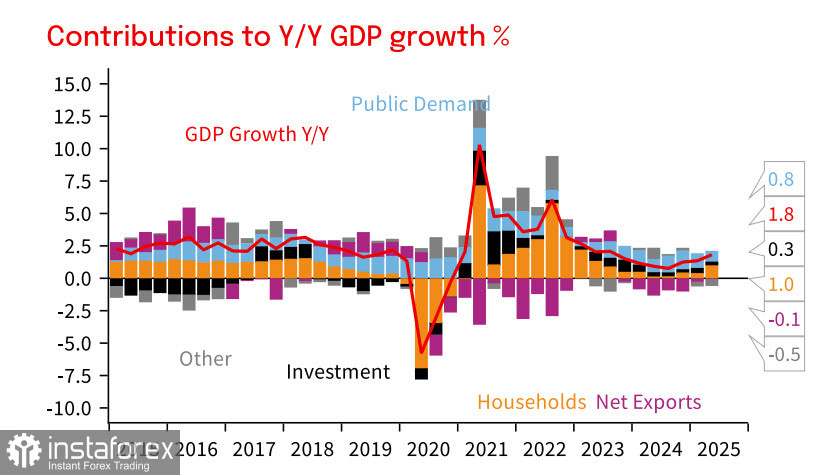

Australia's GDP rose 0.6% in the second quarter (+1.8% year-over-year), largely due to a surprise increase in demand—household consumption climbed 0.9% quarter-on-quarter. It appears real incomes are rising, though the picture is nuanced: the savings rate dropped from 5.2% to 4.2%, which suggests the uptick may not be solely due to growing disposable income, but also reduced savings.

Overall, Australia is recovering slightly faster than expected. According to NAB, economic growth could approach the trend level of 2.5% year-over-year next year. If there are no signs of a renewed surge in inflation, the RBA is expected to cut rates twice more—once in November and again in February—taking the cash rate down to a neutral level of 3.1%, after which the easing cycle would come to an end.

Exports contributed only modestly to GDP growth in the second quarter, but this component has high potential to support recovery if demand for Australian exports remains solid. In this respect, Australia could benefit from the strengthening of the Shanghai Cooperation Organization and especially China, as the main market for Australian commodities is concentrated in the Asian region.

The market is in an uneasy equilibrium as it awaits the US Supreme Court's decision on tariffs. The next two weeks leading up to the Federal Reserve meeting will be critical, both from a macroeconomic perspective and amid ongoing geopolitical risks, making the odds of a sharp market move notably higher.

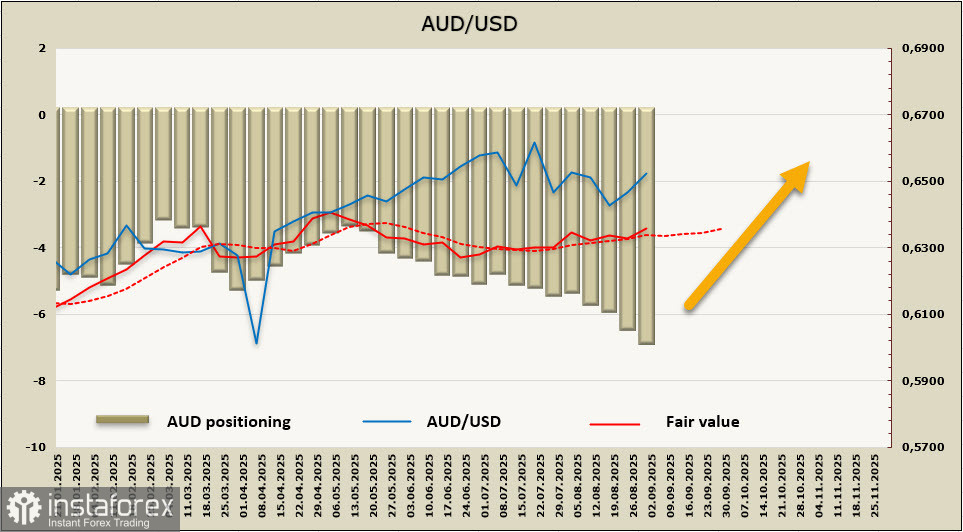

Net short positioning in the Australian dollar increased by $409 million over the reporting week to -$6.53 billion, reflecting firmly bearish speculative sentiment. At the same time, the estimated fair value is trying to turn higher, primarily due to diverging yields between US and Australian bonds.

In the previous review, we noted risks of another test of the 0.6410/20 support area. That threat now appears somewhat diminished. We still see the upside in AUD/USD as largely exhausted, with bearish positioning in the bond market supporting this view. Investors remain cautious on Australia's outlook, assessing that China has low odds of gaining the upper hand in the US-China trade standoff, and any export restrictions from China would directly impact Australia's export volumes, limiting future GDP growth. The most likely scenario for now is range trading while waiting for new data. Support sits at 0.6410/20, with a lower likelihood of a move down, and there is little justification for a rally to the local high at 0.6628.