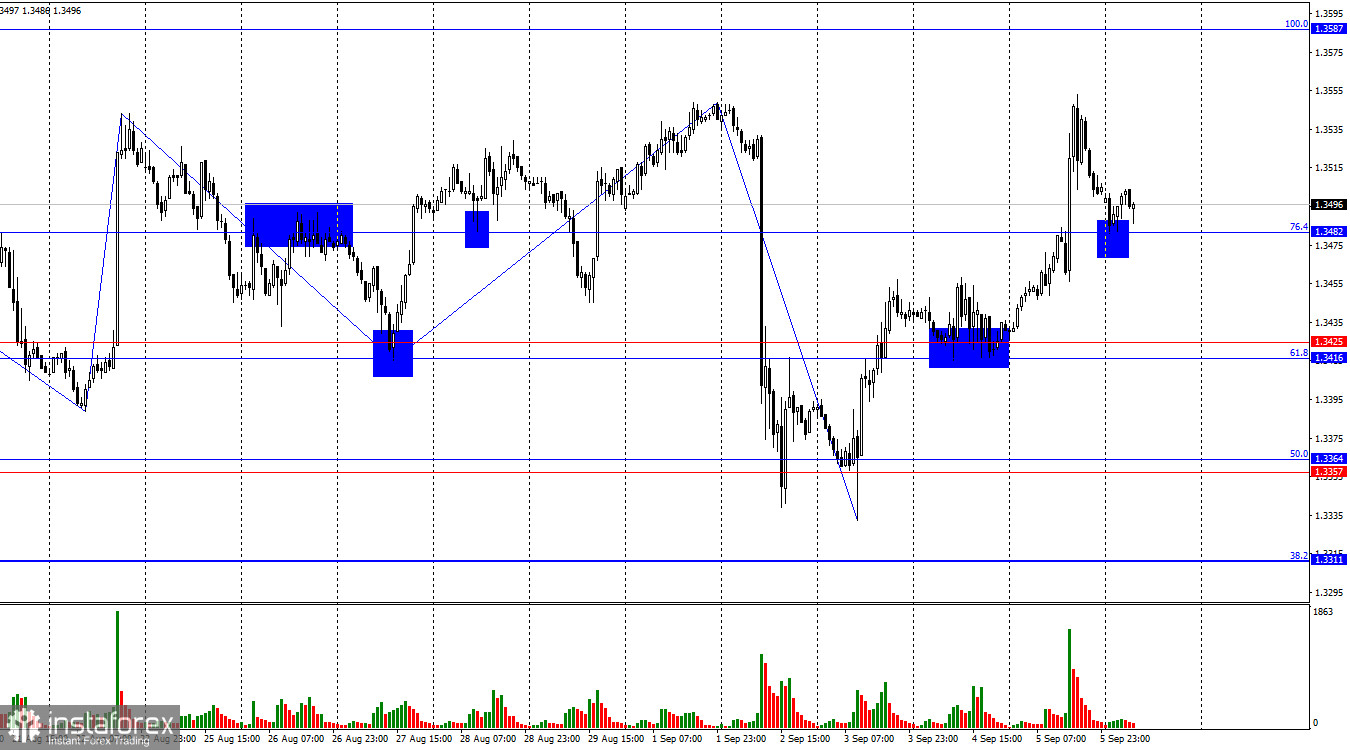

On the hourly chart, the GBP/USD pair on Friday continued its upward movement after rebounding from the support zone of 1.3416–1.3425 and consolidated above the 76.4% retracement level at 1.3482. The rebound from this level overnight suggests further pound growth toward the next Fibonacci level of 100.0% at 1.3587. A move below 1.3482 would favor the U.S. dollar and some decline toward the 1.3416–1.3425 level.

