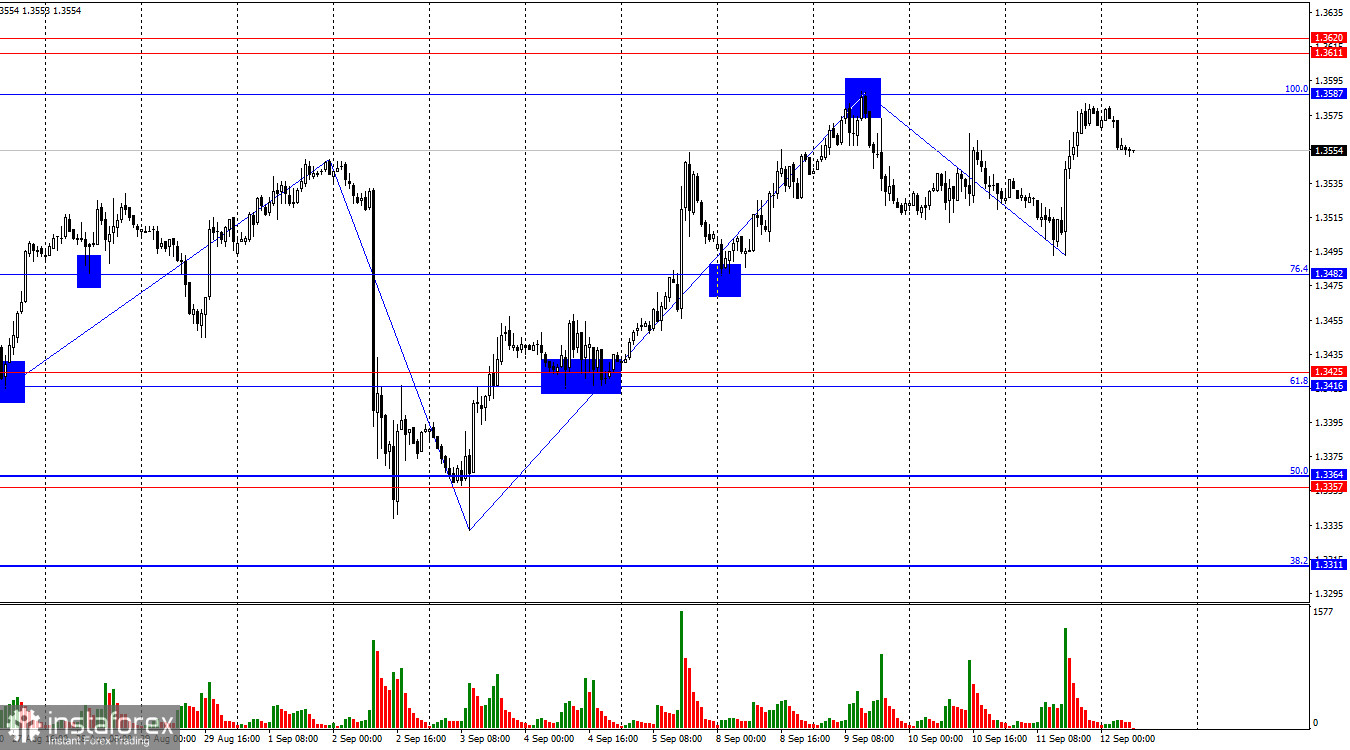

Good afternoon, traders! On the hourly chart, the GBP/USD pair reversed in favor of the pound on Thursday and rallied almost to the 100.0% correction level at 1.3587. A clear sell signal was not formed. Today, a rebound from this level would allow traders to look for a decline toward the 76.4% Fibonacci level at 1.3482. If the pair consolidates above the resistance zone at 1.3611–1.3620, the likelihood of further pound gains increases, with the next target being the 127.2% Fibonacci level at 1.3708.

