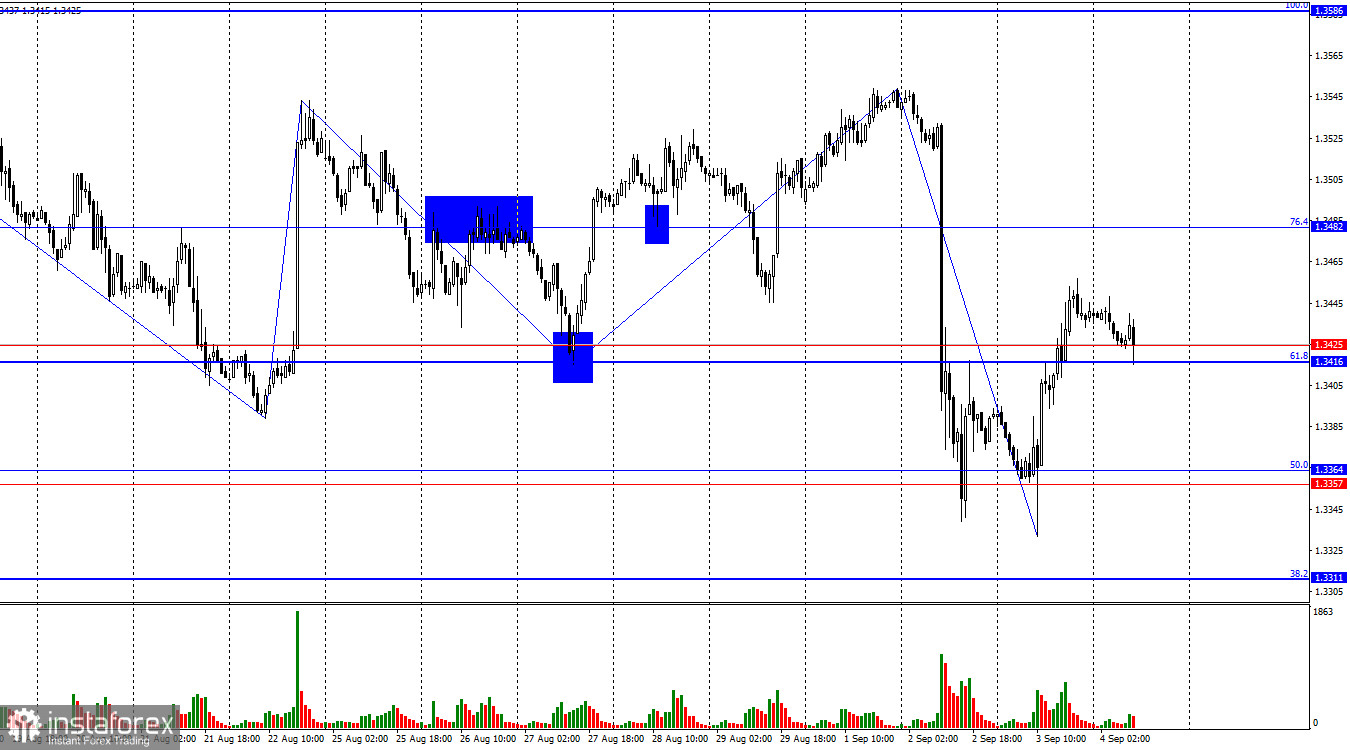

On the hourly chart, GBP/USD on Wednesday rebounded from the support zone of 1.3357–1.3364, reversed in favor of the pound, and consolidated above the 1.3416–1.3425 zone. Thus, the growth process may continue toward the next Fibonacci level of 76.4% – 1.3482. A consolidation below the 1.3416–1.3425 support zone would work in favor of the dollar and lead to a decline toward the 1.3357–1.3364 zone.

The wave structure remains "bearish," as confirmed by yesterday's decline. The last completed upward wave broke the previous peak by only a few pips, while the last downward wave broke two previous lows at once. The news background played a major role in shaping the waves we have seen in recent weeks. In my view, the background is not "bullish," but certain events have still provided support to the bears.

On Wednesday, traders' attention was drawn mainly to the JOLTS report in the U.S., but the pound's upward movement began long before its release. As the day before, quotes simply started moving. Recall that on Tuesday, the surge in U.K. bond yields to nearly 30-year highs triggered a sharp fall in the British currency. However, by Wednesday the market recovered and rightly judged that there are more factors currently favoring the pound against the dollar. Thus, the pound's collapse only confused some traders, but in my view, nothing has changed. This week is highly dependent on the news background, so movements do not always look predictable. There will be plenty of reports, and the U.K. bond surprise has already added pressure. Therefore, by the end of the week, we may still see dollar growth if the remaining U.S. reports turn out stronger than those already available. Today, close attention should be paid to ADP and ISM.

