GBP/USD

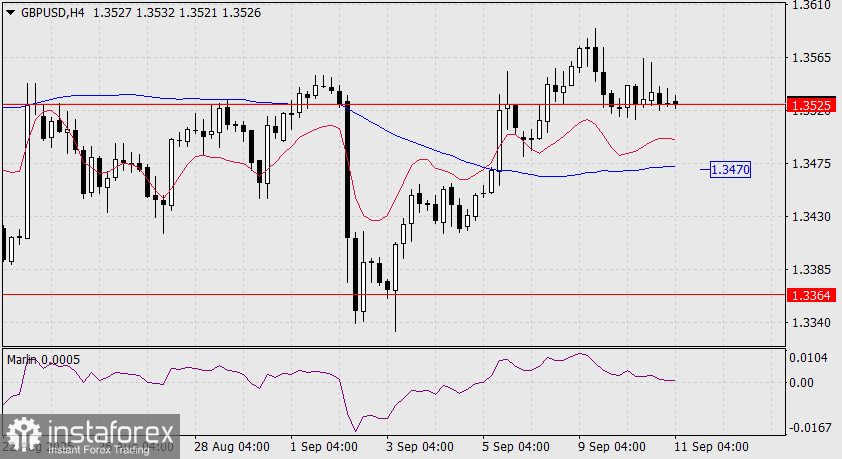

On Wednesday, similar to Tuesday, the British pound managed to rise above the daily MACD indicator line, albeit only with its upper shadow. The day closed at the opening level, which is the support level of 1.3525.

The declining Marlin oscillator and, likely, today's release of an increased US CPI for August (forecast at 2.9% y/y versus 2.7% y/y a month earlier) could easily pull the GBP/USD pair below 1.3525 with consolidation under it. This would open up a target at 1.3364.

If the signal line of the oscillator moves below the zero line, it will also exit the 0.0007–0.0162 range, which could accelerate the price drop. Alternatively, this may first accelerate the oscillator's fall, followed by price (Marlin is a leading indicator).

On the H4 timeframe, price is consolidating around 1.3525. The Marlin oscillator has slowly reached the boundary of its downward trend. The pound is poised for its first leap, with the US inflation data being a natural trigger. The first target is 1.3470—the MACD line on this chart.