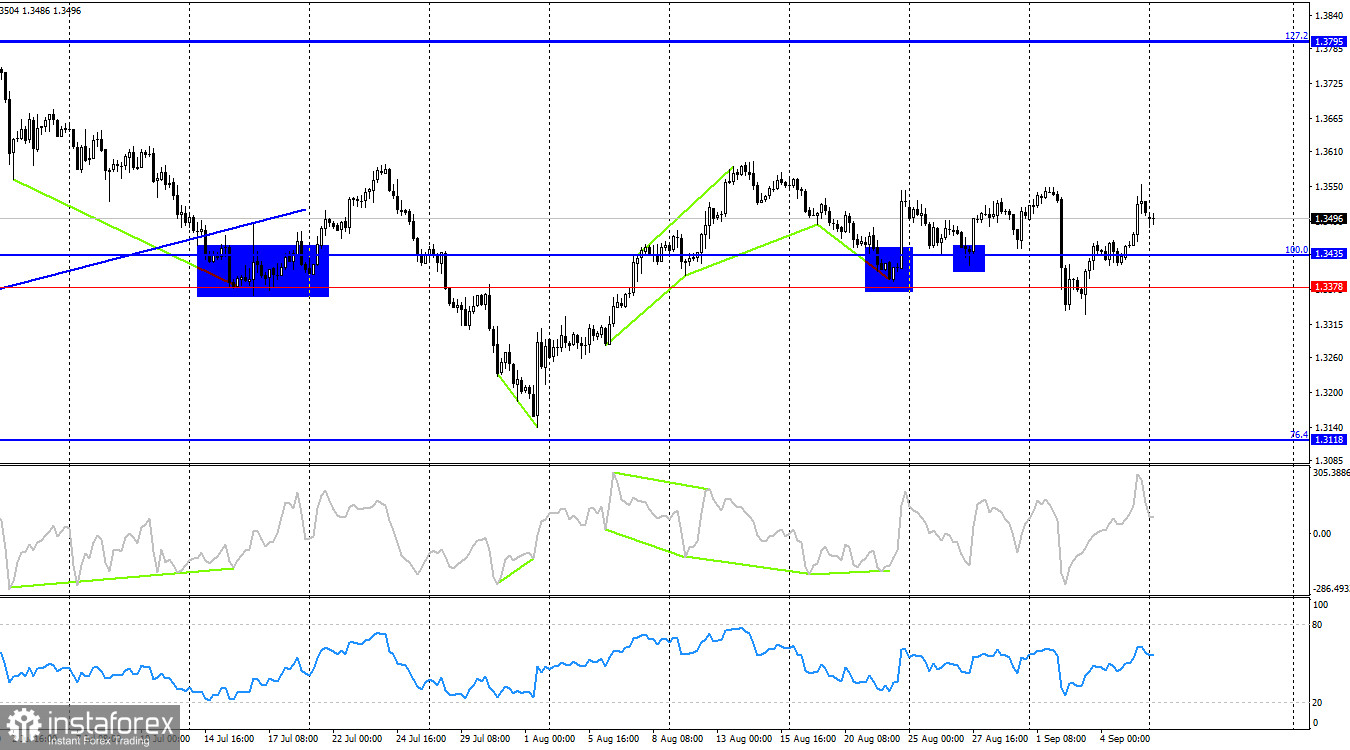

The wave structure remains "bearish." The last completed downward wave broke through two previous lows at once, while the latest upward wave has not yet managed to surpass the previous peak. The news background has played a significant role in shaping the waves we've seen in recent weeks. In my view, the backdrop is not "bearish," but the current waves point to either a continuation of the bearish trend or sideways movement.

On Friday, bear traders suffered another blow that they may not recover from anytime soon. The Nonfarm Payrolls report showed weak figures for the fourth consecutive month. Not only is job creation minimal, but unemployment is also rising. Other reports on the day, including U.K. retail sales, also worked in favor of the bulls. Thus, the three most important releases on Friday all pointed only to GBP/USD growth.

On the 4-hour chart, sideways movement is clearly visible, but the latest news background allows me to assume that after the range ends, we will see new pound growth rather than dollar growth. The dollar continues to balance on the edge and cannot find even a straw to hold onto. The situation is worsening by the day, as the FOMC will ease monetary policy in September, and this will not be a one-time action to satisfy Trump.

On the 4-hour chart, the pair has also reversed in favor of the pound and consolidated above the 1.3378–1.3435 level. This means the growth process may continue toward the next retracement level of 127.2% at 1.3795. The chart remains mixed, with traders pushing the pair back and forth. At this point, I recommend focusing more on the hourly chart. No developing divergences are observed on any indicator.

