Yesterday, Bitcoin tested the $112,500 level but failed to hold it. Ethereum also saw a sharp pullback after a decent recovery of more than 3%.

Today's sharp decline during Asian trading keeps key trading instruments within their current channels, and most likely, there will be no significant market moves until the upcoming Federal Reserve meeting.

Meanwhile, according to a River report, private companies reinvest an average of 22% of their profits in BTC. This indicates that, in 2025, the adoption of BTC in corporate finance is advancing faster than ever before.

This trend clearly reflects the growing recognition of BTC not only as a speculative asset but also as a means to diversify corporate reserves and protect against inflation. Many companies view BTC as a means to preserve assets, particularly in the context of uncertain traditional financial markets and depreciating fiat currencies. The 22% reinvestment rate indicates a serious and long-term commitment to BTC, not just short-term experimentation. Additionally, the spread of information about positive experiences by early corporate BTC adopters serves as extra motivation for other market participants. These success stories demonstrate potential benefits and alleviate concerns regarding BTC's volatility.

Overall, the accelerated integration of BTC into corporate finance is a crucial trend that could significantly impact the future of the cryptocurrency industry and the financial world at large. The further development of this trend will depend on factors such as regulatory policy, technological advancement, and overall macroeconomic conditions.

As for intraday strategy on the crypto market, I will continue to rely on significant Bitcoin and Ethereum dips, aiming for the continuation of a mid-term bull market, which is still intact.

For short-term trading, the strategy and conditions are described below.

Bitcoin

Buy Scenario

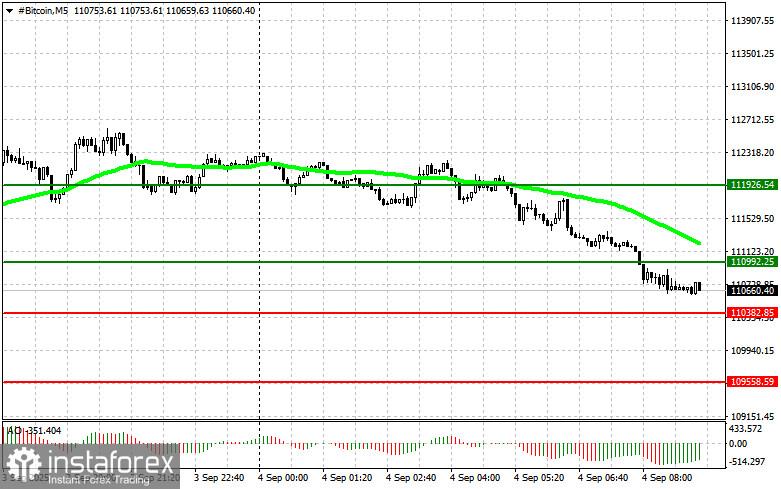

Scenario 1: Today, I will buy Bitcoin when the entry point around $110,900 is reached, targeting a rise to $111,900. Around $111,900, I plan to exit longs and sell immediately on the pullback. Before buying on the breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario 2: You can buy Bitcoin from the lower boundary of $110,300 if there is no strong market reaction to its breakdown, with an upward target at $110,900 and $111,900.

Sell Scenario

Scenario 1: Today, I will sell Bitcoin when the entry point around $110,300 is reached, targeting a fall to $109,500. Around $109,500, I will exit shorts and immediately buy on the bounce. Before selling on the breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario 2: You can sell Bitcoin from the upper boundary of $110,900 if there is no strong market reaction to its breakout, targeting $110,300 and $109,500 below.

Ethereum

Buy Scenario

Scenario 1: Today, I will buy Ethereum when the entry point around $4,393 is reached, targeting a rise to $4,446. Around $4,446, I'll exit longs and sell immediately on the pullback. Before buying on the breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario 2: You can buy Ethereum from the lower boundary of $4,352 if there's no market reaction to its breakdown, aiming for $4,393 and $4,446.

Sell Scenario

Scenario 1: Today, I will sell Ethereum when the entry point around $4,352 is reached, targeting a fall to $4,296. Around $4,296, I'll exit shorts and immediately buy on the bounce. Before selling on the breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario 2: You can sell Ethereum from the upper boundary of $4,393 if there's no market reaction to its breakout, targeting $4,352 and $4,296 below.