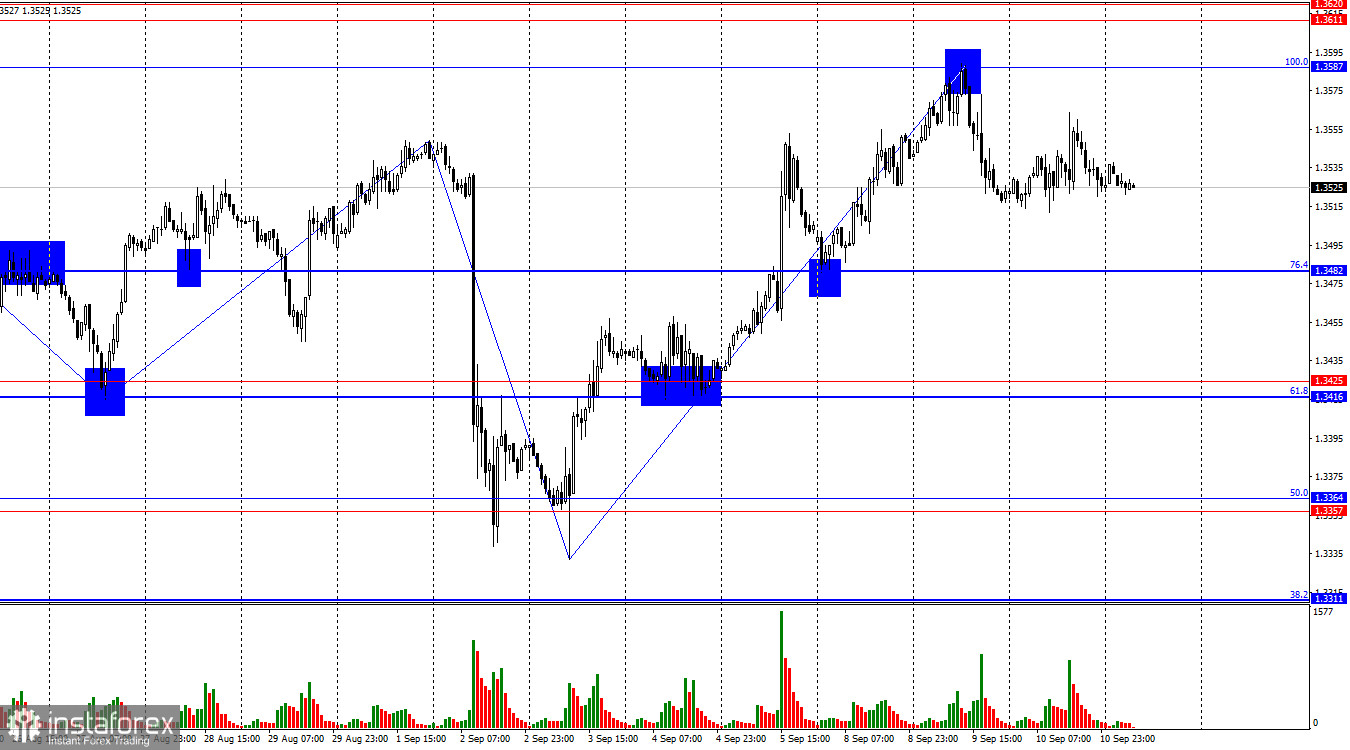

Good day, traders! On the hourly chart, GBP/USD on Wednesday traded exactly between the 1.3482 and 1.3587 levels. Thus, no new trading signals or ideas emerged—one of those two levels needs to be tested before a clearer direction returns. If the pair bounces off 1.3587, the decline may resume.