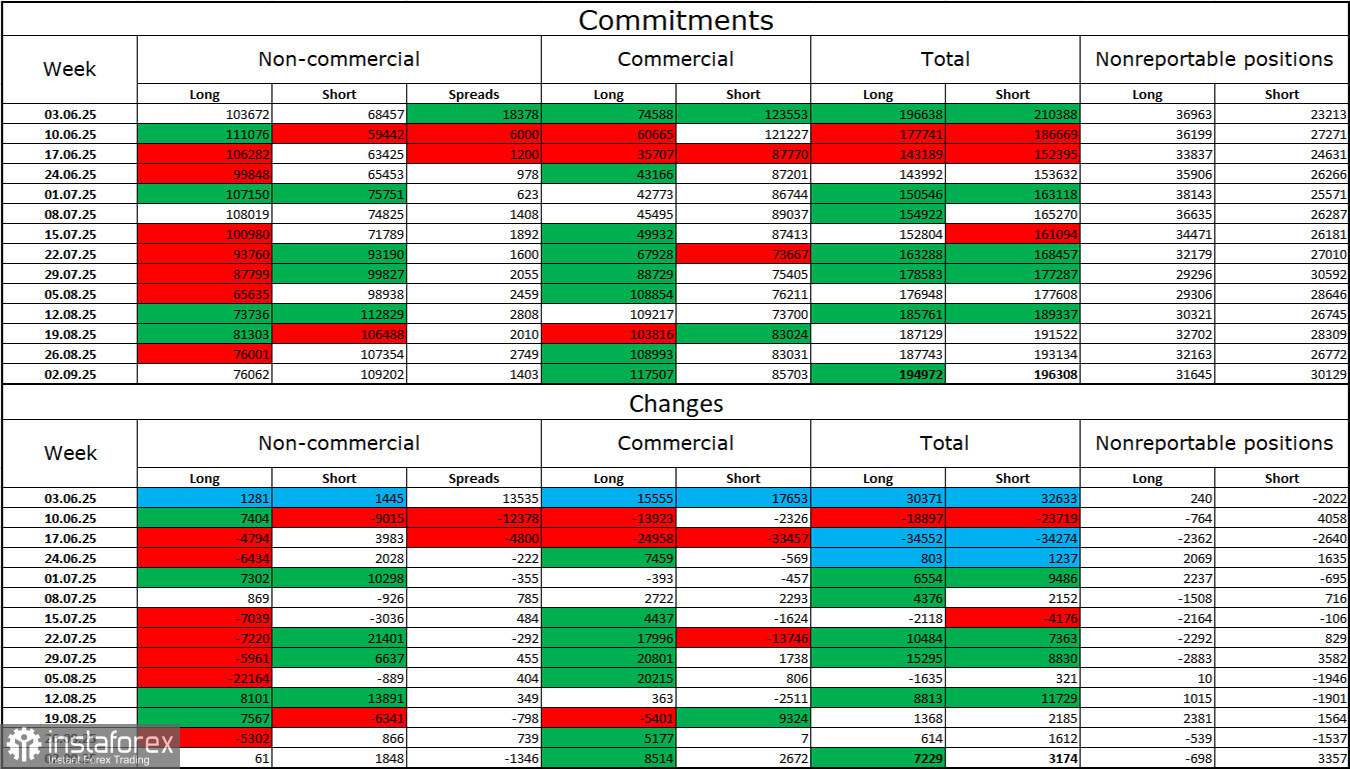

Commitments of Traders (COT) report:

Sentiment among "Non-commercial" traders over the last reporting week became slightly more bearish. The number of long contracts held by speculators increased by 61, while shorts rose by 1,848. The gap between longs and shorts now stands at about 76,000 vs. 109,000. Still, as we can see, the pound remains tilted toward growth, and traders are leaning toward buying.

In my opinion, the pound still has downward prospects. For the first six months of the year, the U.S. dollar's backdrop was terrible, but it is slowly improving. Trade tensions are easing, key deals are being signed, and the U.S. economy should recover in Q2 thanks to tariffs and various investments in the country. At the same time, prospects for Fed easing in the second half of the year are already putting serious pressure on the dollar, while the U.S. labor market is weakening and unemployment is rising. Thus, I still see no grounds for a "dollar trend."

News calendar for the U.S. and the U.K.:

On September 8, the economic calendar contains no notable entries. Market sentiment on Monday will not be influenced by news.

GBP/USD forecast and trading tips:

Selling the pair is possible today if it consolidates below 1.3482 on the hourly chart, with targets at 1.3416–1.3425. Buying was possible on rebounds from the 1.3357–1.3364 and 1.3416–1.3425 level. Today, those positions can be held with a target of 1.3587 if there is a rebound from 1.3482.

Fibonacci grids are drawn from 1.3586–1.3139 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.