The European Central Bank has lowered three interest rates, which can now be considered "neutral." Let me remind you, "neutral" rates are those that neither stimulate the economy nor restrain inflation. The consumer price index in the Eurozone has dropped to the target level and isn't falling below 2%. Thus, for now, further monetary policy easing is genuinely unnecessary. ECB board member Isabel Schnabel confirmed this.

She stated that she still considers trade tariffs a threat to price stability within the European Union, but that tariffs might only cause a short-term spike in inflation, and current monetary policy settings could potentially contain price growth. Undoubtedly, there is much potential in this viewpoint, but it must be admitted: the ECB has achieved its goal, unlike the Federal Reserve or the Bank of England. Recall that inflation in the US is nearing 3%, and in Britain it's close to 4%. In both cases, further easing is contraindicated; for instance, the Fed is left with no other choice, as the labor market has been "cooling" for four months already.

Based on the above, a rate cut is only likely in 2025—and only from the Fed. The Bank of England may run another round of easing as was planned at the start of the year, but in my view, with inflation twice the norm, the British central bank may opt out of this step. If the Fed continues cutting rates on its own, how will this affect all instruments involving the US dollar?

Accordingly, it's reasonable to expect continued weakness for the US dollar. Considering the current wave structure, news background, US economy state and trends, the Fed's dovish attitude, and Trump's demands for faster and deeper rate cuts—if my assumption is correct —the 1.1830 level reached in July won't be the high for 2025. I fully expect that this year, the EUR/USD will close above the 1.2000s, closer to 1.2500.

Wave Picture for EUR/USD:

Based on my analysis of EUR/USD, I conclude that the instrument continues to build an upward trend. The wave markup still entirely depends on the news background linked to Trump's decisions and US foreign policy. The targets of the trend section may stretch as far as the 1.25 area. Accordingly, I continue to consider longs with targets around 1.1875 (which corresponds to 161.8% of the Fibonacci extension) and higher. I assume that wave 4 construction is complete. Thus, now remains a good time to buy.

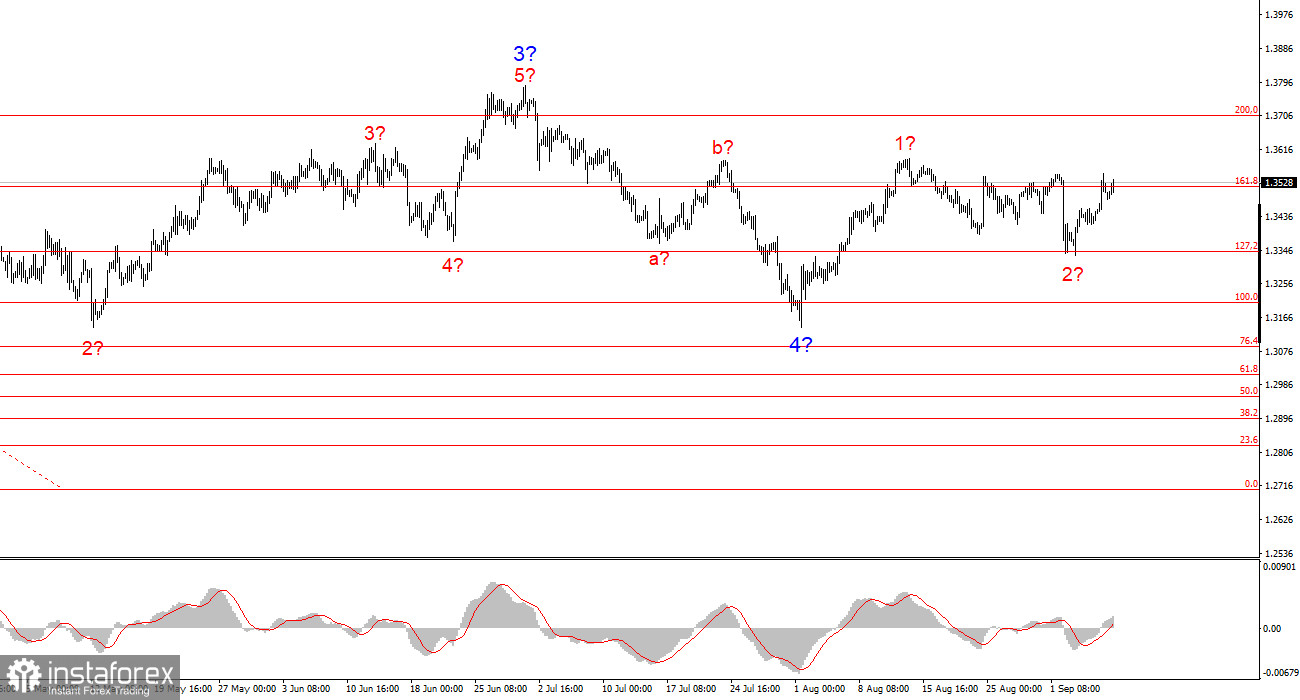

Wave Picture for GBP/USD:

The wave markup for GBP/USD remains unchanged. We are dealing with an impulsive upward trend section. With Trump, the markets may experience many more shocks and reversals, which could seriously affect the wave picture, but for now, the working scenario remains intact. The target for the upward trend section is now around 1.4017. At this time, I believe that the construction of corrective wave 4 is complete. Wave 2 of 5 may be either completed or nearing completion. Therefore, I advise buying with a target of 1.4017.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are challenging to trade and often require adjustments.

- If you are unsure about the market, it is better to stay out.

- One can never be 100% certain of market direction. Never forget to use stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.