The EUR/USD currency pair traded relatively quietly on Monday, which is not surprising, as the macroeconomic and fundamental background in both the EU and the US was virtually absent. Donald Trump continues to make statements almost every day, but at present, his comments are more about resolving conflicts between Ukraine and Russia, as well as in the Gaza Strip. You could say that Trump has eased up a bit on his pressure on the rest of the world regarding the "unfairness in trade that allowed many countries to rob the US for decades."

It would seem there's no better time for the dollar to rally. For once, Donald Trump is not introducing new tariffs or raising existing ones. However, as we have said many times before, the US currency basically has no reason to cheer. What is there to be happy about if the economy continues to weaken despite a strong GDP figure for Q2? After all, GDP is not the only indicator of the state of the economy. For example, last week showed that business activity in the manufacturing sector continues to fall, the number of job openings is decreasing, new job creation has remained minimal for four straight months, and unemployment is rising. Can we really celebrate GDP growth under these circumstances?

We believe not. The economy may post double-digit growth, but if unemployment is rising, inflation is rising, the labor market is shrinking, and the Federal Reserve is cutting rates, then the dollar will continue to fall for a very long time. And that is precisely the scenario we are heading towards.

No one doubts anymore that the Fed will cut the key rate in September. Now, the market is questioning whether the central bank will cut rates only twice by 0.25% before year-end. Last week's hopes were pinned to the Nonfarm Payrolls report. Traders were hoping the number might beat the not-so-positive forecast, which would have suggested stabilization in the labor market. But that didn't happen.

Therefore, the Fed will have to cut rates to save the jobs market. A more dovish monetary policy will give companies access to cheap loans, which can be channeled into development and investment, allowing new jobs to be created—or at least that's how the theory should work. In practice, it's not that simple. Recall that Trump's policies also concern migrants, both legal and illegal. With the stroke of his pen, Trump can turn hundreds of thousands of legal migrants into illegals. Given that the US, as a country, exists only because of migrants, it is not surprising that the labor market is shrinking. First, no one wants to work in America with such a president. Second, deportations from the US continue, so the labor force is shrinking. The economy is struggling due to import tariffs; demand, incomes, and profits are all falling. Meanwhile, GDP is growing thanks to additional budget revenues, and the Department of Defense is now called the Department of War.

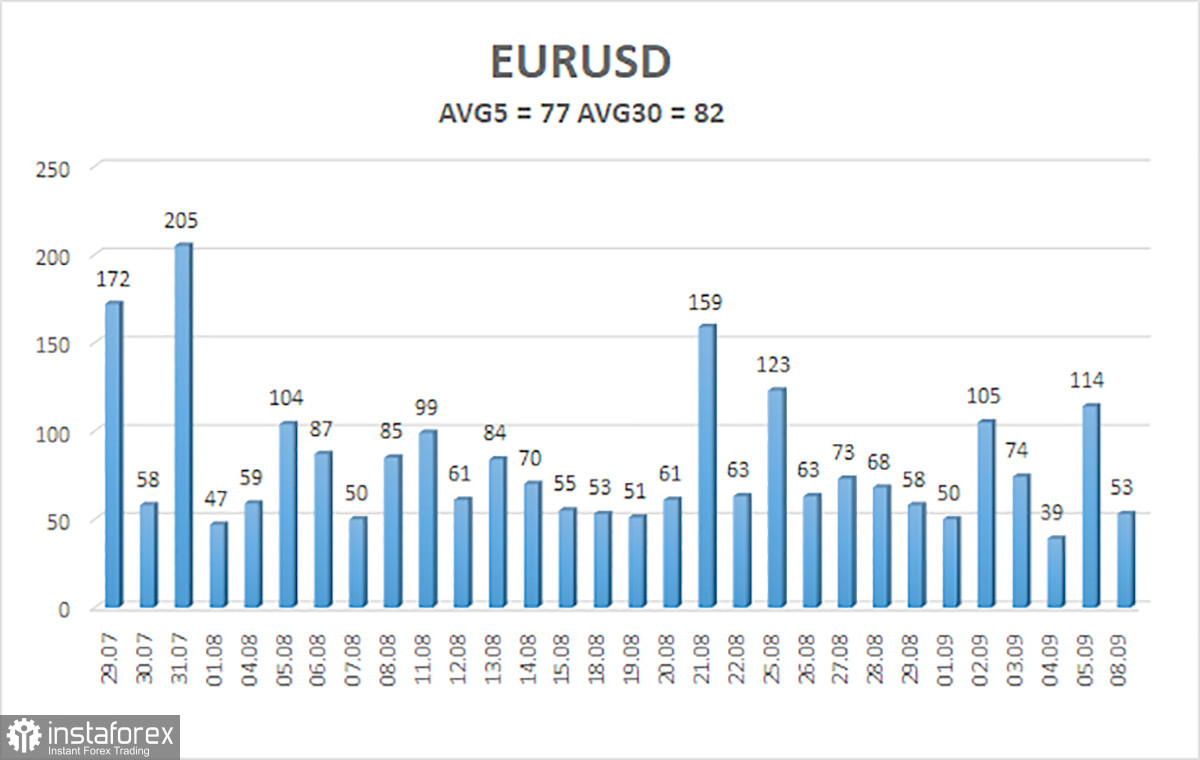

The average volatility of EUR/USD over the last five trading days as of September 9 is 77 pips, which is considered "average." On Tuesday, we expect the pair to move between the levels of 1.1674 and 1.1828. The linear regression channel's upper band is pointing upward, still indicating an upward trend. The CCI indicator entered the oversold area three times, warning of the renewal of the uptrend. A bullish divergence also formed, signaling growth.

Nearest Support Levels:

S1 – 1.1719

S2 – 1.1658

S3 – 1.1597

Nearest Resistance Levels:

R1 – 1.1780

R2 – 1.1841

Trading Recommendations:

The EUR/USD pair may resume its uptrend. The US currency is still strongly impacted by Trump's policies, and he has no intention of "resting on his laurels." The dollar has risen as much as it could, but now it seems time for a new round of prolonged decline. If the price settles below the moving average, small shorts with a target of 1.1597 can be considered. Long positions remain relevant above the moving average, with targets at 1.1780 and 1.1828 as part of the trend's continuation.

Chart Elements Explained:

- Linear regression channels help determine the current trend. If both channels point in the same direction, the trend is strong.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and trade direction.

- Murray levels serve as target levels for moves and corrections.

- Volatility levels (red lines) are the likely price channel for the next day, based on current volatility readings.

- The CCI indicator: dips below -250 (oversold) or rises above +250 (overbought) mean a trend reversal may be near.