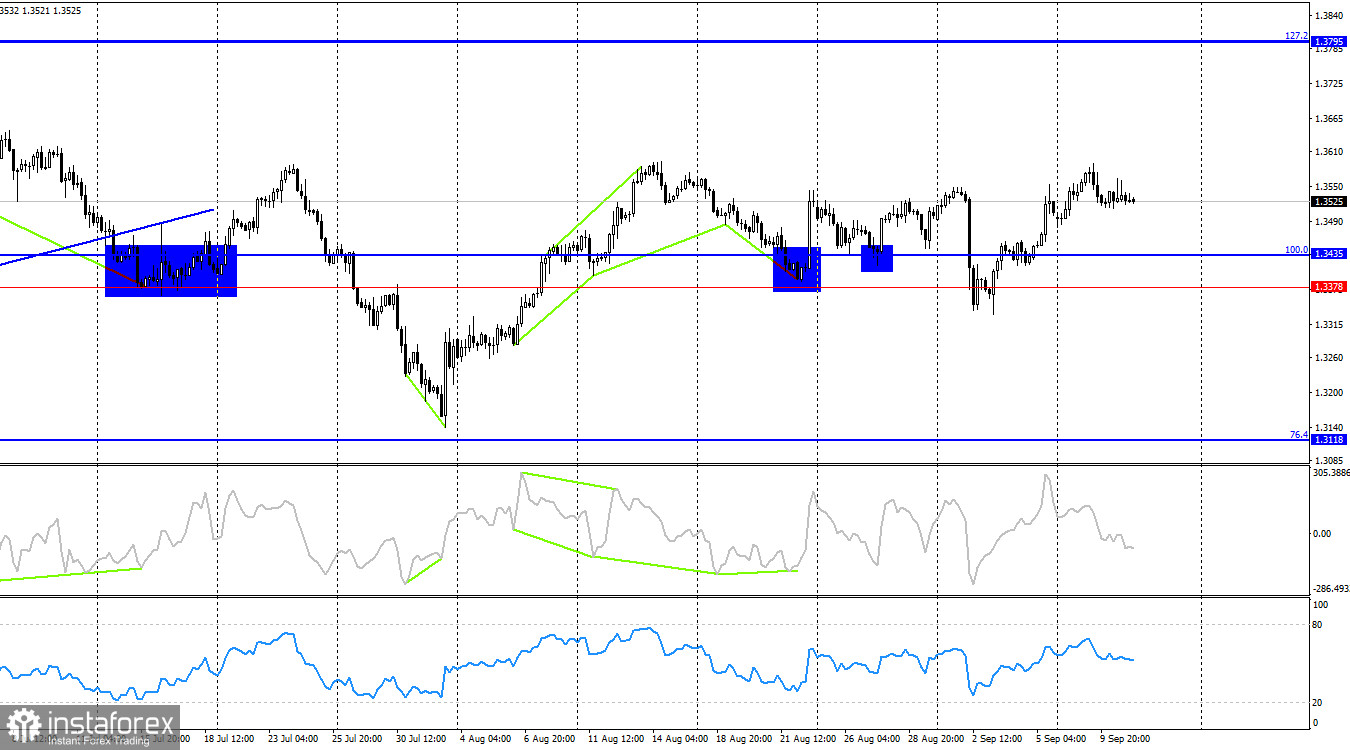

The wave picture continues to shift to bullish. The last completed down wave broke through two previous lows, but the new up wave broke the last two highs. At the moment, this suggests a new bullish trend after more than two months of weak bearish dominance—largely unsupported by fundamentals.

On Thursday, the US will release its August Consumer Price Index—the data that traders prioritized over Wednesday's PPI. Producer prices declined by 0.1% last month, but that's not enough to signify a downtrend. However, such price declines could slow headline inflation, which is even worse for the dollar than rising inflation. If inflation in the US rises, it may curb the Fed's dovish tilt, and also soften Trump's rate-cutting pressure on the FOMC. President Trump has repeatedly referenced weak inflation, insisting that the trade war won't cause significant price increases and demanding a rate cut. But at present, there's little point forecasting US inflation trends, given ongoing Supreme Court investigations into Trump-era tariffs and the real possibility import tariffs could be canceled. If that happens, who knows what will happen to prices next? So I recommend acting based on the actual CPI outcome, whatever it is.

On the H4 chart, the pair has made another upside reversal in favor of the pound, consolidating above the 1.3378–1.3435 zone. Thus, further growth may continue toward the next 127.2% correction target at 1.3795. The chart pattern is ambiguous now; traders keep pushing the pair back and forth. For now, I advise paying the most attention to the hourly chart. No emerging divergences are seen on any indicator.