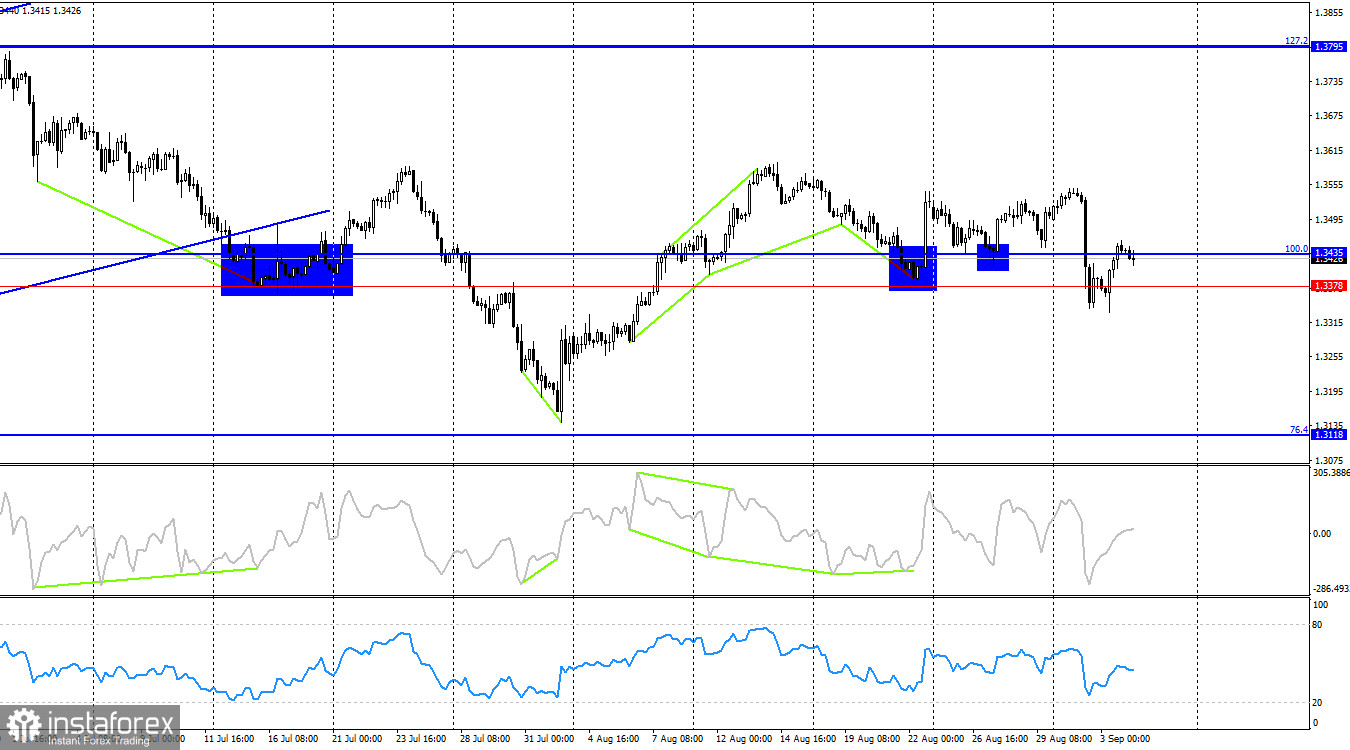

On the 4-hour chart, the pair turned in favor of the dollar and consolidated below the 1.3378–1.3435 support zone, from which it previously rebounded twice. Thus, the decline process may continue toward the 76.4% retracement level – 1.3118. The chart picture remains ambiguous, with traders pushing the pair in both directions. At this point, I would advise paying more attention to the hourly chart. No divergences are forming in any indicator.

