EUR/USD

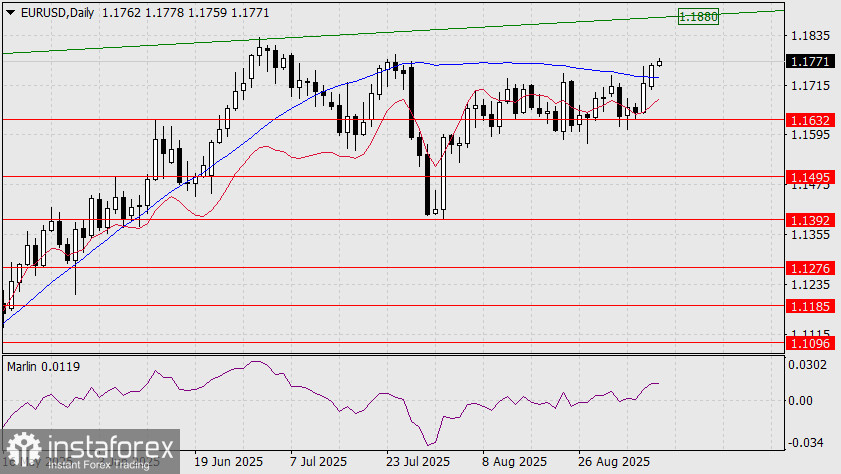

The euro managed to rise above the MACD indicator line and hold above it. The Marlin oscillator is rising, and the price may reach the upper boundary of the price channel around 1.1880.

Today, US producer inflation data will be released; tomorrow, the CPI, and on Thursday, the European Central Bank will present its updated monetary policy outlook. The extension of the rate-cutting pause, as well as overheated expectations for the Federal Reserve (three cuts by year-end), are currently pushing the euro up. But here's the issue: the forecast for US CPI in August is 2.9% y/y versus 2.7% y/y in July. With this level of inflation—which brings us back to January of this year—even a single rate cut comes into question. The probability of a cut in September is assessed by investors at 92.6%, in October (another 0.25%) at 82.8%, and in December (to a final rate of 3.75%) at 71.0%. But even now, two cuts are already priced in. A sharp unwinding of these expectations could lead to a devastating drop in the European currency.

Yields on US government bonds are noticeably below the current 4.50% rate; only 20-year bonds have a yield of 4.65% (30-year bonds yield 4.69%). Therefore, the Fed will still be forced to cut rates in September, but will give a very strong signal that there will be no more cuts until the end of the year. Thus, regardless of the ECB's decision on Thursday, and whatever the market reaction—other than downward—it could turn out to be a false move.

On the H4 chart, there's nothing to prevent the price from continuing to climb. Even the MACD line is turning upward. We are expecting further euro growth and the FOMC meeting.