Thursday. The most important is the US ISM Services PMI. Recall that the equivalent index for the manufacturing sector, if not an outright failure in August, nevertheless came in weaker than traders expected. The services sector may also disappoint. In the Eurozone, today's focus should be on the July retail sales report. Sales are expected to drop by 0.2%, but in reality, the decline could be much steeper, as the European economy continues to go through less-than-ideal times, virtually stagnation. In the UK, today brings the Construction PMI, which has very low significance for traders. In the US, the ADP report and weekly jobless claims will also be published. Note that while the ADP report is interesting, it essentially reflects the same as the NonFarm Payrolls data. However, the market draws its main conclusions about the labor market based on NFP.

Fundamental Events Review:

Among Thursday's key fundamental events are the speeches by FOMC members Austan Goolsbee and John Williams. September 17 is approaching—a day when the Federal Reserve may resume monetary policy easing. Of course, final conclusions are best made after the NonFarm Payrolls report, but you can already start tracking shifts in the attitudes of Fed officials. Recall that many FOMC members support a rate cut in September, but do not support rate cuts in the medium term. Most of the FOMC Committee believes the US economy needs no more than two rate cuts of 0.25%.

One of the main factors for traders remains the trade war. As we see no signs of de-escalation, we likewise see no justification for markets to build medium-term US dollar longs. Last week, Donald Trump increased tariffs up to 50% for India. As before, the US currency can only count on local gains based on technical factors or isolated events/reports, but nothing more.

General Conclusions:

