Traders have switched to "wait-and-see" mode ahead of key data that may significantly impact the Federal Reserve's future decisions. That's why volatility is so low and why many instruments are seeing choppy, range-bound moves.

In the first half of the day, we expect data releases on changes in Eurozone GDP for Q2, changes in employment, German industrial orders, and Italian retail sales. These indicators will provide insight into the state of the European economy and help assess its prospects. Special attention will be paid to the Eurozone GDP. Economists expect the region's economy to have shown moderate growth in Q2, which could support the euro. The employment reading will also be an important indicator of the health of the labor market and consumer confidence.

As for the pound, UK retail sales data will be in focus during the first half of the day. This indicator reflects consumer spending trends and serves as a key gauge of the British economy. Retail sales are expected to show moderate growth. At the same time, the Halifax House Price Index—one of the UK's largest mortgage lenders—will be released. This index is among the most reputable housing market barometers in the country.

If the data meet economists' expectations, it's best to trade based on the Mean Reversion strategy. If data comes in much higher or lower than expected, the Momentum strategy is more appropriate.

Momentum Strategy (Breakout):

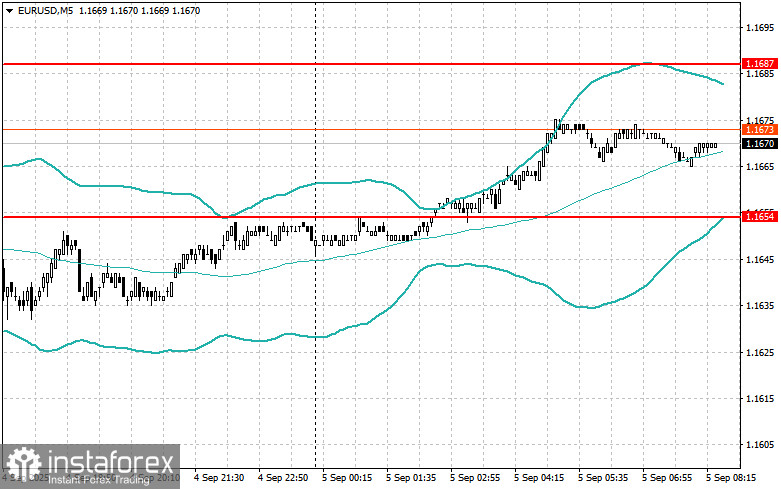

EUR/USD

- Buying on a breakout above 1.1682 could lead to euro gains toward 1.1715 and 1.1740

- Selling on a breakout below 1.1660 could lead to euro declines toward 1.1640 and 1.1610

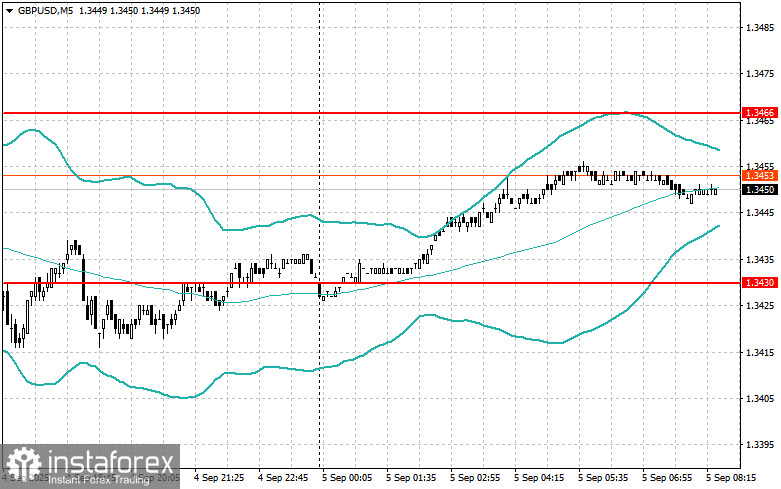

GBP/USD

- Buying on a breakout above 1.3455 could lead to pound gains toward 1.3485 and 1.3515

- Selling on a breakout below 1.3440 could lead to pound declines toward 1.3410 and 1.3380

USD/JPY

- Buying on a breakout above 148.35 could lead to dollar gains toward 148.85 and 149.10

- Selling on a breakout below 148.10 could lead to dollar declines toward 147.85 and 147.50

Mean Reversion Strategy (Pullbacks):

EUR/USD

- Look to sell after an unsuccessful breakout above 1.1687 and a return below this level

- Look to buy after an unsuccessful breakout below 1.1654 and a return above this level

GBP/USD

- Look to sell after an unsuccessful breakout above 1.3466 and a return below this level

- Look to buy after an unsuccessful breakout below 1.3430 and a return above this level

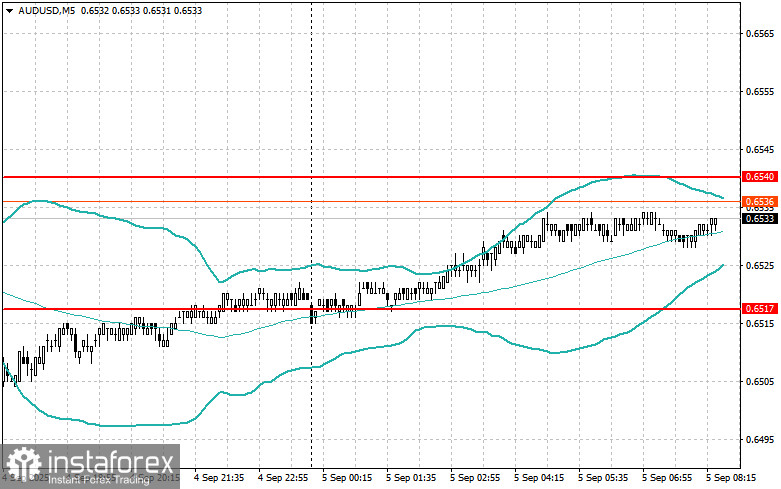

AUD/USD

- Look to sell after an unsuccessful breakout above 0.6540 and a return below this level

- Look to buy after an unsuccessful breakout below 0.6517 and a return above this level

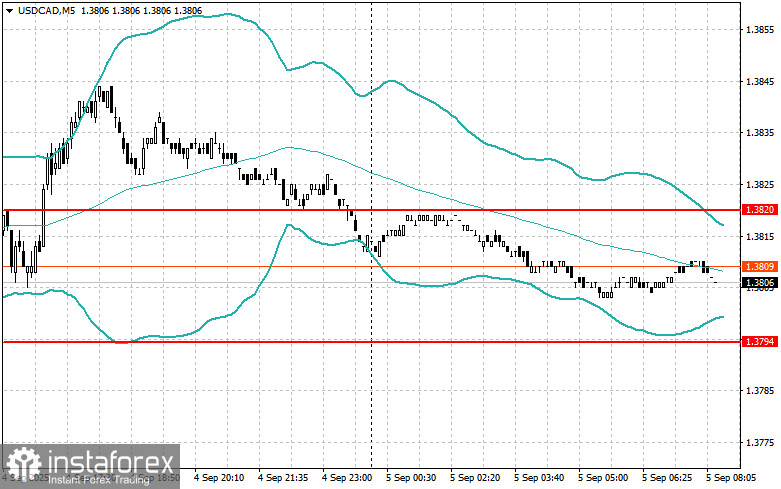

USD/CAD

- Look to sell after an unsuccessful breakout above 1.3820 and a return below this level

- Look to buy after an unsuccessful breakout below 1.3794 and a return above this level