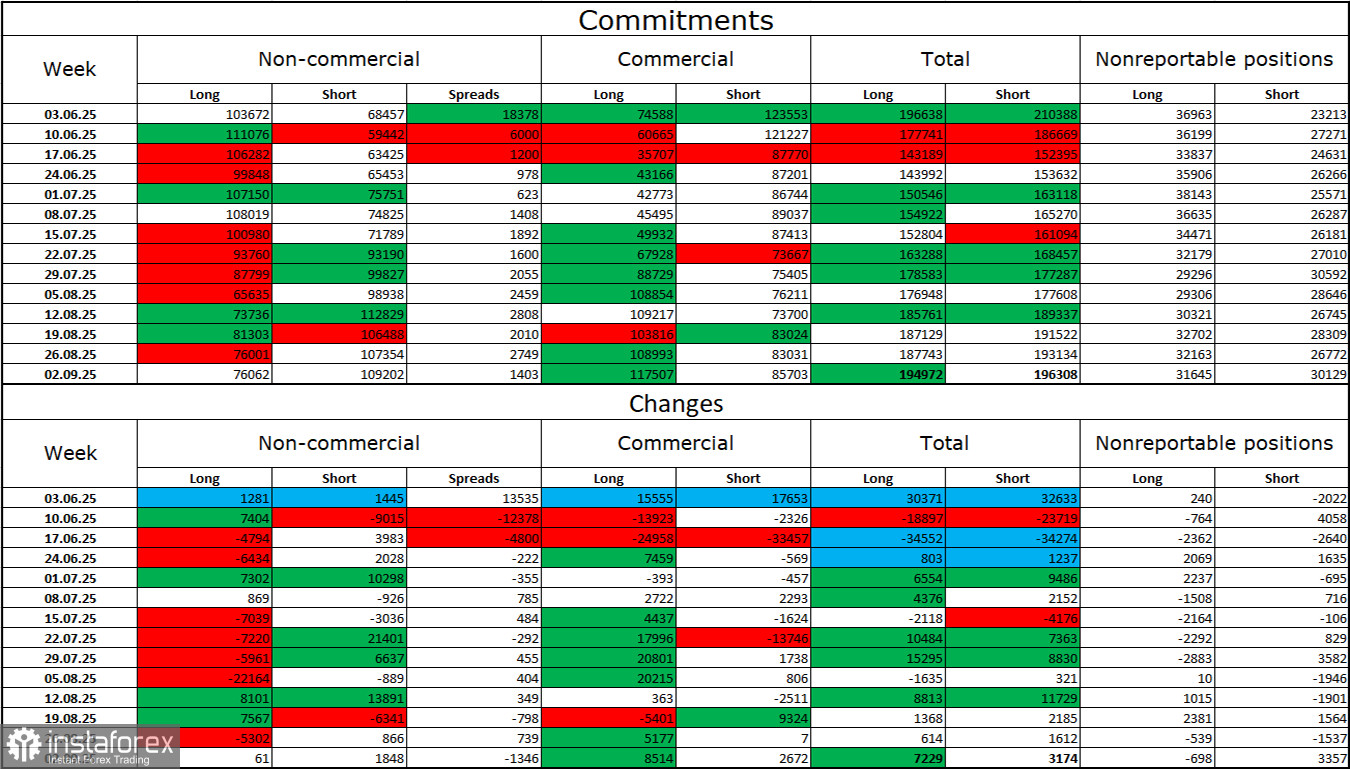

Commitments of Traders (COT) Report:

The Non-commercial trader sentiment turned a bit more bearish in the last reporting week. Speculators increased the number of Long contracts by 61, but Shorts rose by 1,848. The Long/Short split is now about 76,000 versus 109,000. Yet, GBP is still inclined to rise, and traders keep buying.

In my view, the pound still faces downside risks. The information backdrop was awful for the dollar for the first six months of the year, but it is slowly turning positive. Trade tensions are easing, important deals are being signed, and the US economy is set to recover in Q2 thanks to tariffs and various investments. At the same time, the prospect of Fed policy easing in the second half now puts serious pressure on the dollar as the labor market sags and unemployment ticks higher. For now, I see no reason for a "dollar trend."

News Calendar for the US and UK:

- US – Consumer Price Index (12:30 UTC)

- US – Initial Jobless Claims (12:30 UTC)

- September 11 has two key events, with one (CPI) standing out. The information backdrop may heavily impact the market in the latter half of the day.

GBP/USD Forecast and Trader Tips:

Selling was possible on a bounce from 1.3587 on the hourly chart, targeting 1.3482. I'm not sure the decline will persist, so it's best to set the Stop Loss to breakeven. Buys are possible today on a bounce from 1.3482 or a close above the 1.3611–1.3620 area.

Fibonacci grids:

- Drawn from 1.3586–1.3139 on H1

- Drawn from 1.3431–1.2104 on H4