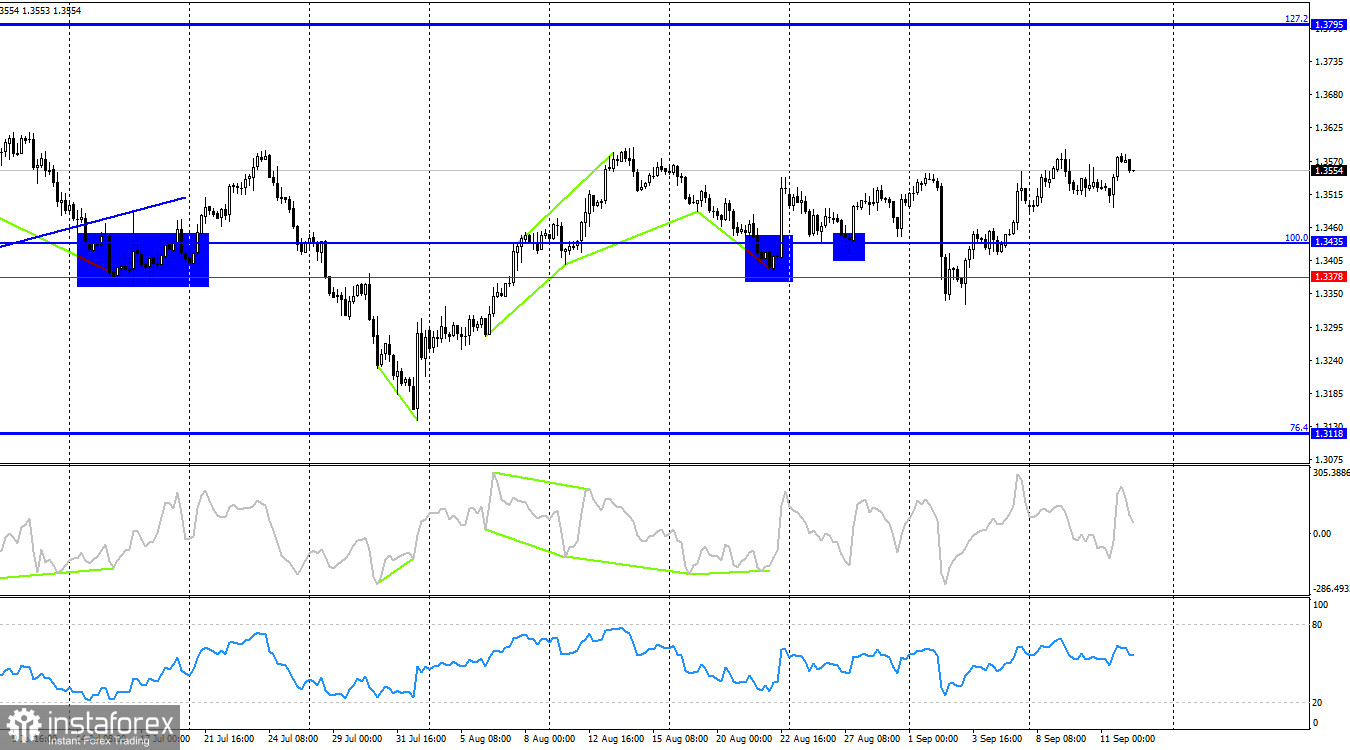

The wave pattern continues to shift bullish. The last completed wave downward broke two previous lows, while the new upward wave broke the last two highs. Thus, at this point, it is fair to say that a new bullish trend is beginning after more than two months of bearish dominance. That dominance was very weak, as news flow generally did not support the bears.

On Thursday, bulls charged ahead on the back of weak US inflation data. The consumer price index rose, but it does not give the Fed grounds to tighten monetary policy, which would have benefited the US dollar. Thus, as forecast, the dollar continued its decline. This morning, the UK reports on industrial production and GDP, which came in, once again disappointing the market. July GDP showed 0% growth (which traders didn't really expect to be any higher), while industrial production dropped by 0.9% versus 0% forecast. Another -0.9%. Thus, some bullish enthusiasm was curbed today, but overall, the dollar remains in a much more precarious state than the pound. Trader activity may be subdued today, as only the US University of Michigan Consumer Sentiment Index could attract attention in the afternoon.

On the 4-hour chart, the pair reversed in favor of the pound and settled above the 1.3378–1.3435 zone. As such, the rally may continue toward the next 127.2% corrective level at 1.3795. The chart pattern remains uncertain, with traders pushing the pair in both directions. At the moment, I recommend paying closer attention to the hourly chart. No brewing indicator divergences are observed.

