The euro and British pound both worked excellently today using the Mean Reversion strategy. I traded the Japanese yen, as usual, with Momentum.

Inflation data from eurozone countries and UK GDP figures almost entirely matched economists' forecasts, so there were no significant shifts in the currency market. As long as the European Central Bank and Bank of England remain in wait-and-see mode, aiming to avoid choking off economic growth, demand for risk assets will persist. However, if they turn to a softer policy, things could change quickly.

From the US, we await the University of Michigan's Consumer Sentiment Index and its inflation expectations later in the day. Only very strong numbers can help the dollar rise against the euro, pound, and other risk assets. The sentiment index is expected to show slight improvement, reflecting a stabilization in the economic situation. However, as always, the devil is in the details—especially regarding the inflation expectations component. If consumers express concern about future prices, this could put pressure on the Fed and support the dollar. Conversely, if inflation expectations remain under control, the Fed will have more flexibility and may adopt a softer stance.

If the data is strong, I'll use the Momentum strategy. If there's no significant market reaction, I'll continue using Mean Reversion.

Momentum (Breakout) Strategy for the Second Half of the Day:

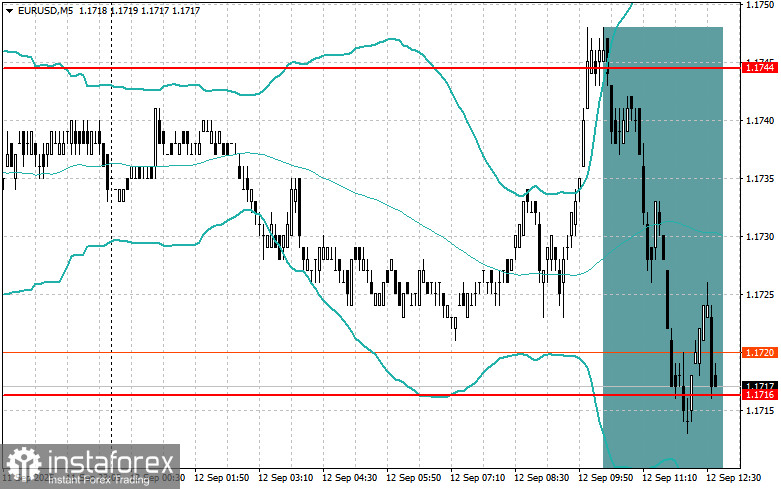

EUR/USD

Buying on a breakout above 1.1735 can lead to euro growth towards 1.1760 and 1.1815

Selling on a breakout below 1.1705 can lead to a euro decline towards 1.1664 and 1.1631

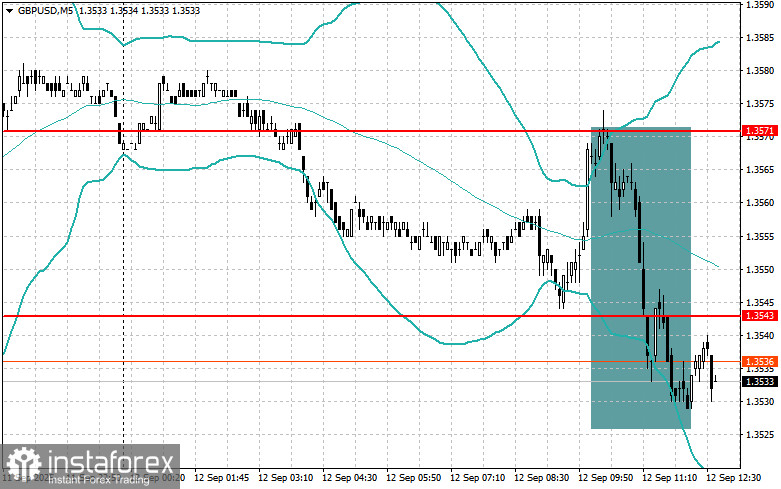

GBP/USD

Buying on a breakout above 1.3553 can lead to pound growth towards 1.3587 and 1.3615

Selling on a breakout below 1.3525 can lead to a pound decline towards 1.3494 and 1.3451

USD/JPY

Buying on a breakout above 148.03 can lead to dollar growth towards 148.44 and 148.76

Selling on a breakout below 147.72 can lead to a dollar decline towards 147.39 and 146.96

Mean Reversion (Pullback) Strategy for the Second Half of the Day:

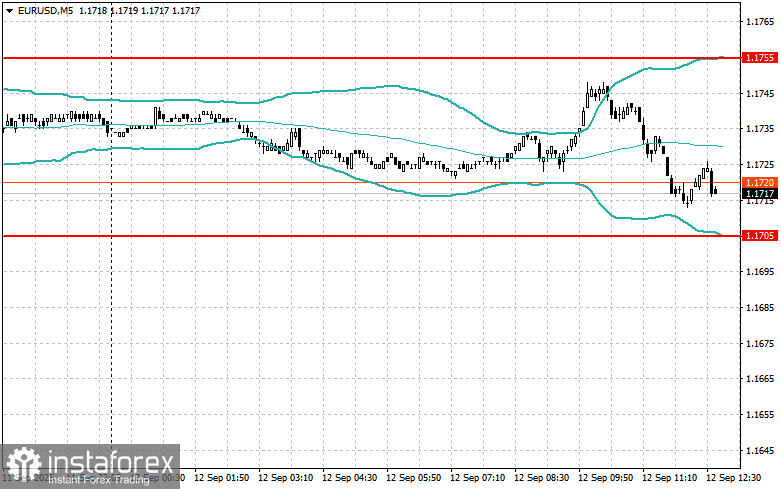

EUR/USD

Sell after a failed breakout above 1.1755, when the price returns below this level

Buy after a failed breakout below 1.1705, when the price returns above this level

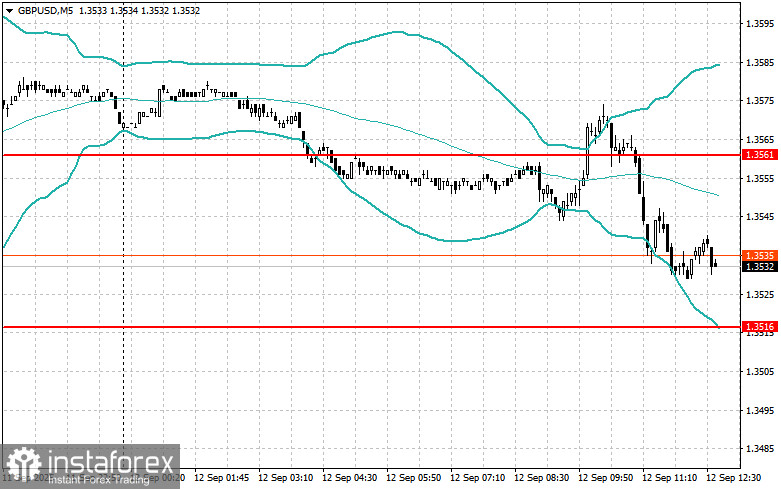

GBP/USD

Sell after a failed breakout above 1.3561, when the price returns below this level

Buy after a failed breakout below 1.3516, when the price returns above this level

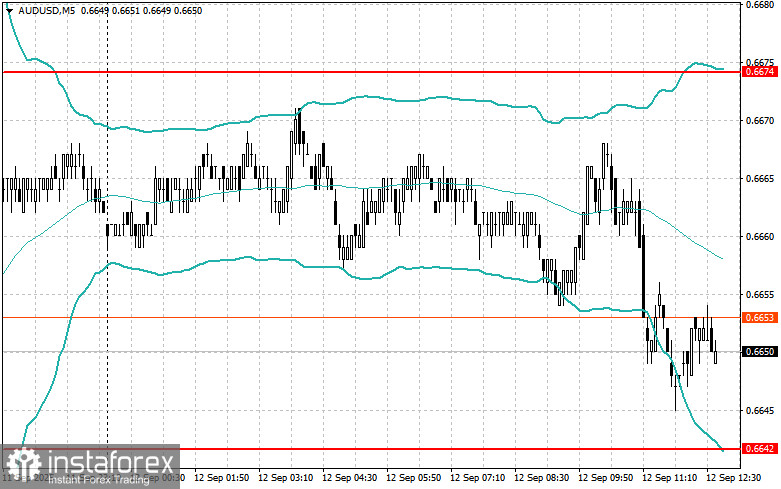

AUD/USD

Sell after a failed breakout above 0.6674, when the price returns below this level

Buy after a failed breakout below 0.6642, when the price returns above this level

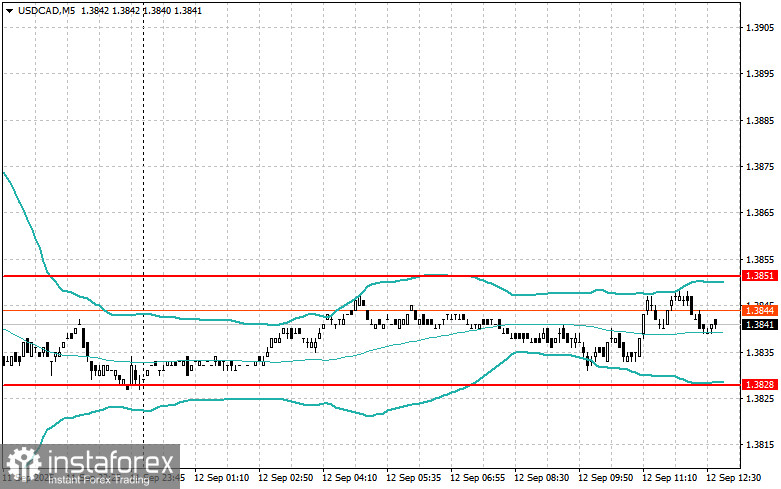

USD/CAD

Sell after a failed breakout above 1.3851, when the price returns below this level

Buy after a failed breakout below 1.3828, when the price returns above this level