Analysis of trades and tips for trading the British pound

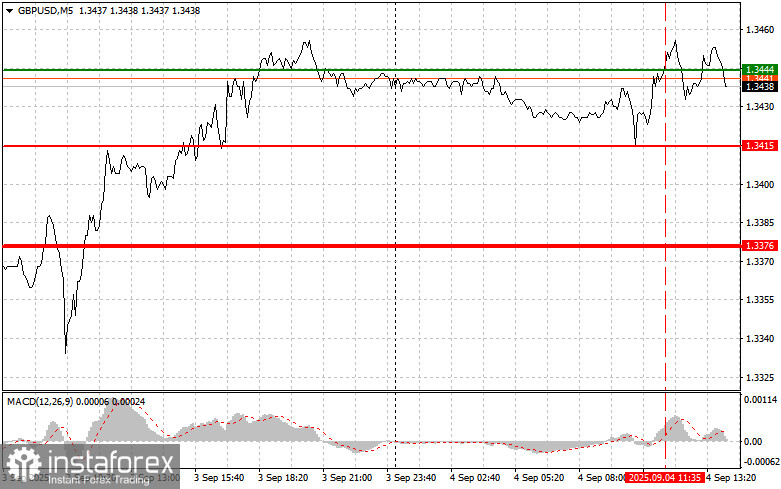

The test of 1.3444 occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the pound.

Strong data on U.K. construction sector activity supported the pound, allowing it to recover quickly. This surge in optimism, however, requires consideration in a broader economic context. While construction figures are important, they are only one of many factors shaping the country's overall economic health. Recovery in construction may be linked to the execution of delayed projects, completion of earlier ones, seasonal fluctuations, or this year's rate cuts in the U.K. Still, it should be understood that the strengthening of the pound following positive construction data may be short-lived. Today's U.S. reports will have a much greater impact on the currency market.

In particular, attention will focus on ADP employment data, as well as the number of new jobless claims. Additionally, the release of the U.S. trade balance and the ISM services PMI will be important. A speech by FOMC member John Williams could add further influence. Strong employment data, especially above forecasts, may reinforce confidence in the resilience of the U.S. economy and, as a result, support the dollar. Conversely, weak figures could fuel concerns about slowing growth and pressure the currency.

The trade balance is no less important. A narrowing deficit may indicate improving competitiveness of U.S. goods globally and support the dollar, while widening may have the opposite effect. The ISM services PMI will provide insight into the condition of a key sector of the U.S. economy. The higher the index, the stronger the positive signal for the dollar.

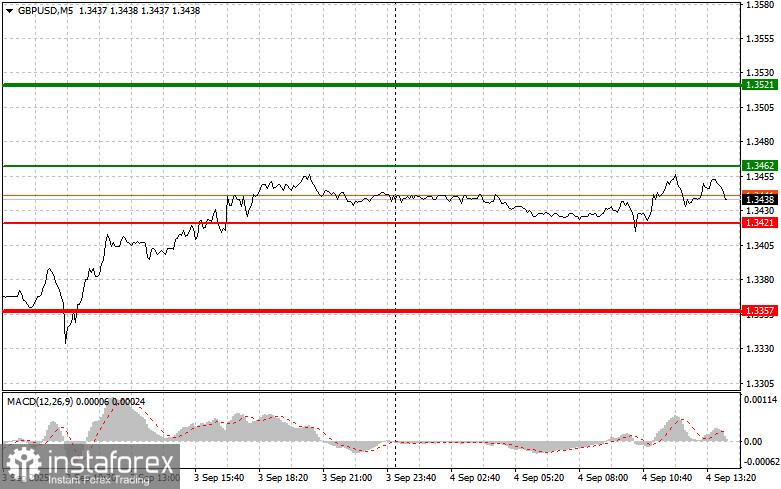

As for the intraday strategy, I will rely mainly on the implementation of scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today at an entry point around 1.3462 (green line on the chart) with a target at 1.3521 (thicker green line on the chart). At 1.3521, I will exit buys and open short positions in the opposite direction (expecting a 30–35-point pullback). Strong pound growth today may be expected after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today in the case of two consecutive tests of 1.3421, at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth toward 1.3462 and 1.3521 can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after a break below 1.3421 (red line on the chart), which would lead to a quick decline. The key target for sellers will be 1.3357, where I will exit shorts and immediately open long positions in the opposite direction (expecting a 20–25-point pullback). Strong data would trigger another drop in the pair. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell the pound today in the case of two consecutive tests of 1.3462, at a moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline toward 1.3421 and 1.3357 can then be expected.

What is shown on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – suggested price for placing Take Profit or fixing profits manually, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – suggested price for placing Take Profit or fixing profits manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to be guided by overbought and oversold zones.

Important. Beginner Forex traders must be very cautious in making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember, successful trading requires a clear trading plan, like the one outlined above. Spontaneous decisions based on current market conditions are, from the start, a losing strategy for an intraday trader.