The euro and the pound worked well today through the Mean Reversion strategy. However, an interesting move in the opposite direction occurred only with the pound. I did not trade anything using Momentum.

Data showed that retail sales in the euro area fell by 0.5%, worse than economists' forecasts. However, looking deeper into the details, it should be noted that the decline in retail sales may be due to a variety of factors, including changing consumer habits and overall economic uncertainty.

Even though inflation is not high, it still creates problems for consumers, and even the risks of its future growth due to tariffs are not affecting them in any way. In any case, the drop in retail sales in the euro area is an alarming signal, pointing to potential problems in the region's economy. This may influence the European Central Bank's monetary policy decisions and ultimately affect the pace of economic growth.

Ahead, we face much more significant data. It will begin with the ADP employment change for August and the number of initial jobless claims. In particular, the ADP data, published a few days before the official Labor Department report, often serves as a barometer for predicting overall labor market trends. Traders always watch these figures closely to assess how strong employment growth was in the private sector. A deviation from expected values can trigger significant volatility in financial markets.

In addition to labor data, traders will also pay close attention to the U.S. trade balance. An increase in the trade deficit may pressure the dollar, while a reduction could support it. The ISM Services PMI will also be in the spotlight, where strong results could strengthen the dollar.

If the statistics are strong, I will rely on implementing the Momentum strategy. If the market shows no reaction, I will continue to use the Mean Reversion strategy.

Momentum strategy (breakout) for the second half of the day:

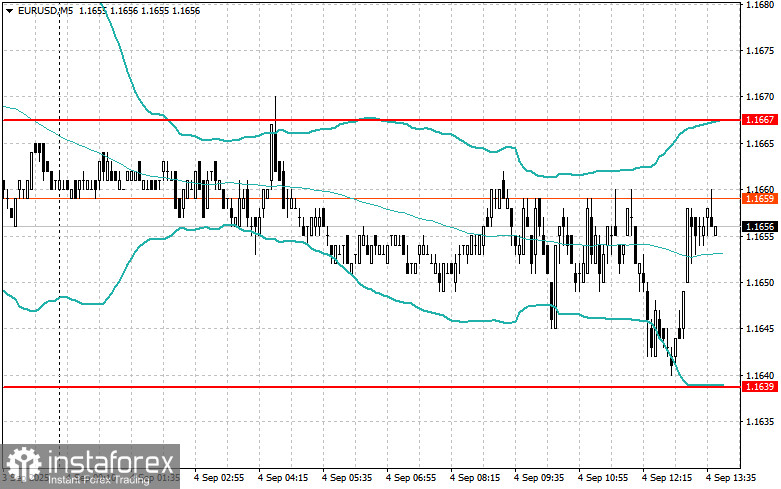

For EUR/USD

- Buying on a breakout of 1.1665 may lead to growth toward 1.1690 and 1.1715;

- Selling on a breakout of 1.1645 may lead to a decline toward 1.1610 and 1.1575.

