Wednesday Trade Review:

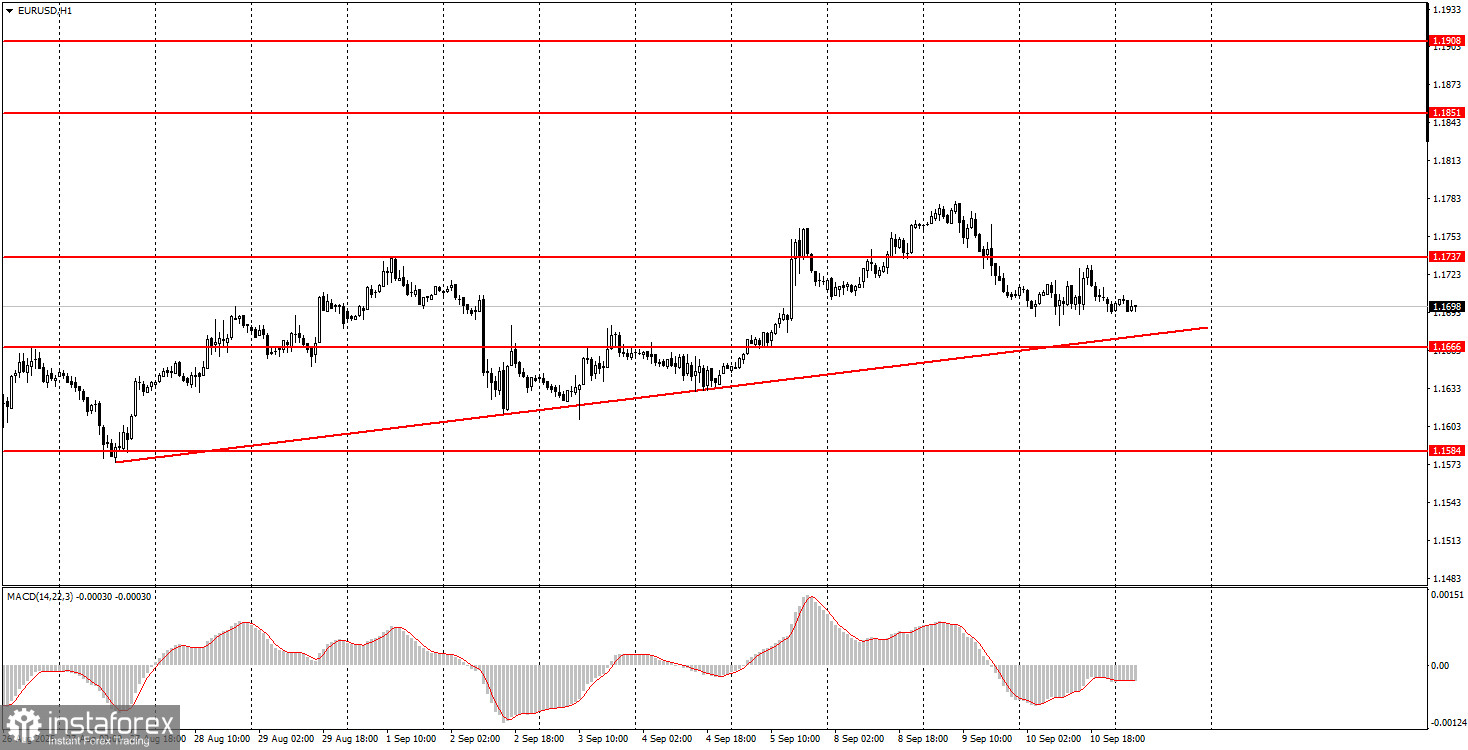

1H Chart of EUR/USD

On Wednesday, the EUR/USD currency pair traded with minimal volatility and without any trend. This is now the second day in a row this week that the market has shown completely illogical movements. We'll leave aside what's happening in the crypto market—there's little logic there either. Recall that on Tuesday, the annual Nonfarm Payrolls report was published. Although it didn't reveal anything new—US labor market contraction continues—it remains an important report that traders ignored. Yesterday, the US Producer Price Index (PPI) showed a price decline of 0.1% in August. We don't believe this drop in PPI will have any impact on the Federal Reserve's September decision; in any case, a more important inflation report will be released today, on which more definite conclusions can be based. Nevertheless, a formal reason for dollar weakness existed yesterday. The uptrend on the hourly timeframe remains in place, as shown by the ascending trend line. Therefore, the pair's rally could resume at any moment.