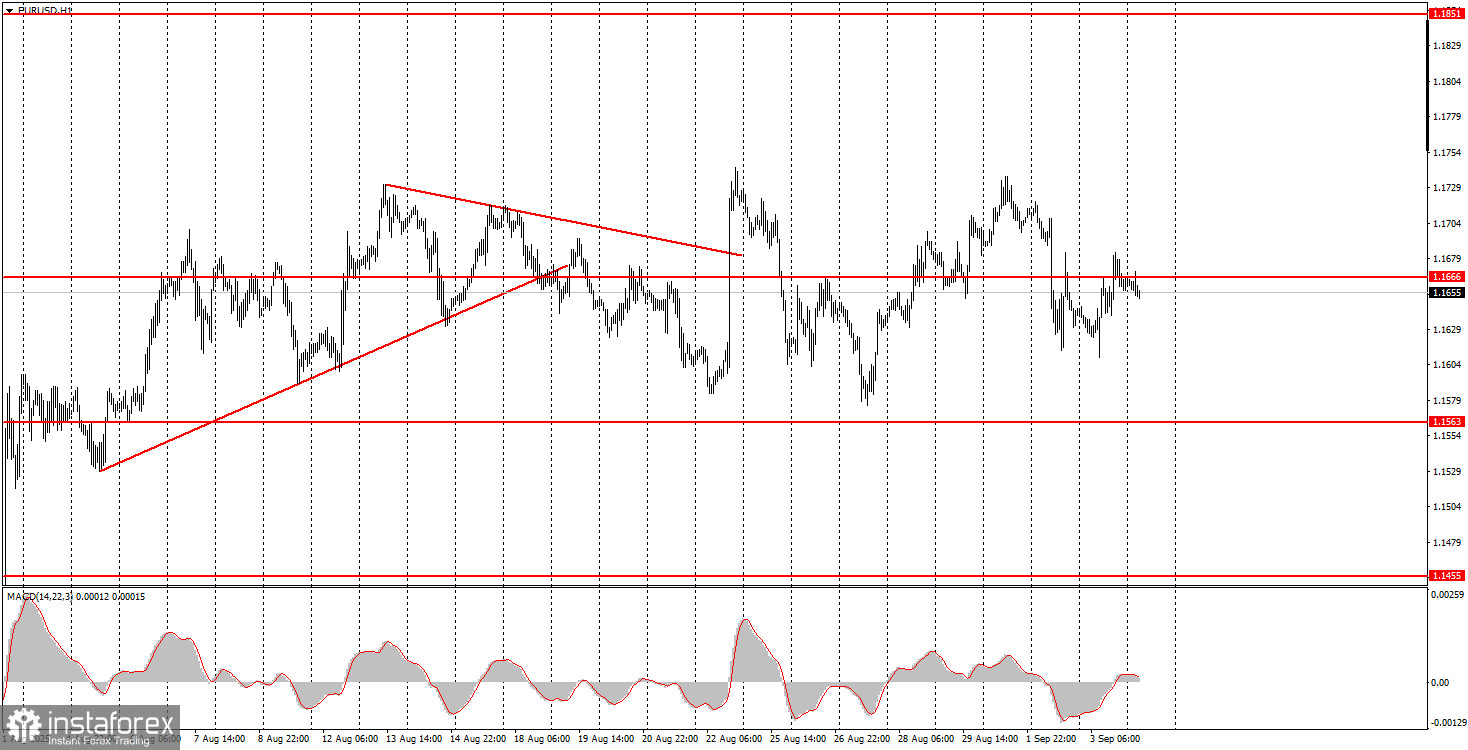

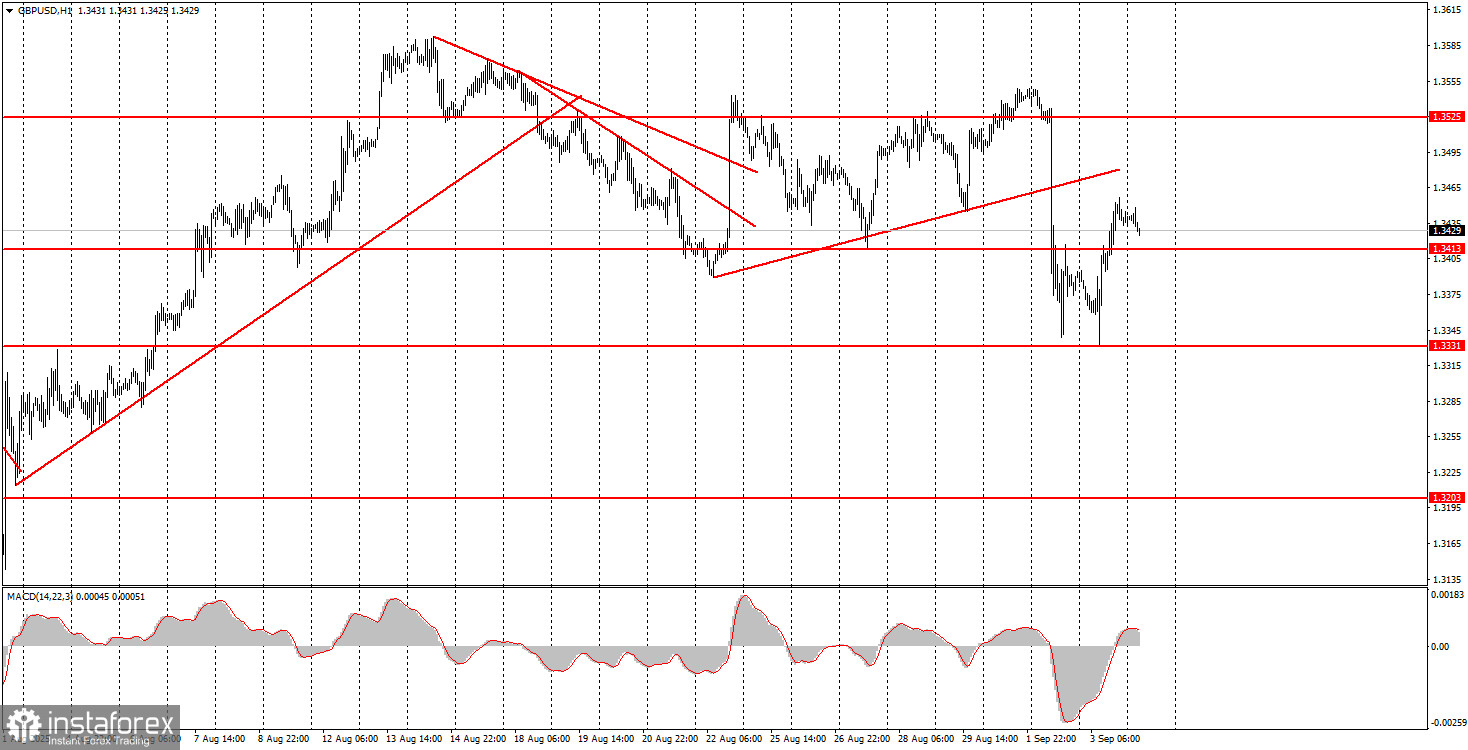

During the penultimate trading day of the week, both currency pairs will trade mainly based on technical factors. For the euro, focus should be on the 1.1655–1.1666 area. For the pound sterling, focus on the 1.3413–1.3421 area.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.