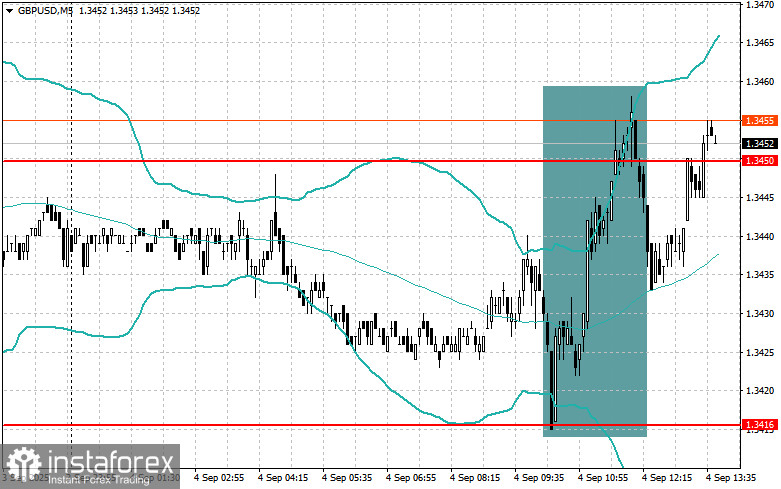

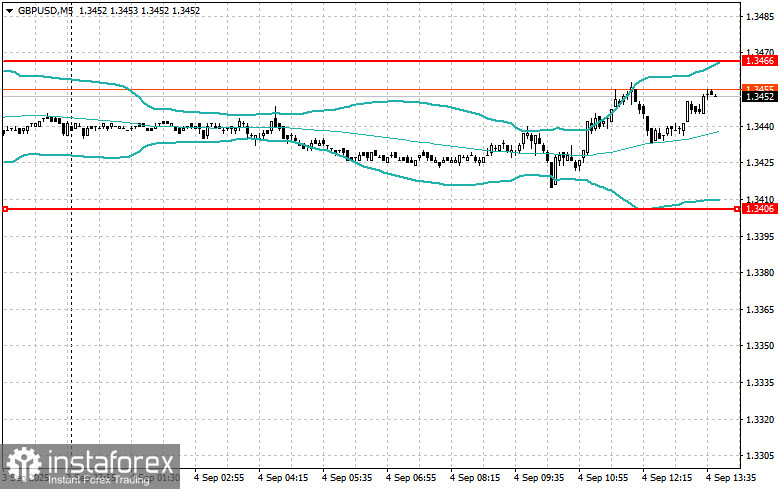

For GBP/USD

- Buying on a breakout of 1.3454 may lead to growth toward 1.3485 and 1.3500;

- Selling on a breakout of 1.3430 may lead to a decline toward 1.3405 and 1.3365.

For USD/JPY

- Buying on a breakout of 148.50 may lead to growth toward 148.75 and 149.04;

- Selling on a breakout of 148.17 may lead to a decline toward 147.85 and 147.50.

Mean Reversion strategy (reversal) for the second half of the day:

For EUR/USD

- I will look for selling opportunities after a failed breakout above 1.1667 with a return below this level;

- I will look for buying opportunities after a failed breakout below 1.1639 with a return above this level.

For GBP/USD

- I will look for selling opportunities after a failed breakout above 1.3466 with a return below this level;

- I will look for buying opportunities after a failed breakout below 1.3406 with a return above this level.

For AUD/USD

- I will look for selling opportunities after a failed breakout above 0.6535 with a return below this level;

- I will look for buying opportunities after a failed breakout below 0.6517 with a return above this level.

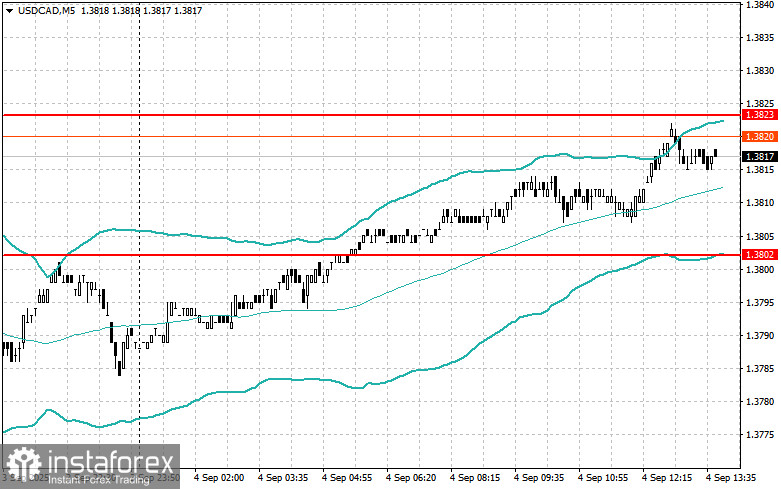

For USD/CAD

- I will look for selling opportunities after a failed breakout above 1.3823 with a return below this level;

- I will look for buying opportunities after a failed breakout below 1.3802 with a return above this level.