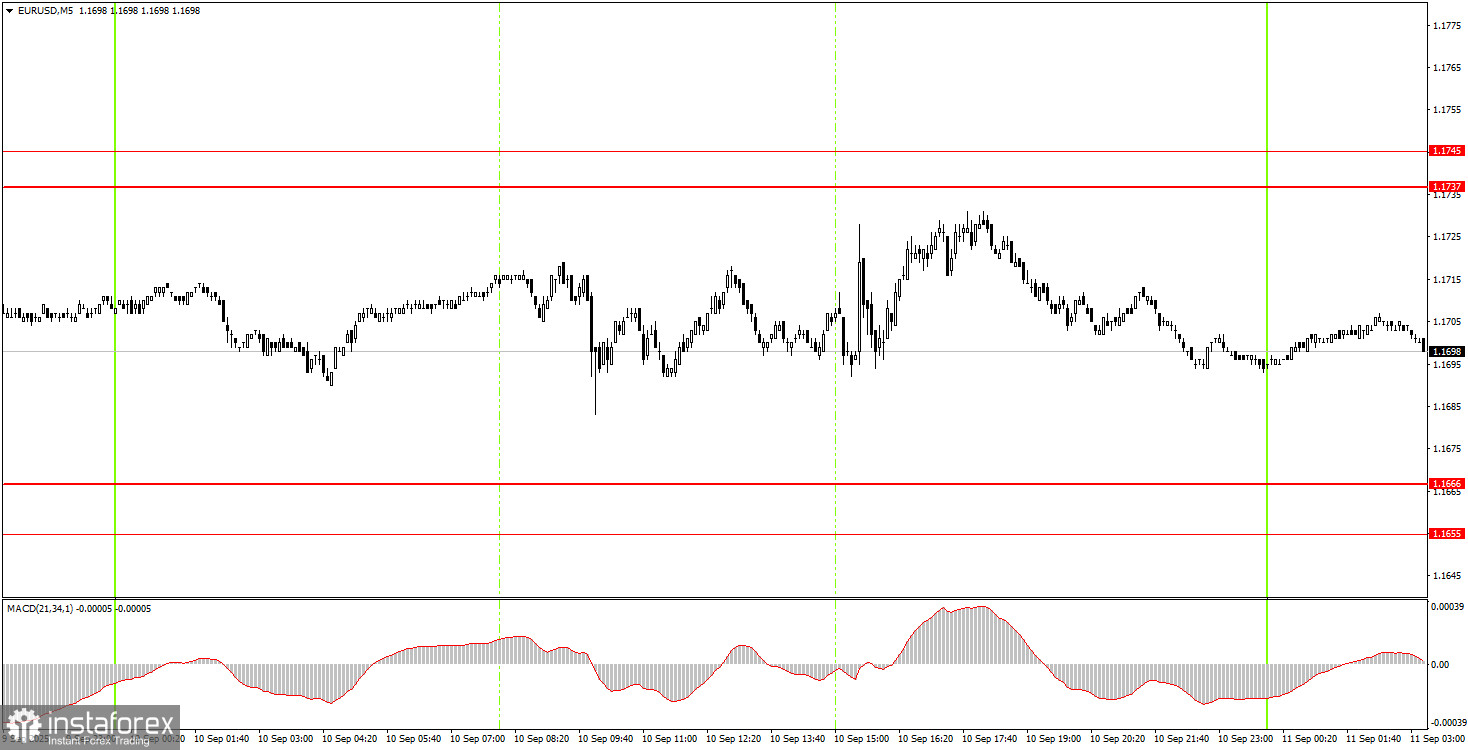

5M Chart of EUR/USD

On the 5-minute timeframe on Wednesday, not a single trading signal was formed, which is a good thing. As seen in the chart above, the price bounced up and down all day, with total daily volatility under 50 pips. With such moves, it was clearly best to stay out of the market.

How to Trade on Thursday:

On the hourly timeframe, the EUR/USD pair has every chance to resume the uptrend that's been forming since the start of the year. The range-bound flat can be considered complete. The fundamental and macro background remains negative for the US dollar, so we still do not expect USD strength. In our opinion, as before, the dollar can only count on technical corrections. However, consolidation below the trend line could trigger a new wave of technical decline for the pair.

On Thursday, EUR/USD may resume its upward move, as the trend remains bullish. However, new trading signals are needed in the areas of 1.1655–1.1666 and 1.1737–1.1745.

On the 5-minute timeframe, watch the following levels: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1737–1.1745, 1.1808, 1.1851, 1.1908. On Thursday, the European Central Bank meeting will occur in the Eurozone, and the US inflation report will be published. Both are important events, but only formally so. No one expects a rate cut or even a promise to cut from the ECB at this point. US inflation won't affect the Fed's decision on September 17. However, both events could still trigger market reaction.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.