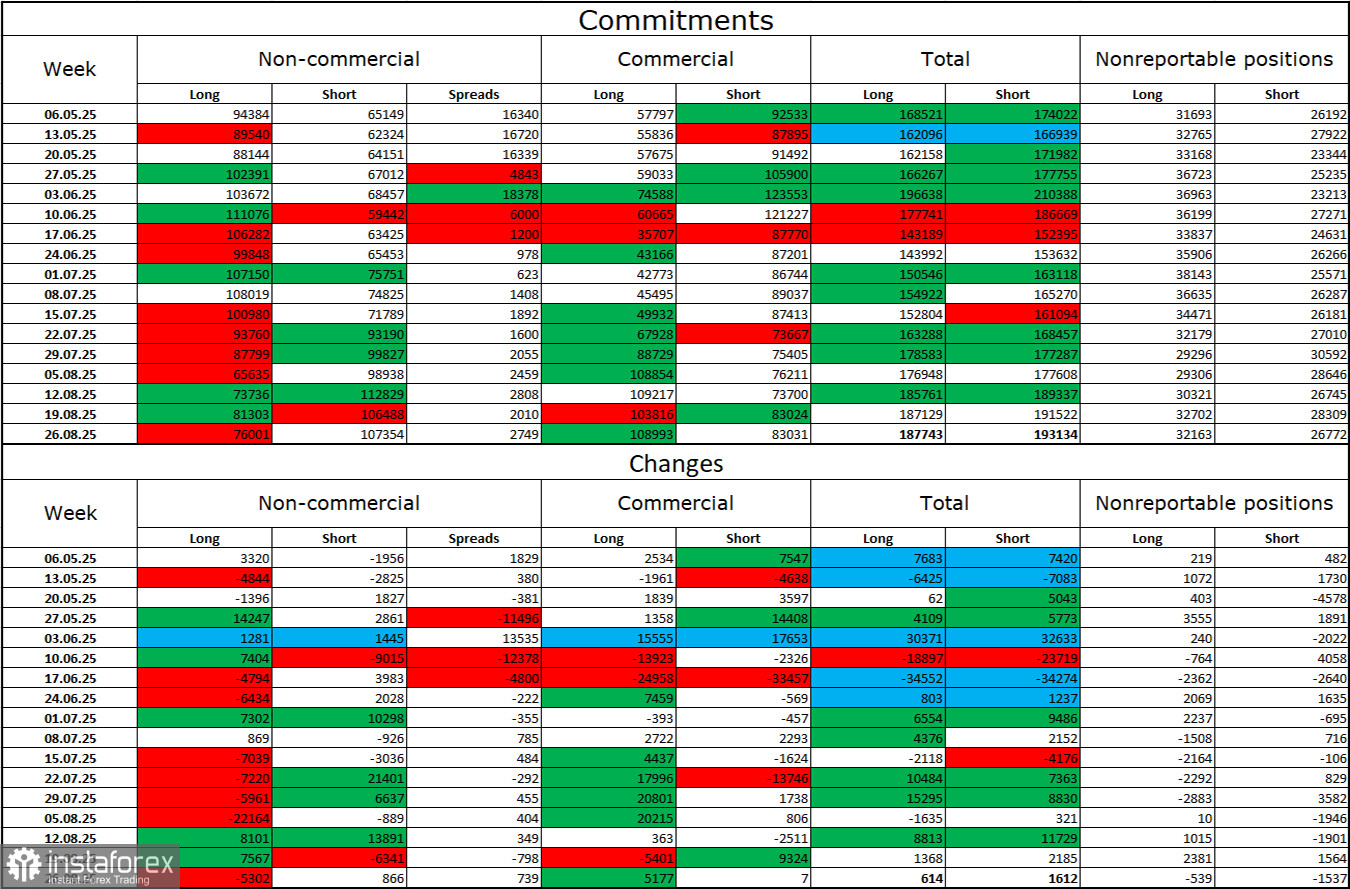

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" category became more bearish last week. The number of long positions held by speculators fell by 5,302, while the number of shorts increased by 866. The gap between longs and shorts is now about 76,000 versus 107,000. But as we can see, the pound still tends toward growth, and traders toward buying.

In my view, the pound still has downside prospects. The news background in the first six months of the year was disastrous for the dollar, but it is gradually starting to improve. Trade tensions are easing, major deals are being signed, and the U.S. economy is expected to recover in the second quarter thanks to tariffs and various investments. At the same time, the outlook for Fed monetary policy easing in the second half of the year has already created serious pressure on the dollar. Thus, I still see no basis for a "dollar trend."

News calendar for the U.S. and the U.K.:

- U.S. – ADP Employment Change (12:15 UTC).

- U.S. – Initial Jobless Claims (12:30 UTC).U.S. – ISM Services PMI (14:00 UTC).

On September 4, the economic calendar contains three entries, two of which should be considered important. The news background will affect market sentiment mainly in the second half of the day.

GBP/USD forecast and trader tips: Selling the pair is possible today if the hourly close occurs below the 1.3416–1.3425 zone, targeting 1.3357–1.3364. Buying was possible yesterday on a rebound from the 1.3357–1.3364 zone with targets at 1.3416–1.3425 and 1.3482. Today, buying is possible on a rebound from the 1.3416–1.3425 zone.

Fibonacci grids are built from 1.3586–1.3139 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.