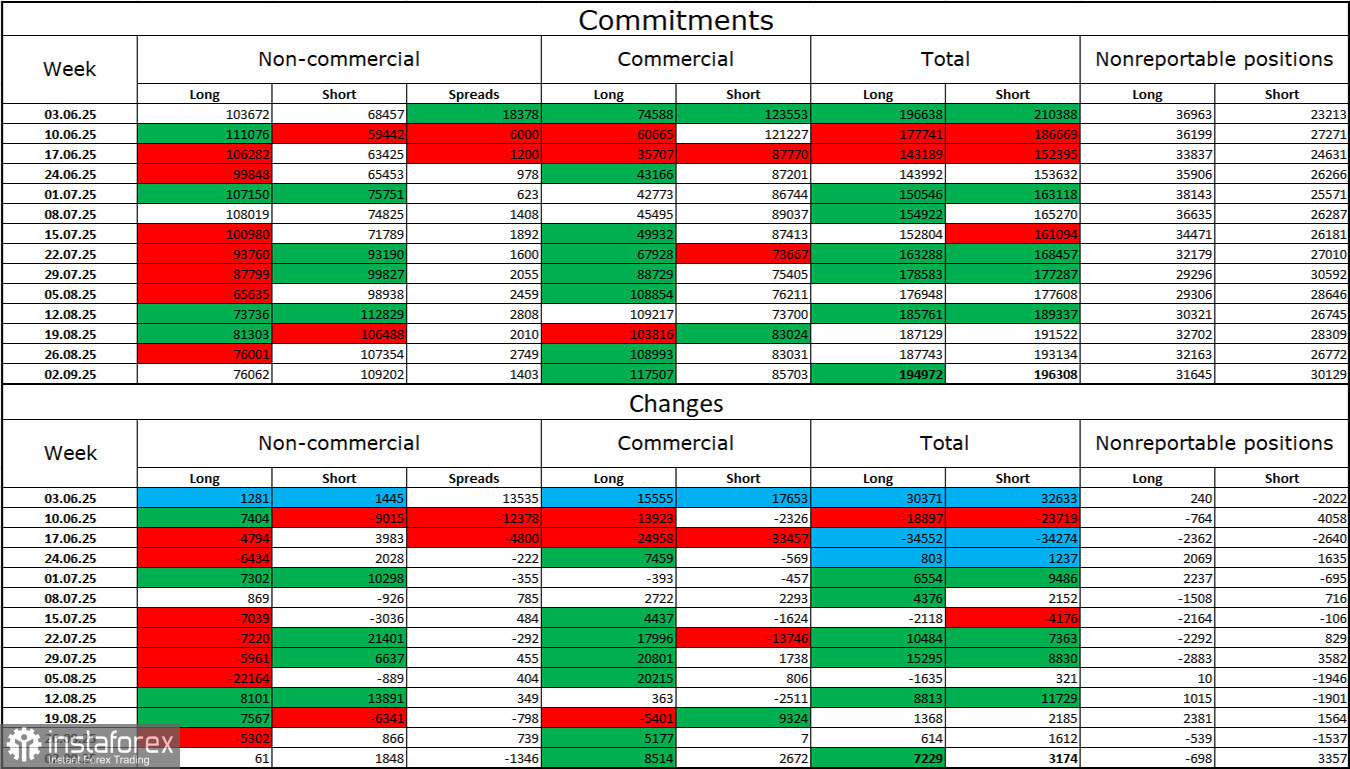

Commitments of Traders (COT) Report:

Sentiment among the "Non-commercial" category became slightly more bearish over the last reporting week. The number of long contracts held by speculators increased by 61, while shorts rose by 1,848. The gap between long and short positions is now roughly 76,000 vs. 109,000. Nevertheless, the pound is still leaning toward growth, and traders are mostly buying it.

In my opinion, the pound remains vulnerable to a decline. The news background for the US dollar was terrible for the first half of the year, but it is gradually turning positive. Trade tensions are easing, key deals are being signed, and the US economy will recover in Q2 thanks to tariffs and various investments. At the same time, prospects of Fed policy easing in the second half of the year are creating real pressure on the dollar, as the US labor market weakens and unemployment rises. Thus, I currently see no rationale for a "dollar trend."

News Calendar for the USA and UK:

- UK – Monthly GDP change (06:00 UTC)

- UK – Industrial production change (06:00 UTC)

- USA – University of Michigan Consumer Sentiment Index (14:00 UTC)

September 12's economic calendar includes three (all second-tier) events. The impact of news on market sentiment will be weak.

GBP/USD Forecast and Trading Tips:

Sell the pair on a rebound from 1.3587 on the hourly chart, targeting 1.3482. Buy positions are possible if the pair closes above the 1.3611–1.3620 zone, targeting 1.3708. Fibonacci levels are built from 1.3586–1.3139 on H1 and 1.3431–1.2104 on H4.